Question

The Situation It is time to negotiate a new contract with some of Lightning Wholesale's unionized employees. The company believes in dealing fairly with its

The Situation It is time to negotiate a new contract with some of Lightning Wholesale's unionized employees. The company believes in dealing fairly with its employees. Based on the current economic environment, cost of living increases, and the financial health of the organization, management feels that the best it can offer is a 3% wage increase. From its own analysis, the union believes that the company is holding out and that a 5.5% wage increase is more than possible. Unfortunately, negotiations have broken down, and the union has turned to its employee group seeking strike action. The union is certain of achieving its wage increase through the strike action, though it advises the employees that they may need to go on strike for three months to achieve the goal. The employees are trying to figure out their best course of actionshould they vote to go on strike or not?

The Data

The typical an employee in the unionized group currently earns $48,000 per year, which is paid out at the end of every month equally.

Six employees have five years until retirement.

Eight employees have 10 years until retirement.

Nine employees have 15 years until retirement.

Seven employees have 20 years until retirement.

Important Information

During the three months that employees would be on strike, employees receive no wages from Lightning Wholesale.

The time value of money is unknown, but employees have three annually compounded estimates of 6%, 5% and 4%.

Assume employees make their strike vote according to their best financial outcome.

The decision to go on strike is determined by the majority vote.

No future wage increases are important when making this decision to strike or not.

Your Tasks

The employees are uncertain of the time value of money, so they need to run a few scenarios. Perform steps 1 through 3 below using EACH of the time value of money estimates as a different scenario. Determine the outcome of the strike vote (go on strike or not go on strike).

1. Calculate the present value of the company offer for each of the employee groups. (12 marks)

2. Calculate the present value of the union increase for each of the employee groups. (12 marks)

3. Cast the votes according to your results and determine the strike vote outcome under each time value of money possibility. (12 marks)

4. Management is trying to figure out the most likely outcome of the strike vote so that they can adjust their bargaining strategy if necessary. Based on the completed scenario analysis, what outcome should management plan on? (4 marks)

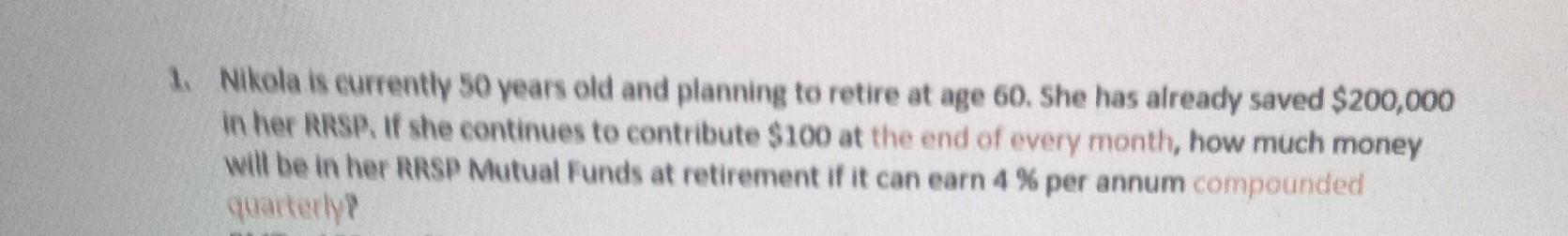

1. Nikola is currently 50 years old and planning to retire at age 60. She has already saved $200,000 in her RRSP. If she continues to contribute $100 at the end of every month, how much money will be in her RRSP Mutual Funds at retirement if it can earn 4 % per annum compounded quarterlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started