Answered step by step

Verified Expert Solution

Question

1 Approved Answer

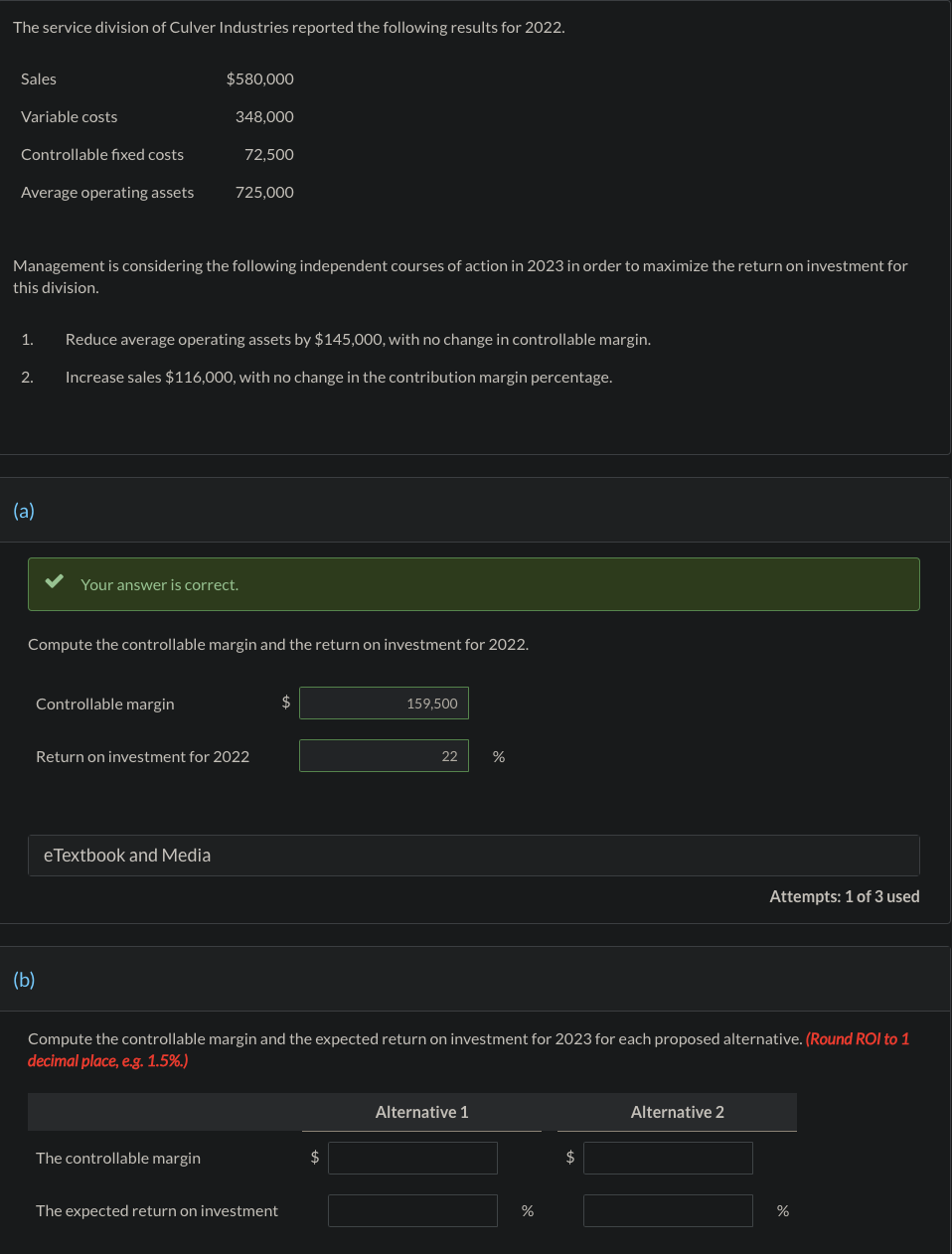

The service division of Culver Industries reported the following results for 2022. Sales $580,000 Variable costs 348,000 Controllable fixed costs 72,500 Average operating assets

The service division of Culver Industries reported the following results for 2022. Sales $580,000 Variable costs 348,000 Controllable fixed costs 72,500 Average operating assets 725,000 Management is considering the following independent courses of action in 2023 in order to maximize the return on investment for this division. 1. Reduce average operating assets by $145,000, with no change in controllable margin. 2. Increase sales $116,000, with no change in the contribution margin percentage. (a) (b) Your answer is correct. Compute the controllable margin and the return on investment for 2022. Controllable margin Return on investment for 2022 eTextbook and Media 159,500 22 % Attempts: 1 of 3 used Compute the controllable margin and the expected return on investment for 2023 for each proposed alternative. (Round ROI to 1 decimal place, e.g. 1.5%.) The controllable margin The expected return on investment Alternative 1 % Alternative 2 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Compute the controllable margin and the return on investment for 2022 Controllable Margin Sales Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663de86cb0c5c_961163.pdf

180 KBs PDF File

663de86cb0c5c_961163.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started