Question

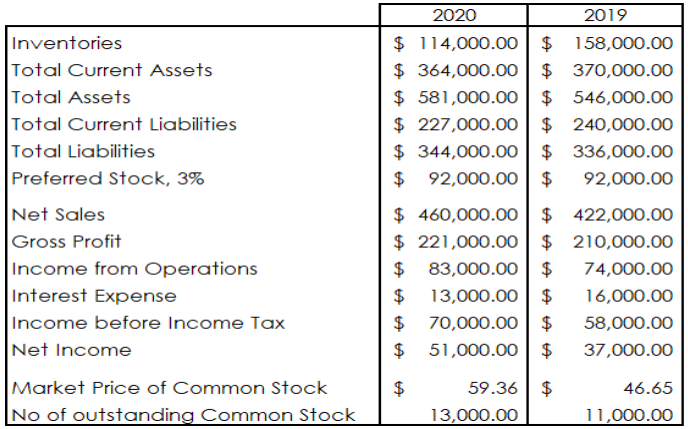

The shares of a company traded on the local stock market and this company is being considered as a potential investment. The comparative financial data

The shares of a company traded on the local stock market and this company is being considered as a potential investment. The comparative financial data for the company is shown below

a. Compute following nine (9) ratios for both years. i. Acid Test ratio ii. Current ratio iii. Times-interest earned ratio iv. Inventory turnover v. Gross profit percentage vi. Debt to equity ratio vii. Rate of return on common stockholders equity viii.Earnings per share of common stock ix. Price/earnings ratio

b. Discuss the attractiveness of the companys common stock from the viewpoint of a potential investor over the past two years.

2020 2019 Inventories Total Current Assets Total Assets Total Current Liabilities Total Liabilities Preferred Stock, 3% Net Sales Gross Profit Income from Operations Interest Expense Income before Income Tax Net Income $ 114,000.00 $ 158,000.00 $ 364,000.00 $ 370,000.00 $ 581,000.00 $ 546,000.00 $ 227,000.00 $ 240,000.00 $ 344,000.00 $ 336,000.00 $ 92,000.00 $ 92,000.00 $ 460,000.00 $ 422,000.00 $ 221,000.00 $ 210,000.00 $ 83,000.00 $ 74,000.00 $ 13,000.00 $ 16,000.00 $ 70,000.00 $ 58,000.00 $ 51,000.00 $ 37,000.00 $ $ Market Price of Common Stock No of outstanding Common Stock 59.36 13,000.00 46.65 11,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started