Question

The SPDR S&P Biotech ETF's investment objective is to produce returns that match those of the S&P Biotechnology Select Industry Index.There also exist leverage and

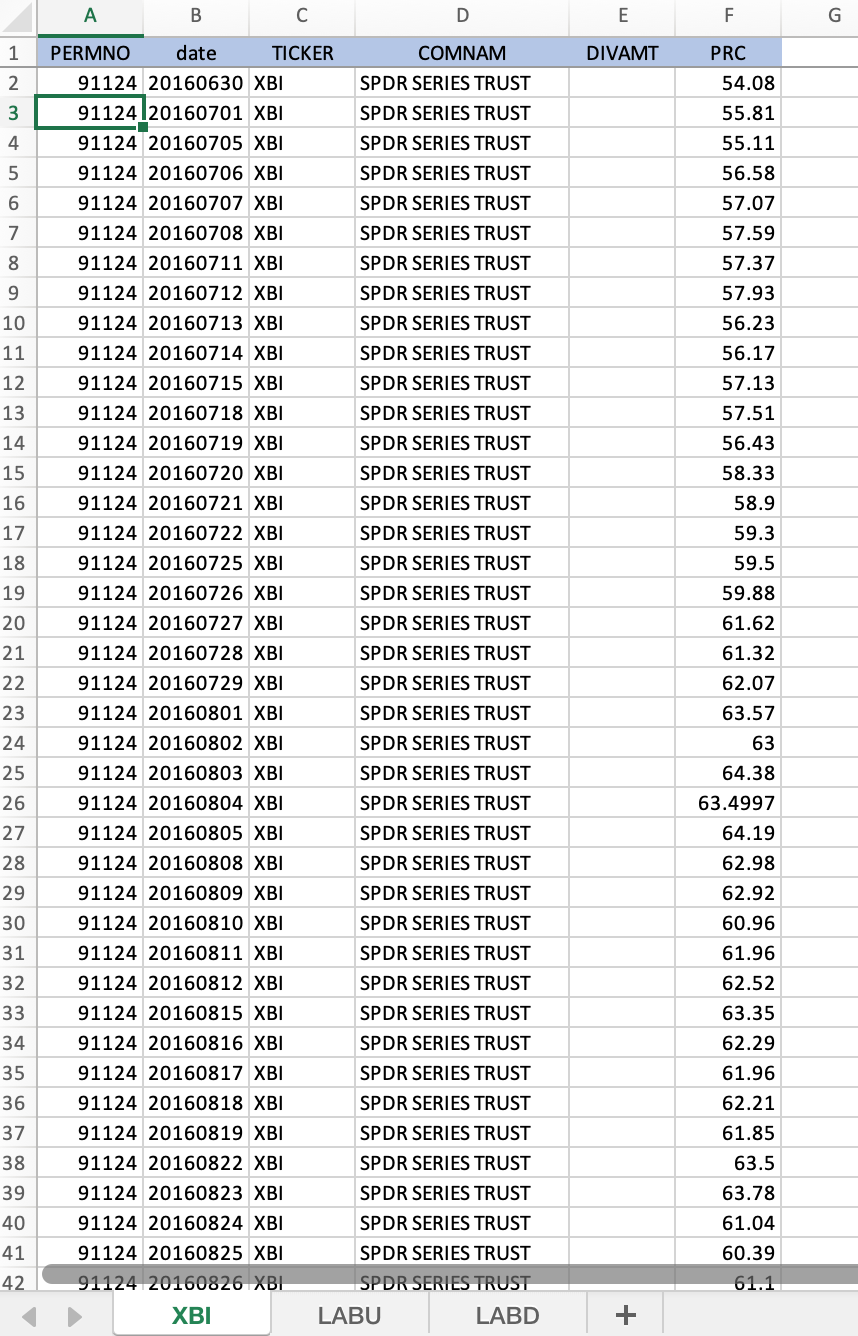

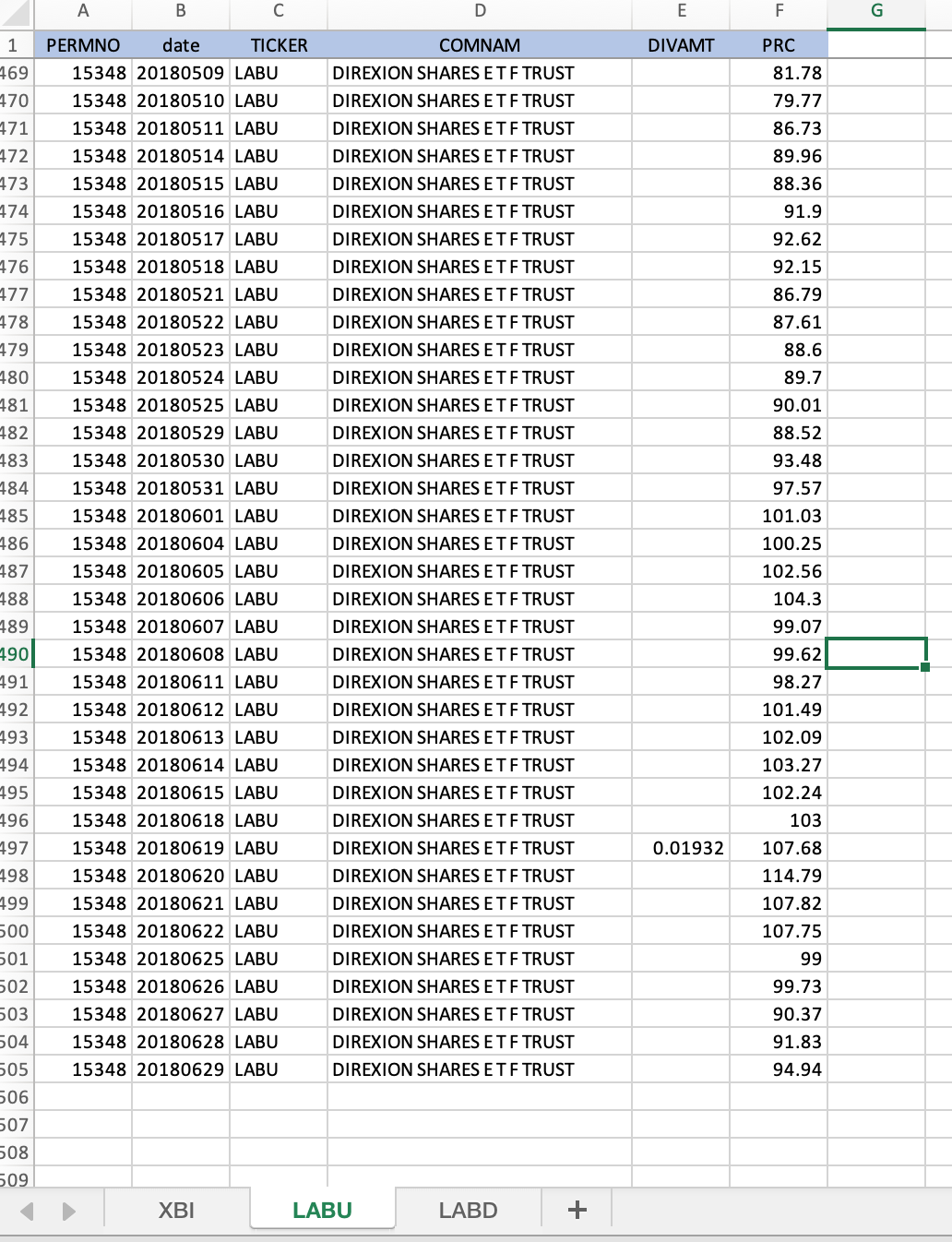

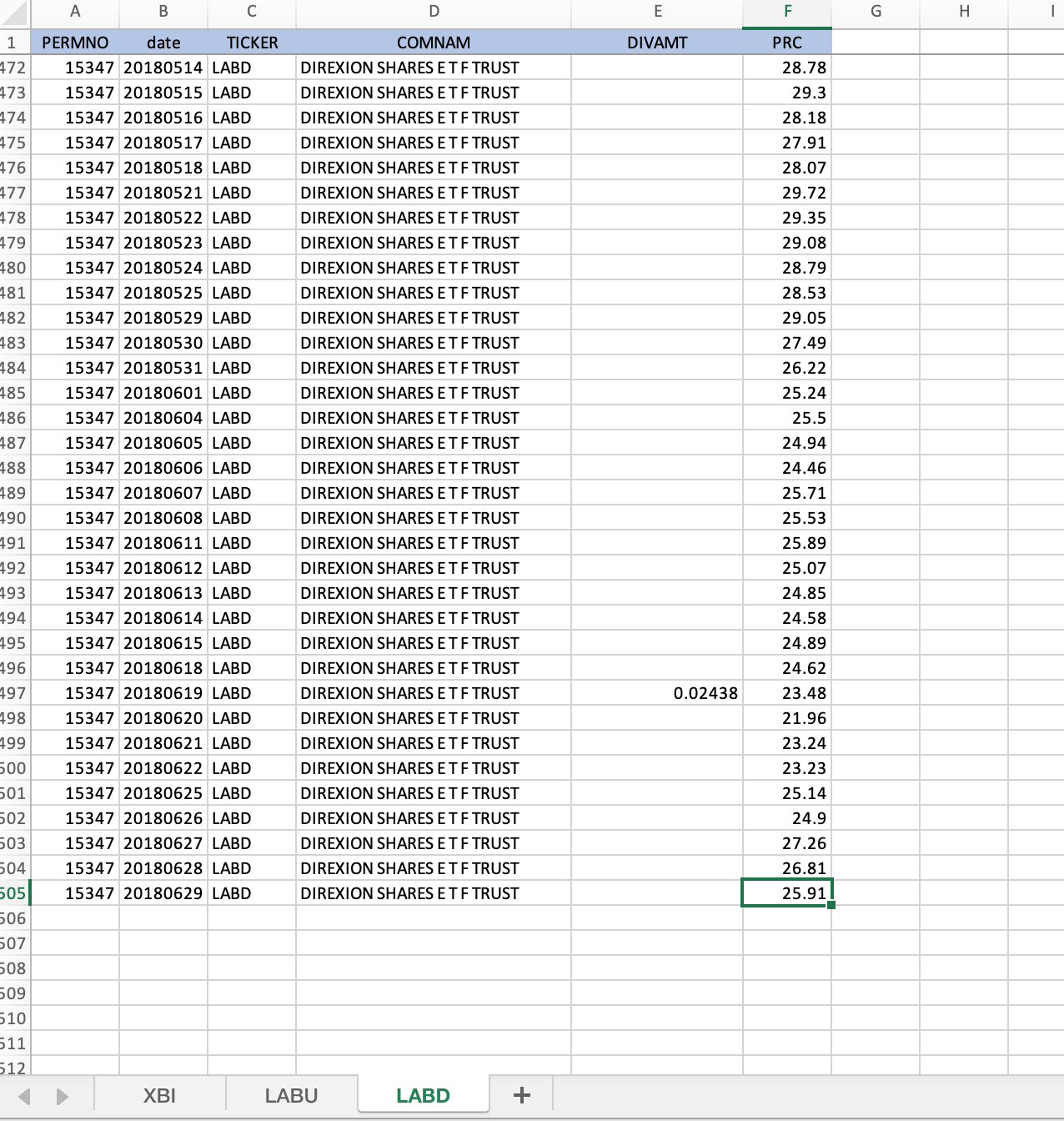

The SPDR S&P Biotech ETF's investment objective is to produce returns that match those of the S&P Biotechnology Select Industry Index.There also exist leverage and inverse leveraged ETFs having investment objectives that are multiples of that index.Specifically, these are the Direxion Daily S&P Biotech Bull 3x shares (ticker LABU) that aims to return +3 times the daily index return and the Daily S&P Biotech Bear 3x Shares (ticker LABD) that aims to return -3 times the daily index return.The spreadsheet data_PS_2.xlsx accompanies this problem set.There you will find daily prices and distribution amounts for these 3 ETFs.Use that data to answer the following questions.

A.[4 points] Use the daily prices and distributions to compute the daily returns to each ETF for the time period July 1 2016 to June 30 2018.Note, the dividends appear on the ex-date, so the seller of the stock receives the dividend, not the buyer.

B.[3 points] Compute the arithmetic average daily returns to each of the funds.

C.[3 points] Compute the geometric average daily returns to each of the funds.

D.[2 points] Why does the geometric average return differ from the arithmetic average?To what is that difference proportional?

E.[3 points] Compute the holding period return (across the full holding period) for each of the funds.

F.[6 points] Assume that on June 30, 2016, you invested $100,000 in equal amounts of LABU and LABD (i.e. use $50,000 to buy LABU shares at the 06/30/2016 closing price, and $50,000 to do the same with LABD).

i.What would that portfolio be worth at the end of June 30, 2018?

ii.What would be the weights of LABU and LABD in the portfolio as of June 30, 2018?

iii.One might think since LABU and LABD return +3 and -3 times the daily returns to the same index that the portfolio return would be 0%.Why is this not the case?

A B C 1234567 PERMNO date TICKER D COMNAM E LL F G DIVAMT PRC 91124 20160630 XBI 91124 20160701 XBI 91124 20160705 XBI SPDR SERIES TRUST 54.08 SPDR SERIES TRUST 55.81 SPDR SERIES TRUST 55.11 91124 20160706 XBI SPDR SERIES TRUST 56.58 91124 20160707 XBI SPDR SERIES TRUST 57.07 91124 20160708 XBI SPDR SERIES TRUST 57.59 8 91124 20160711 XBI SPDR SERIES TRUST 57.37 9 91124 20160712 XBI SPDR SERIES TRUST 57.93 10 91124 20160713 XBI SPDR SERIES TRUST 56.23 11 91124 20160714 XBI SPDR SERIES TRUST 56.17 12 91124 20160715 XBI SPDR SERIES TRUST 57.13 13 91124 20160718 XBI SPDR SERIES TRUST 57.51 14 91124 20160719 XBI SPDR SERIES TRUST 56.43 15 91124 20160720 XBI SPDR SERIES TRUST 58.33 16 91124 20160721 XBI SPDR SERIES TRUST 58.9 17 91124 20160722 XBI SPDR SERIES TRUST 59.3 18 91124 20160725 XBI SPDR SERIES TRUST 59.5 19 91124 20160726 XBI SPDR SERIES TRUST 59.88 20 91124 20160727 XBI SPDR SERIES TRUST 61.62 21 91124 20160728 XBI SPDR SERIES TRUST 61.32 22 91124 20160729 XBI SPDR SERIES TRUST 62.07 23 91124 20160801 XBI SPDR SERIES TRUST 63.57 24 91124 20160802 XBI SPDR SERIES TRUST 63 25 91124 20160803 XBI SPDR SERIES TRUST 64.38 26 91124 20160804 XBI SPDR SERIES TRUST 63.4997 27 91124 20160805 XBI SPDR SERIES TRUST 64.19 28 91124 20160808 XBI SPDR SERIES TRUST 62.98 29 91124 20160809 XBI SPDR SERIES TRUST 62.92 30 91124 20160810 XBI SPDR SERIES TRUST 60.96 31 91124 20160811 XBI SPDR SERIES TRUST 61.96 32 91124 20160812 XBI SPDR SERIES TRUST 62.52 33 91124 20160815 XBI SPDR SERIES TRUST 63.35 34 91124 20160816 XBI SPDR SERIES TRUST 62.29 35 91124 20160817 XBI SPDR SERIES TRUST 61.96 36 91124 20160818 XBI SPDR SERIES TRUST 62.21 37 91124 20160819 XBI SPDR SERIES TRUST 61.85 38 91124 20160822 XBI SPDR SERIES TRUST 63.5 39 91124 20160823 XBI SPDR SERIES TRUST 63.78 40 91124 20160824 XBI SPDR SERIES TRUST 61.04 41 91124 20160825 XBI SPDR SERIES TRUST 60.39 42 91124 20160826 XBI XBI SPDR SERIES TRUST 61.1 LABU LABD +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started