Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The September 30 bank statement for Bennett Company and the September ledger accounts for cash are summarized here: BANK STATEMENT Checks Deposits Balance Balance, September

The September 30 bank statement for Bennett Company and the September ledger accounts for cash are summarized here:

| BANK STATEMENT | ||||||||||||

| Checks | Deposits | Balance | ||||||||||

| Balance, September 1 | $ | 7,150 | ||||||||||

| Deposits recorded during September | $ | 26,850 | 34,000 | |||||||||

| Checks cleared during September | $ | 26,750 | 7,250 | |||||||||

| NSF checksBetty Brown | 110 | 7,140 | ||||||||||

| Bank service charges | 57 | 7,083 | ||||||||||

| Balance, September 30 | 7,083 | |||||||||||

|

| ||||||||||||

| Cash (A) | |||||||

| Sept. 1 Balance | 7,150 | Sept. Checks written | 29,700 | ||||

| Sept. Deposits | 28,250 | ||||||

|

| |||||||

No outstanding checks and no deposits in transit were carried over from August; however, there are deposits in transit and checks outstanding at the end of September.

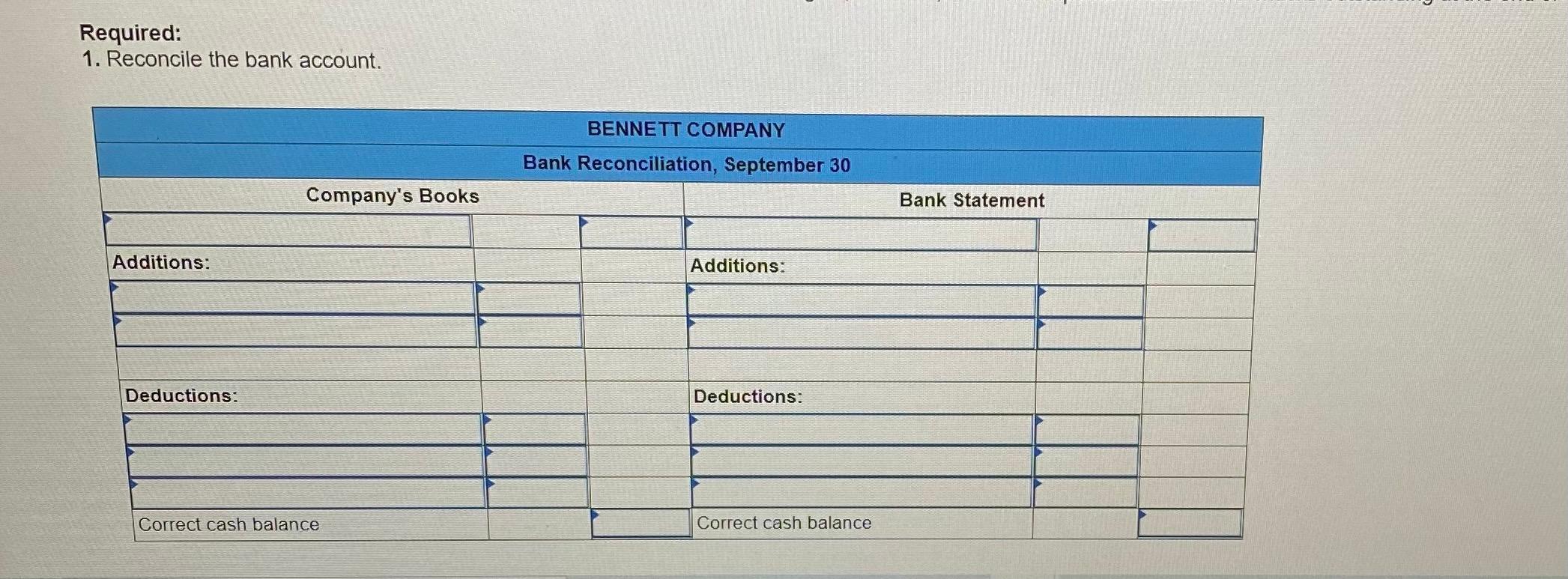

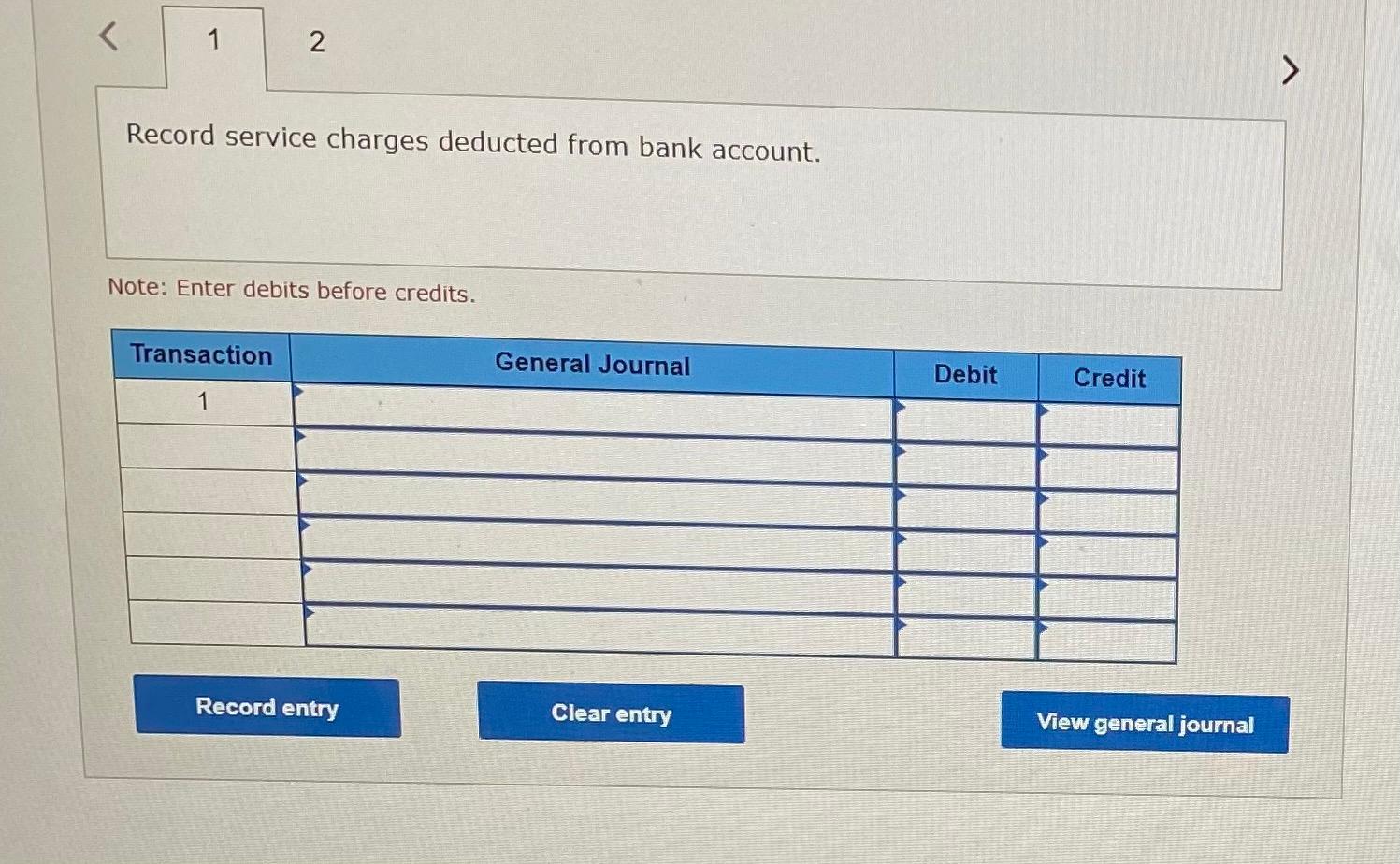

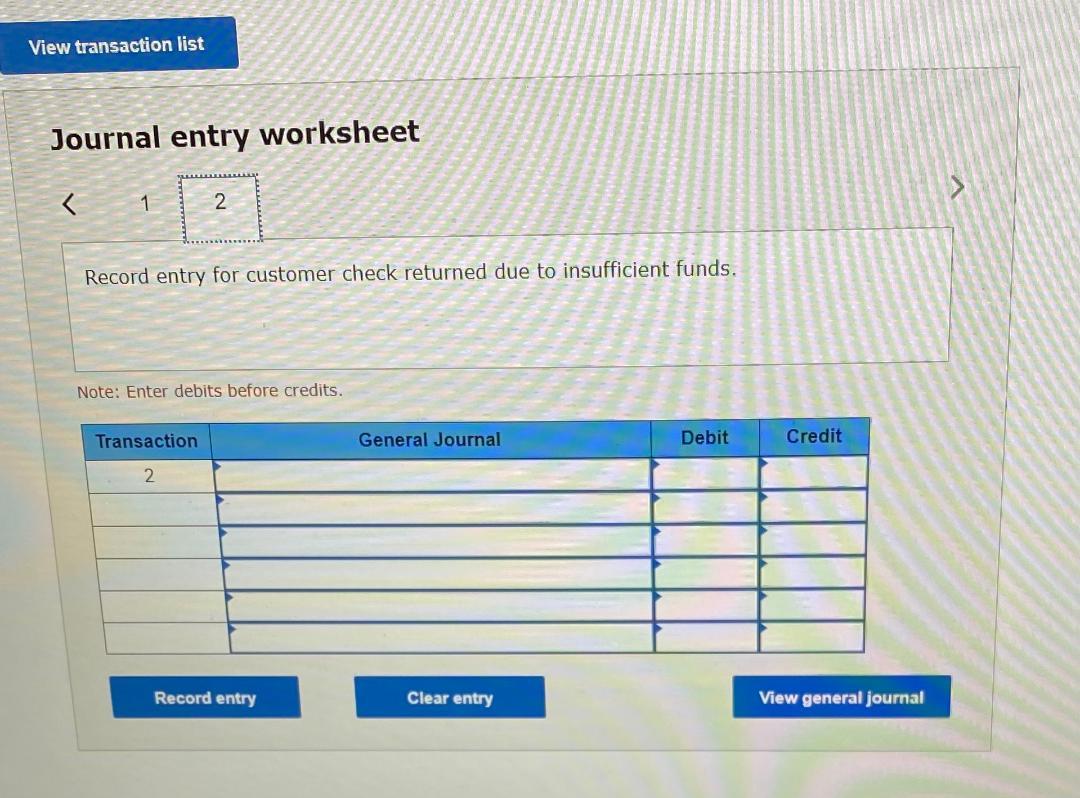

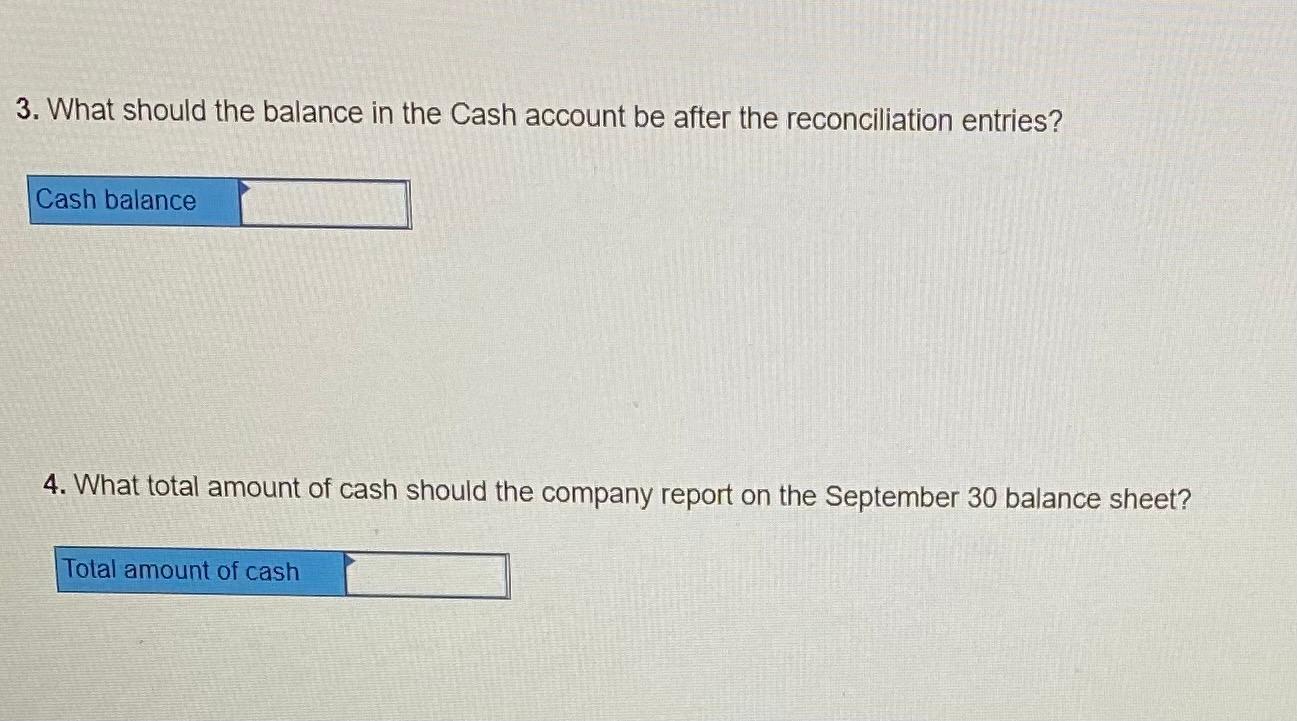

Required: 1. Reconcile the bank account. BENNETT COMPANY Bank Reconciliation, September 30 Company's Books Bank Statement Additions: Additions: Deductions: Deductions: Correct cash balance Correct cash balance Record service charges deducted from bank account. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started