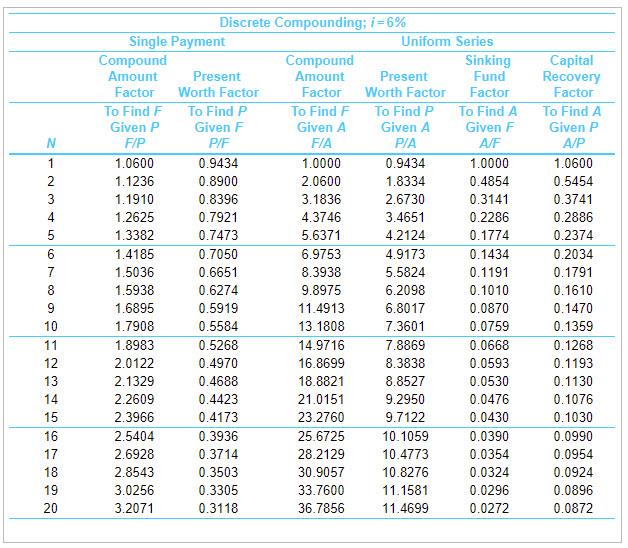

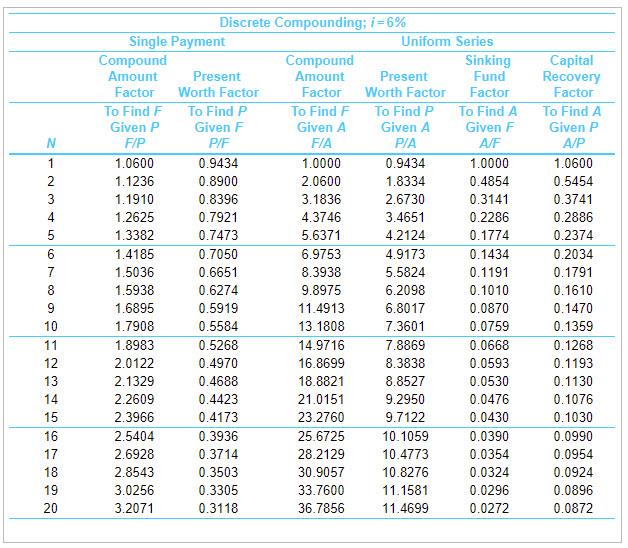

The Shakey Company can finance the purchase of a new building costing $2 million with a bond issue, for which it would pay $110,000 interest per year, and then repay the $2 million at the end of the life of the building. Instead of buying in this manner, the company can lease the building by paying $135,000 per year, the first payment being due one year from now. The building would be fully depreciated for tax purposes over an expected life of 20 years. The income tax rate is 35% for all expenses and capital gains or losses, and the firm's after-tax MARR is 6%. Use AW analysis based on equity (nonborrowed) capital to determine whether the firm should borrow and buy or lease if, at the end of 20 years, the building has the following market values for the owner: (a) nothing. (b) $450,000. Straight-line depreciation will be used but is allowable only if the company purchases the building. Click the icon to view the interest and annuity table for discrete compounding when i = 6% per year. a. The AW of buying is $ thousand. (Round to one decimal place.) The AW of leasing is $ thousand. (Round to one decimal place.) Should the firm buy or lease? Choose the correct answer below. Lease Buy b. The AW of buying is $ thousand. (Round to one decimal place.) The AW of leasing is $ thousand. (Round to one decimal place.) Should the firm buy or lease? Choose the correct answer below. Lease Buy AF N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Discrete Compounding; i=6% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP P/F FIA PIA 1.0600 0.9434 1.0000 0.9434 1.0000 1.1236 0.8900 2.0600 1.8334 0.4854 1.1910 0.8396 3.1836 2.6730 0.3141 1.2625 0.7921 4.3746 3.4651 0.2286 1.3382 0.7473 5.6371 4.2124 0.1774 1.4185 0.7050 6.9753 4.9173 0.1434 1.5036 0.6651 8.3938 5.5824 0.1191 1.5938 0.6274 9.8975 6.2098 0.1010 1.6895 0.5919 11.4913 6.8017 0.0870 1.7908 0.5584 13.1808 7.3601 0.0759 1.8983 0.5268 14.9716 7.8869 0.0668 2.0122 0.4970 16.8699 8.3838 0.0593 2.1329 0.4688 18.8821 8.8527 0.0530 2.2609 0.4423 21.0151 9.2950 0.0476 2.3966 0.4173 23.2760 9.7122 0.0430 2.5404 0.3936 25.6725 10.1059 0.0390 2.6928 0.3714 28.2129 10.4773 0.0354 2.8543 0.3503 30.9057 10.8276 0.0324 3.0256 0.3305 33.7600 11.1581 0.0296 3.2071 0.3118 36.7856 11.4699 0.0272 Capital Recovery Factor To Find A Given P A/P 1.0600 0.5454 0.3741 0.2886 0.2374 0.2034 0.1791 0.1610 0.1470 0.1359 0.1268 0.1193 0.1130 0.1076 0.1030 0.0990 0.0954 0.0924 0.0896 0.0872 The Shakey Company can finance the purchase of a new building costing $2 million with a bond issue, for which it would pay $110,000 interest per year, and then repay the $2 million at the end of the life of the building. Instead of buying in this manner, the company can lease the building by paying $135,000 per year, the first payment being due one year from now. The building would be fully depreciated for tax purposes over an expected life of 20 years. The income tax rate is 35% for all expenses and capital gains or losses, and the firm's after-tax MARR is 6%. Use AW analysis based on equity (nonborrowed) capital to determine whether the firm should borrow and buy or lease if, at the end of 20 years, the building has the following market values for the owner: (a) nothing. (b) $450,000. Straight-line depreciation will be used but is allowable only if the company purchases the building. Click the icon to view the interest and annuity table for discrete compounding when i = 6% per year. a. The AW of buying is $ thousand. (Round to one decimal place.) The AW of leasing is $ thousand. (Round to one decimal place.) Should the firm buy or lease? Choose the correct answer below. Lease Buy b. The AW of buying is $ thousand. (Round to one decimal place.) The AW of leasing is $ thousand. (Round to one decimal place.) Should the firm buy or lease? Choose the correct answer below. Lease Buy AF N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Discrete Compounding; i=6% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP P/F FIA PIA 1.0600 0.9434 1.0000 0.9434 1.0000 1.1236 0.8900 2.0600 1.8334 0.4854 1.1910 0.8396 3.1836 2.6730 0.3141 1.2625 0.7921 4.3746 3.4651 0.2286 1.3382 0.7473 5.6371 4.2124 0.1774 1.4185 0.7050 6.9753 4.9173 0.1434 1.5036 0.6651 8.3938 5.5824 0.1191 1.5938 0.6274 9.8975 6.2098 0.1010 1.6895 0.5919 11.4913 6.8017 0.0870 1.7908 0.5584 13.1808 7.3601 0.0759 1.8983 0.5268 14.9716 7.8869 0.0668 2.0122 0.4970 16.8699 8.3838 0.0593 2.1329 0.4688 18.8821 8.8527 0.0530 2.2609 0.4423 21.0151 9.2950 0.0476 2.3966 0.4173 23.2760 9.7122 0.0430 2.5404 0.3936 25.6725 10.1059 0.0390 2.6928 0.3714 28.2129 10.4773 0.0354 2.8543 0.3503 30.9057 10.8276 0.0324 3.0256 0.3305 33.7600 11.1581 0.0296 3.2071 0.3118 36.7856 11.4699 0.0272 Capital Recovery Factor To Find A Given P A/P 1.0600 0.5454 0.3741 0.2886 0.2374 0.2034 0.1791 0.1610 0.1470 0.1359 0.1268 0.1193 0.1130 0.1076 0.1030 0.0990 0.0954 0.0924 0.0896 0.0872