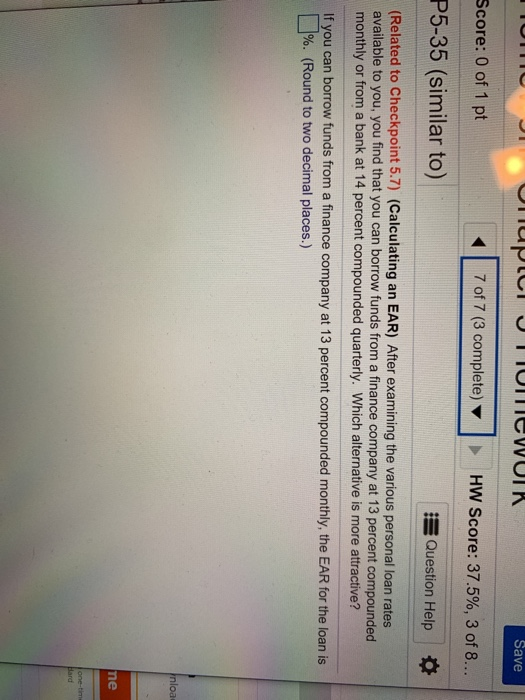

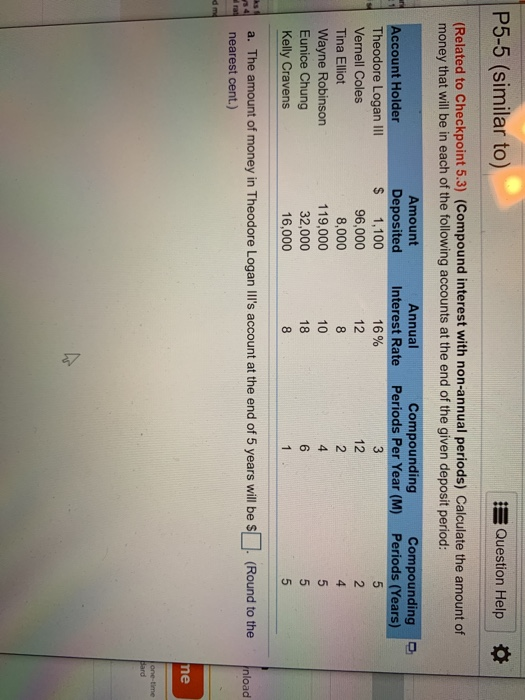

TUTTO Unupili TIUNTICWUIK Save Score: 0 of 1 pt 7 of 7 (3 complete) HW Score: 37.5%, 3 of 8... P5-35 (similar to) Question Help (Related to Checkpoint 5.7) (Calculating an EAR) After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at 13 percent compounded monthly or from a bank at 14 percent compounded quarterly. Which alternative is more attractive? If you can borrow funds from a finance company at 13 percent compounded monthly, the EAR for the loan is %. (Round to two decimal places.) Inloa ne one-thi Bard P5-5 (similar to) Question Help (Related to Checkpoint 5.3) (Compound interest with non-annual periods) Calculate the amount of money that will be in each of the following accounts at the end of the given deposit period: Account Holder Theodore Logan III Vernell Coles Tina Elliot Wayne Robinson Eunice Chung Kelly Cravens Amount Deposited $ 1,100 96,000 8,000 119,000 32,000 16,000 Annual Interest Rate 16% 12 8 10 18 8 Compounding Compounding Periods Per Year (M) Periods (Years) 3 12 2 2 4 4 5 6 5 1 5 a. The amount of money in Theodore Logan III's account at the end of 5 years will be $ (Round to the nearest cent.) Inload dme ne one-time Bard Homework Chapter 5 Homework Save Score: 0 of 1 pt 4 of 7 (3 complete) HW Score: 37.5%, 3 of 8... P5-13 (similar to) Question Help (Related to Checkpoint 5.5) (Solving for n) How many years will it take for $500 to grow to $1,090.49 if it's invested at 7 percent compounded annually? The number of years it will take for $500 to grow to $1,090.49 at 7 percent compounded annually is years. (Round to one decimal place.) Inloa ne one time Hard U UI (5 Lumplete) HW Score: 37.5%, 3 of 8... P5-29 (similar to) Question Help (Present-value comparison) Much to your surprise, you were selected to appear on the TV show "The Price is Right." As a result of your prowess in identifying how many rolls of toilet paper a typical American family keeps on hand, you win the opportunity to choose one of the following: $1,100 today, $9,000 in 14 years, or $28,000 in 30 years. Assuming that you can earn 9 percent on your money, which should you choose? If you are offered $9,000 in 14 years and you can earn 9 percent on your money, what is the present value of $9,000? (Round to the nearest cent.) Inlo ne onet Hard