Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages

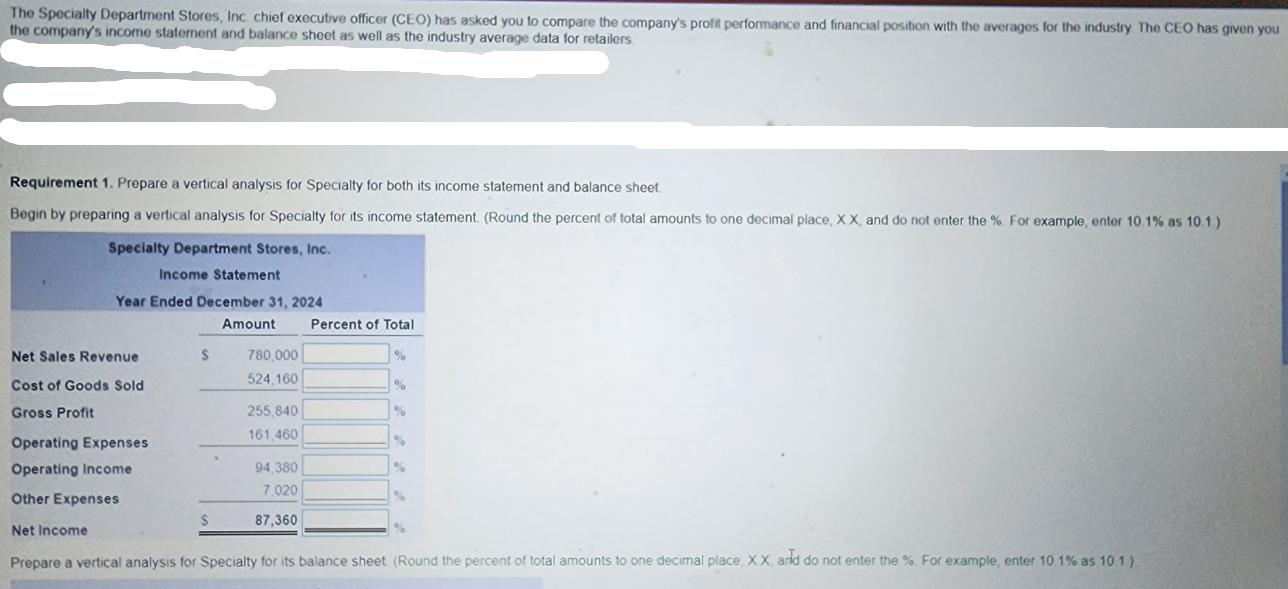

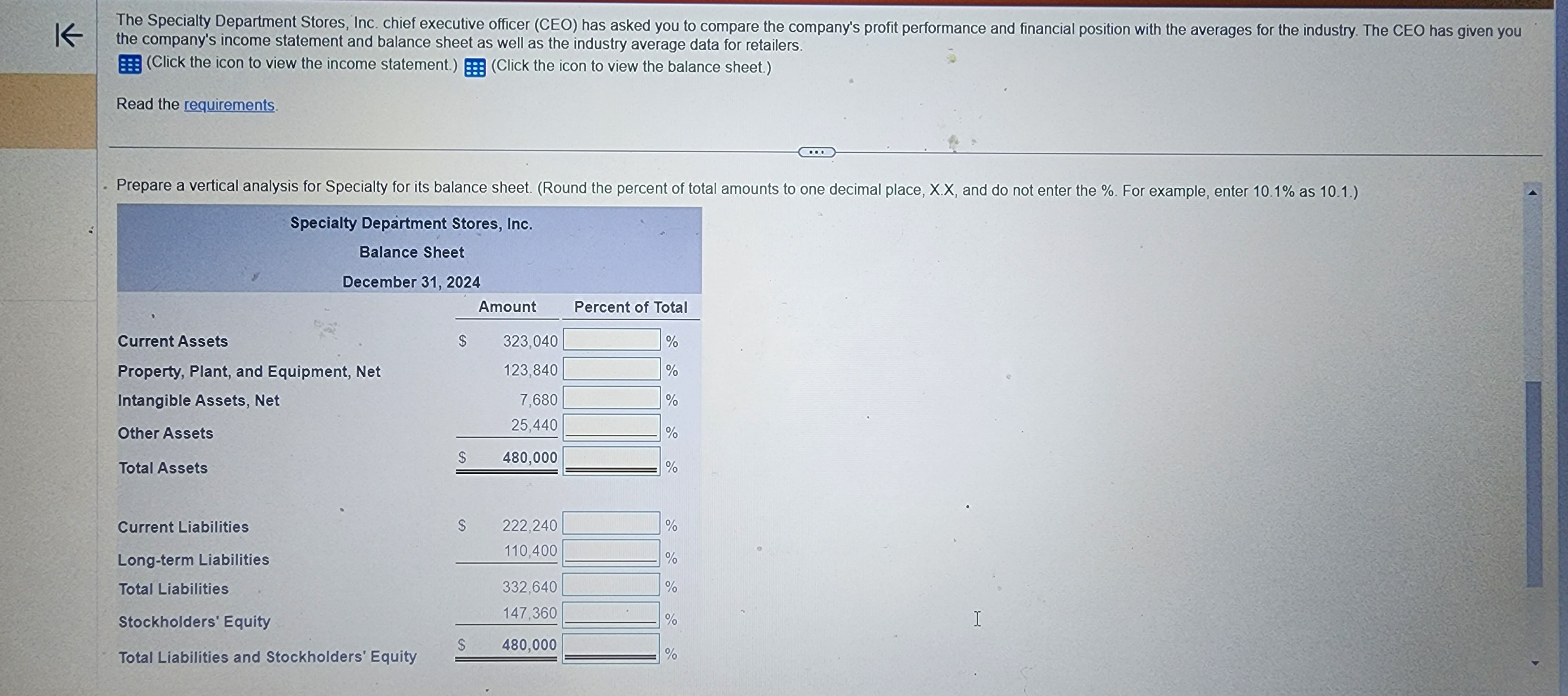

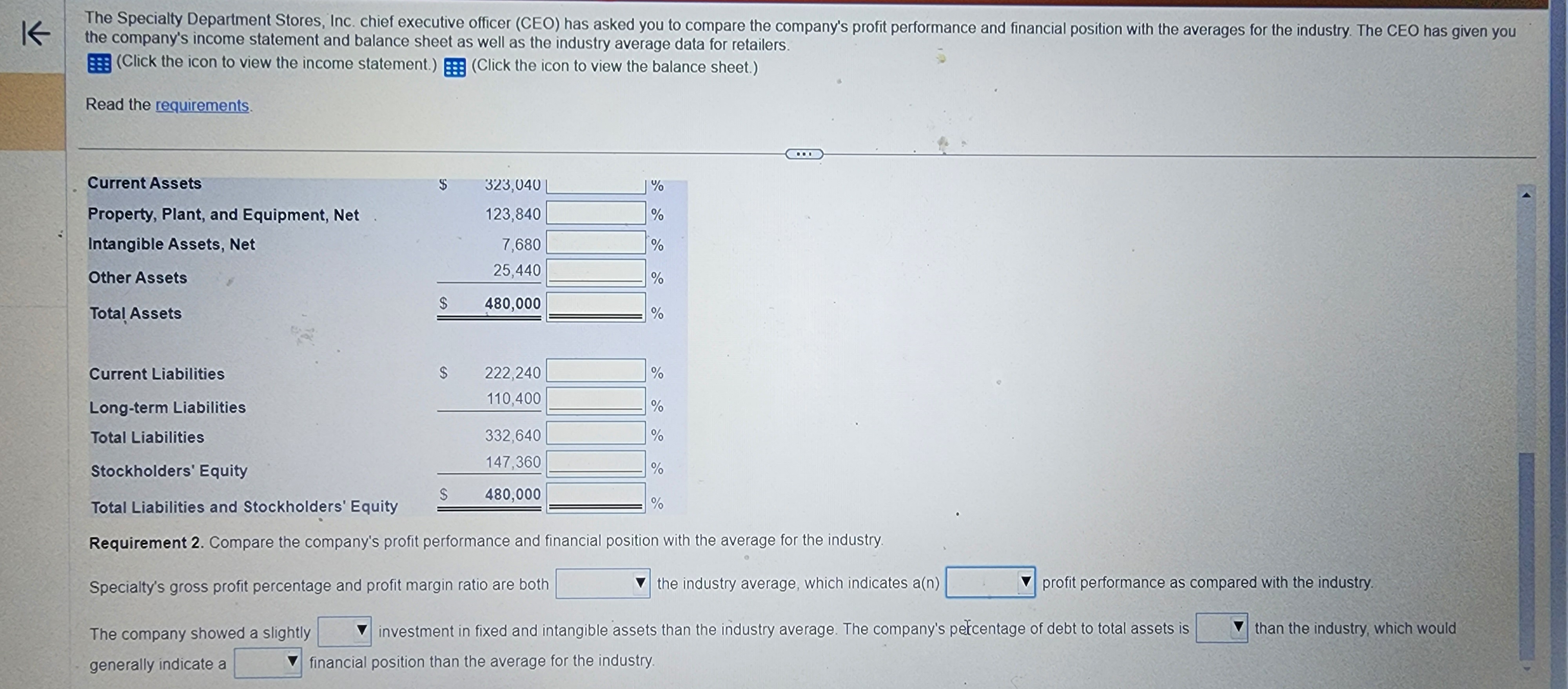

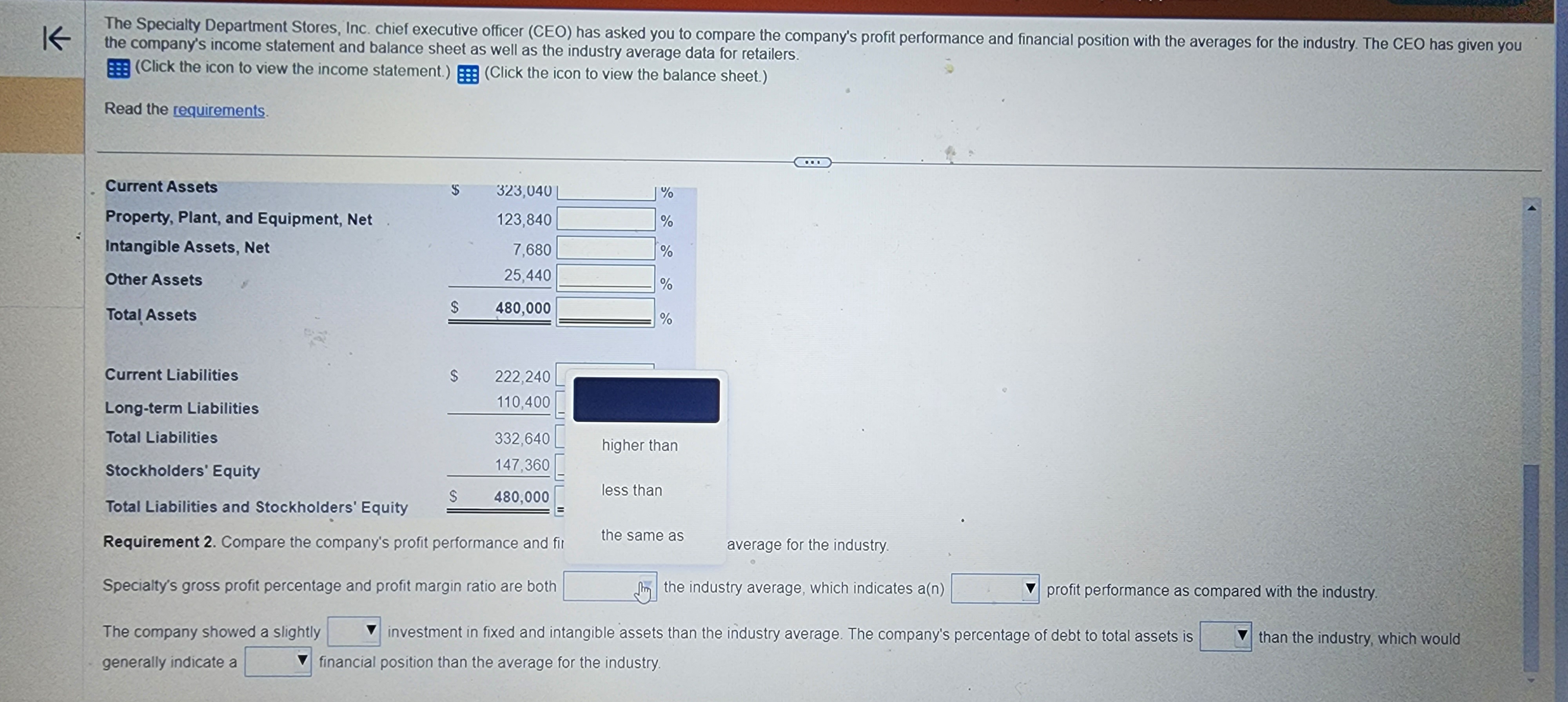

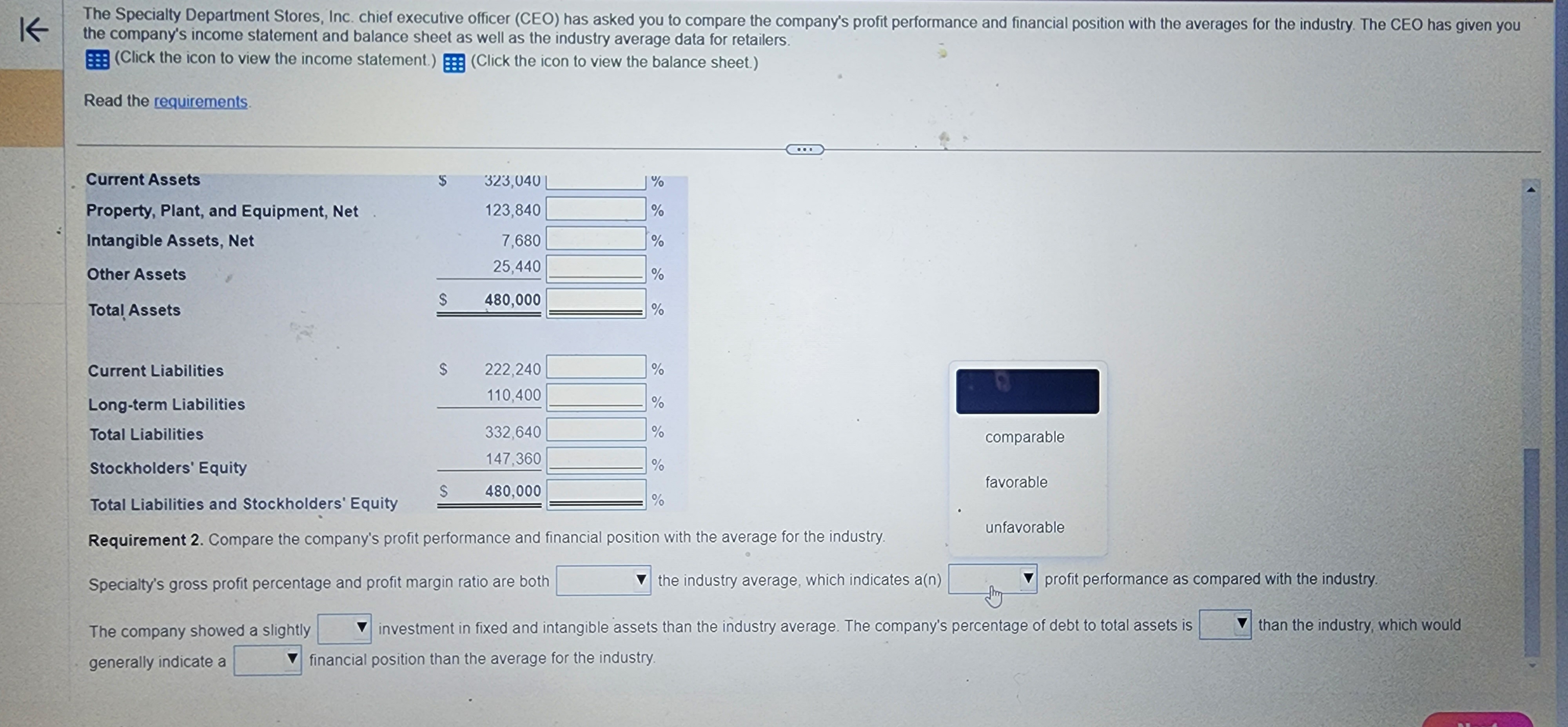

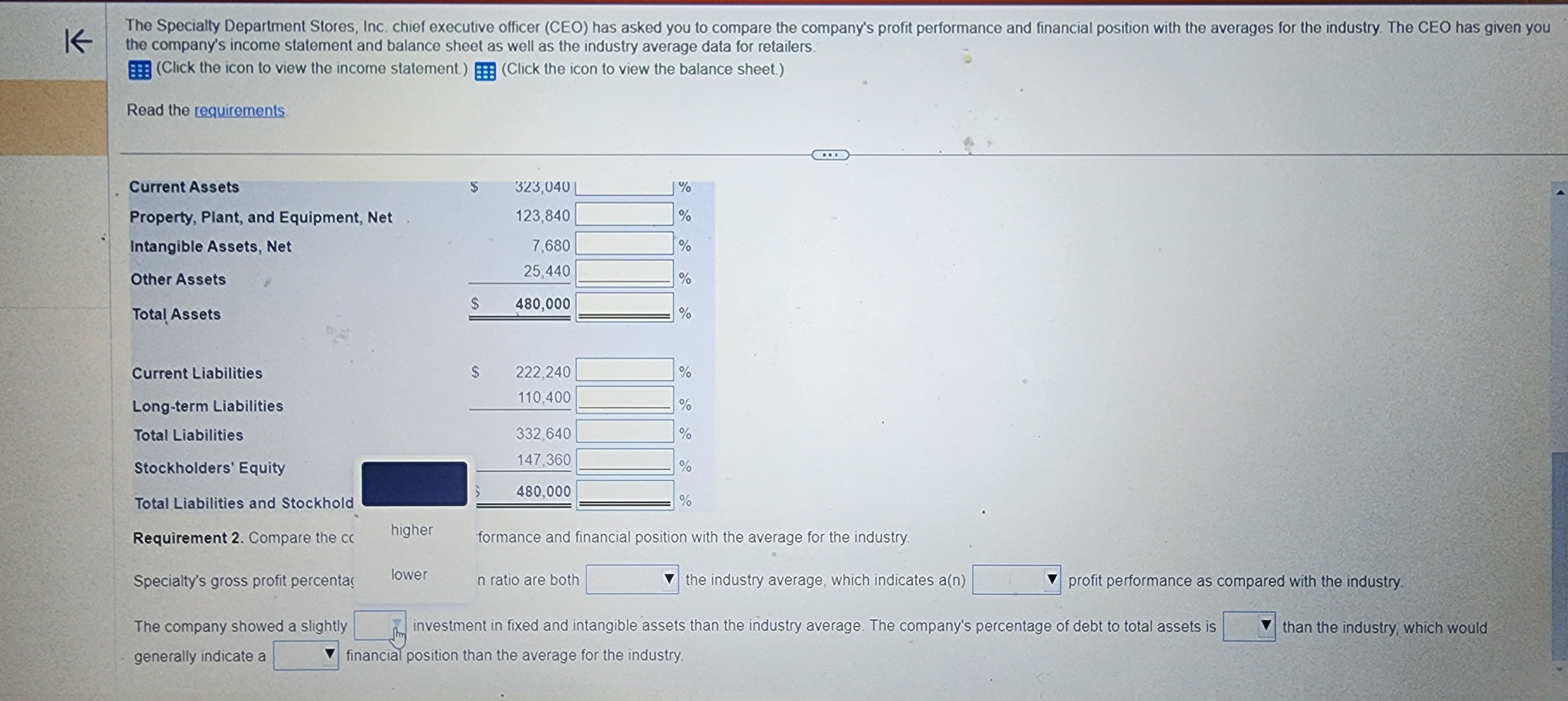

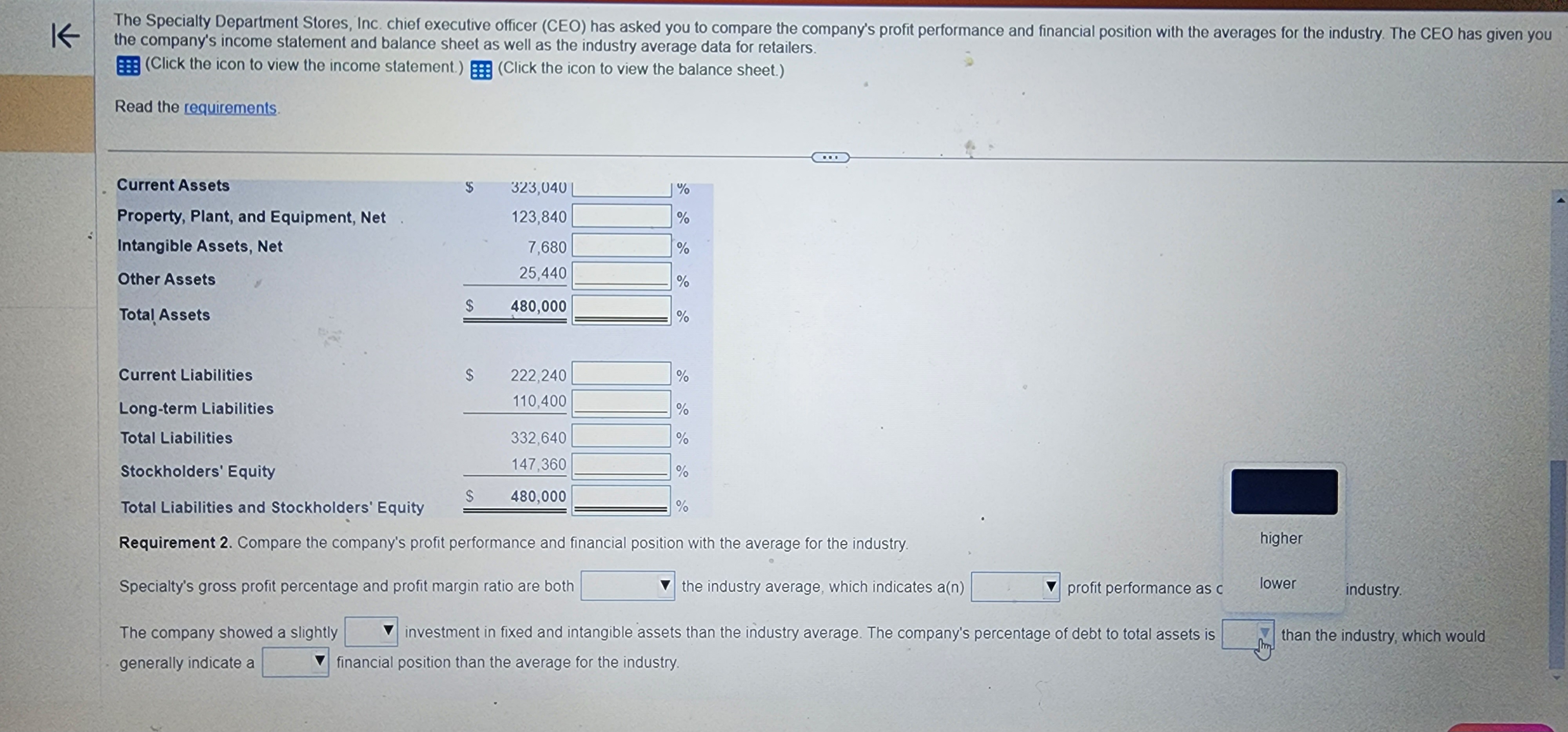

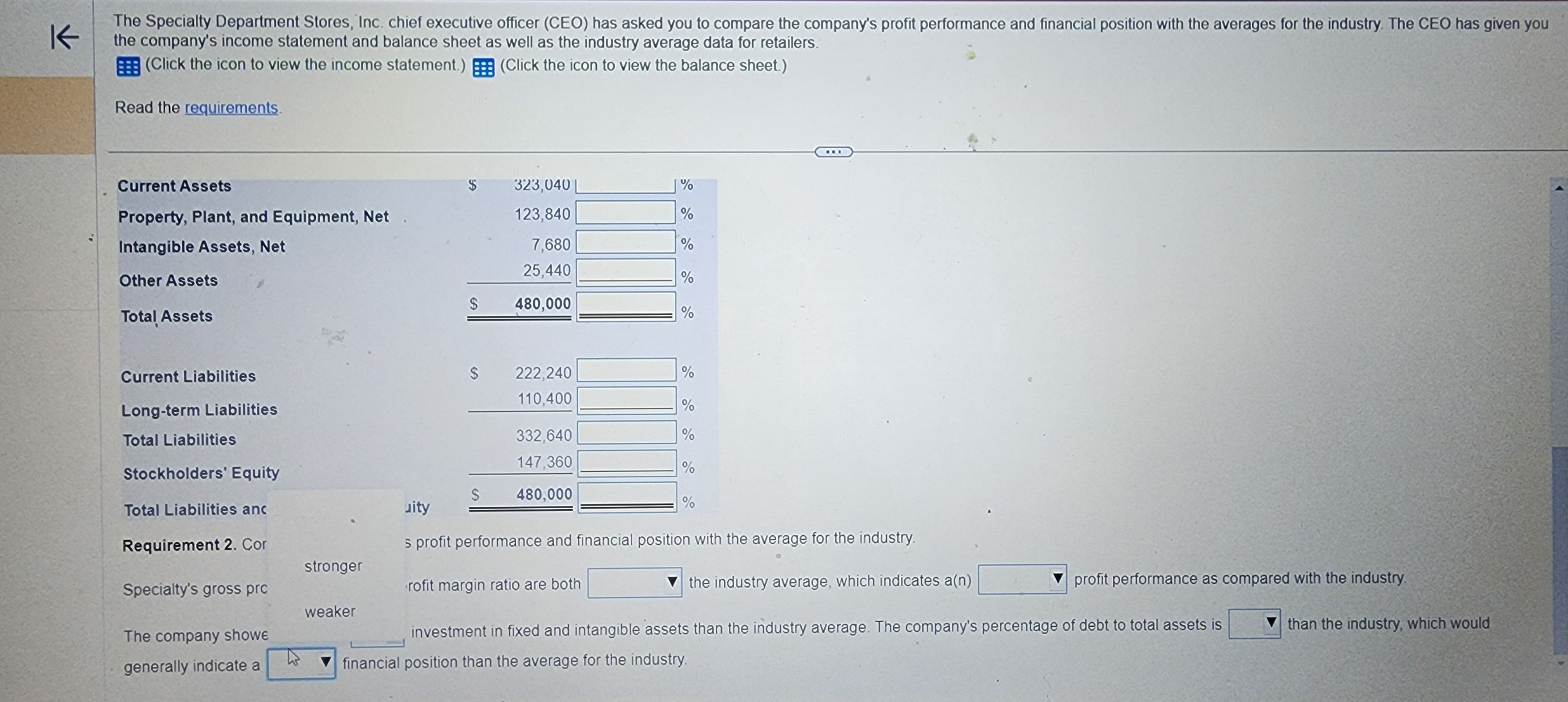

The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers Requirement 1. Prepare a vertical analysis for Specialty for both its income statement and balance sheet. Begin by preparing a vertical analysis for Specialty for its income statement. (Round the percent of total amounts to one decimal place, XX, and do not enter the %. For example, enter 10.1% as 10.1) Specialty Department Stores, Inc. Income Statement Year Ended December 31, 2024 Amount Percent of Total Net Sales Revenue $ 780,000 524,160 Cost of Goods Sold % Gross Profit 255,840 161,460 Operating Expenses Operating Income 94,380 Other Expenses Net Income 7,020 87,360 Prepare a vertical analysis for Specialty for its balance sheet (Round the percent of total amounts to one decimal place, XX, and do not enter the %. For example, enter 10 1% as 10.1.) K The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the balance sheet.) (Click the icon to view the income statement.) Read the requirements. Prepare a vertical analysis for Specialty for its balance sheet. (Round the percent of total amounts to one decimal place, X.X, and do not enter the %. For example, enter 10.1% as 10.1.) Specialty Department Stores, Inc. Balance Sheet December 31, 2024 Amount Percent of Total Current Assets $ 323,040 % Property, Plant, and Equipment, Net 123,840 % Intangible Assets, Net 7,680 % 25,440 % Other Assets $ 480,000 % Total Assets Current Liabilities Long-term Liabilities $ 222,240 % 110,400 % 332,640 % Total Liabilities 147,360 I % Stockholders' Equity $ 480,000 % Total Liabilities and Stockholders' Equity K The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the balance sheet.) BEE (Click the icon to view the income statement.) Read the requirements. Current Assets $ 323,040 Property, Plant, and Equipment, Net 123,840 7,680 Do do do % % % Intangible Assets, Net 25,440 % Other Assets $ 480,000 % Total Assets Current Liabilities $ 222,240 % 110,400 Long-term Liabilities % Total Liabilities 332,640 % 147,360 Stockholders' Equity % $ 480,000 Total Liabilities and Stockholders' Equity % Requirement 2. Compare the company's profit performance and financial position with the average for the industry. Specialty's gross profit percentage and profit margin ratio are both the industry average, which indicates a(n) profit performance as compared with the industry. The company showed a slightly generally indicate a investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is financial position than the average for the industry. than the industry, which would The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the balance sheet.) (Click the icon to view the income statement.) Read the requirements. Current Assets $ 323,040 % Property, Plant, and Equipment, Net 123,840 % Intangible Assets, Net 7,680 % 25,440 Other Assets % $ 480,000 Total Assets % Current Liabilities Long-term Liabilities $ 222,240 110,400 Total Liabilities 332,640 higher than Stockholders' Equity $ 147,360 480,000 less than Total Liabilities and Stockholders' Equity the same as Requirement 2. Compare the company's profit performance and fir average for the industry. the industry average, which indicates a(n) Specialty's gross profit percentage and profit margin ratio are both The company showed a slightly generally indicate a profit performance as compared with the industry. than the industry, which would investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is financial position than the average for the industry. K The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the balance sheet.) BEE (Click the icon to view the income statement.) Read the requirements. Current Assets Property, Plant, and Equipment, Net Intangible Assets, Net Other Assets Total Assets $ 323,040 % 123,840 % 7,680 % 25,440 % $ 480,000 % Current Liabilities $ 222,240 % 110,400 Long-term Liabilities % Total Liabilities 332,640 % 147,360 % Stockholders' Equity $ 480,000 % Total Liabilities and Stockholders' Equity comparable favorable Requirement 2. Compare the company's profit performance and financial position with the average for the industry. Specialty's gross profit percentage and profit margin ratio are both unfavorable the industry average, which indicates a(n) profit performance as compared with the industry. The company showed a slightly generally indicate a investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is financial position than the average for the industry. than the industry, which would K The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the balance sheet.) (Click the icon to view the income statement.) Read the requirements. Current Assets Property, Plant, and Equipment, Net Intangible Assets, Net Other Assets Total Assets $ 323,040 % 123,840 % 7,680 % 25,440 % $ 480,000 % Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Total Liabilities and Stockhold Requirement 2. Compare the cc $ 222,240 % 110,400 % 332,640 % 147,360 % 480,000 % higher formance and financial position with the average for the industry. lower Specialty's gross profit percentag n ratio are both the industry average, which indicates a(n) profit performance as compared with the industry. The company showed a slightly generally indicate a investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is financial position than the average for the industry. than the industry, which would K The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the income statement.) Read the requirements. (Click the icon to view the balance sheet.) Current Assets $ 323,040 L % Property, Plant, and Equipment, Net 123,840 % Intangible Assets, Net 7,680 % 25.440 Other Assets % $ 480,000 Total Assets % Current Liabilities $ 222,240 % 110,400 Long-term Liabilities % Total Liabilities 332,640 % 147,360 % Stockholders' Equity $ 480,000 Total Liabilities and Stockholders' Equity % Requirement 2. Compare the company's profit performance and financial position with the average for the industry. Specialty's gross profit percentage and profit margin ratio are both higher the industry average, which indicates a(n) profit performance as c lower industry. The company showed a slightly generally indicate a investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is financial position than the average for the industry. than the industry, which would K The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the balance sheet.) (Click the icon to view the income statement.) Read the requirements. Current Assets 323,040 % Property, Plant, and Equipment, Net 123,840 % Intangible Assets, Net 7,680 % 25,440 Other Assets % $ 480,000 Total Assets % Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Total Liabilities anc Requirement 2. Cor $ 222,240 % 110,400 % 332,640 % 147.360 % S 480,000 % uity s profit performance and financial position with the average for the industry. stronger Specialty's gross prc rofit margin ratio are both the industry average, which indicates a(n) profit performance as compared with the industry. weaker The company showe generally indicate a investment in fixed and intangible assets than the industry average. The company's percentage of debt to total assets is financial position than the average for the industry. than the industry, which would ts $ 323,040 % nt, and Equipment, Net sets, Net ilities iabilities ies s' Equity ies and Stockholders' Ed t 2. Compare the company ross profit percentage and y showed a slightly icate a D Data table Specialty Department Stores, Inc. Income Statement Compared with Industry Average Year Ended December 31, 2024 - X Industry Specialty Average Net Sales Revenue $ 780,000 100.0 % Cost of Goods Sold 524,160 65.8 Gross Profit 255,840 34.2 161,460 19.7 Operating Expenses Operating Income 94,380 14.5 7,020 0.4 Other Expenses financial $ 87,360 14.1% Net Income profit perf percentage of debt to to urrent Assets operty, Plant, and Equipment, tangible Assets, Net ther Assets otal Assets % 323,040 Data table Specialty Department Stores, Inc. Balance Sheet Compared with Industry Average - X final urrent Liabilities ong-term Liabilities Fotal Liabilities Stockholders' Equity Total Liabilities and Stockholders Requirement 2. Compare the comp Specialty's gross profit percentage The company showed a slightly generally indicate a Current Assets December 31, 2024 Property, Plant, and Equipment, Net Intangible Assets, Net Other Assets Industry Specialty Average $ 323,040 70.9% 123,840 23.6 7,680 0.8 25,440 4.7 profit perform $ 480,000 100.0 % Total Assets entage of debt to total Current Liabilities $ 222,240 48.1 % 110,400 16.6 Long-term Liabilities Total Liabilities 332,640 64.7 147,360 35.3 Stockholders' Equity Total Liabilities and Stockholders' $ 480,000 100.0 % Equity Print Done The Specialty Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial posi the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the income statement.) (Click the icon to view the balance sheet.) Read the requirements. Requirements $ 323,040 % Current Assets Property, Plant, and Equipm Intangible Assets, Net Other Assets Total Assets Requirements Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Total Liabilities and Stockho Requirement 2. Compare the 1. Prepare a vertical analysis for Specialty for both its income statement and balance sheet. 2. Compare the company's profit performance and financial position with the average for the industry. Print Done - x Specialty's gross profit percentage and profit margin ratio are both the industry average, which indicates a(n) profit p The company showed a slightly investment in fixed and intangible assets than the industry average. The company's percentage of debt t generally indicate a financial position than the average for the industry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Specialty Department Stores Inc Income Statement Year Ended December 31 2024 Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started