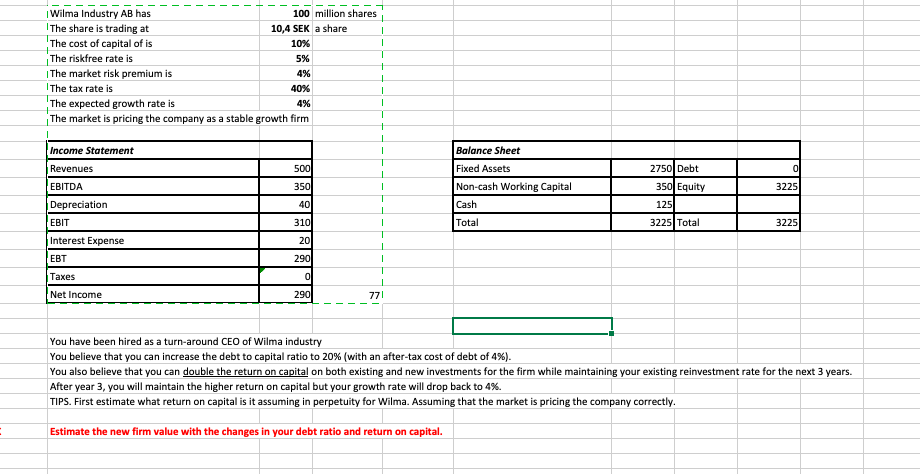

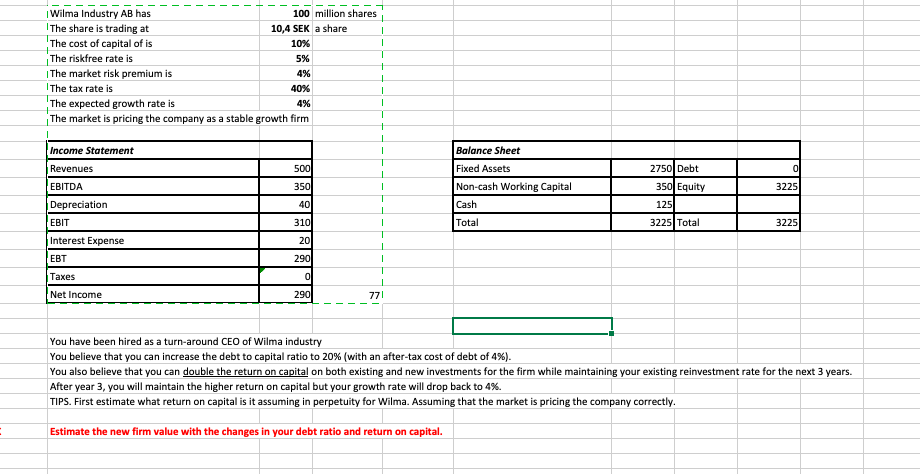

the share is trading at 10,4

- - - - - - - - - - T - - - Wilma Industry AB has - 100 million shares The share is trading at 10,4 SEK a share The cost of capital of is 10% The riskfree rate is The market risk premium is The tax rate is 40% The expected growth rate is The market is pricing the company as a stable growth firm 5% 4% Income Statement Revenues EBITDA Depreciation EBIT Interest Expense Balance Sheet Fixed Assets Non-cash Working Capital Cash Total 3225 2750 Debt 350 Equity 125 3225 Total - - - - - -- EBT Taxes Net Income 290 ---_771 You have been hired as a turn-around CEO of Wilma industry You believe that you can increase the debt to capital ratio to 20% (with an after-tax cost of debt of 4%). You also believe that you can double the return on capital on both existing and new investments for the firm while maintaining your existing reinvestment rate for the next 3 years. After year 3, you will maintain the higher return on capital but your growth rate will drop back to 4%. TIPS. First estimate what return on capital is it assuming in perpetuity for Wilma. Assuming that the market is pricing the company correctly. Estimate the new firm value with the changes in your debt ratio and return on capital. - - - - - - - - - - T - - - Wilma Industry AB has - 100 million shares The share is trading at 10,4 SEK a share The cost of capital of is 10% The riskfree rate is The market risk premium is The tax rate is 40% The expected growth rate is The market is pricing the company as a stable growth firm 5% 4% Income Statement Revenues EBITDA Depreciation EBIT Interest Expense Balance Sheet Fixed Assets Non-cash Working Capital Cash Total 3225 2750 Debt 350 Equity 125 3225 Total - - - - - -- EBT Taxes Net Income 290 ---_771 You have been hired as a turn-around CEO of Wilma industry You believe that you can increase the debt to capital ratio to 20% (with an after-tax cost of debt of 4%). You also believe that you can double the return on capital on both existing and new investments for the firm while maintaining your existing reinvestment rate for the next 3 years. After year 3, you will maintain the higher return on capital but your growth rate will drop back to 4%. TIPS. First estimate what return on capital is it assuming in perpetuity for Wilma. Assuming that the market is pricing the company correctly. Estimate the new firm value with the changes in your debt ratio and return on capital