Answered step by step

Verified Expert Solution

Question

1 Approved Answer

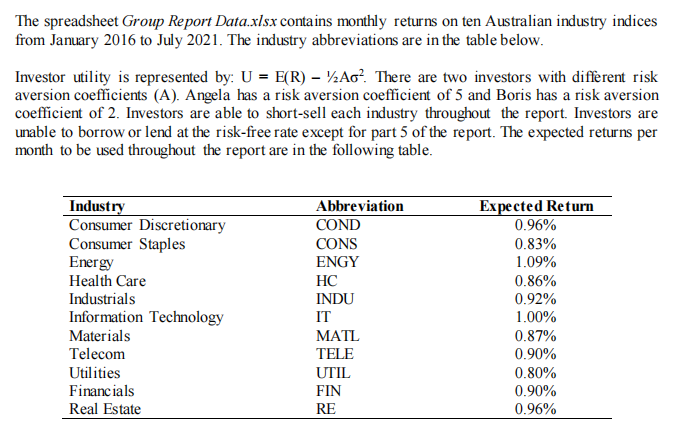

The spreadsheet Group Report Data.xlsx contains monthly returns on ten Australian industry indices from January 2016 to July 2021. The industry abbreviations are in the

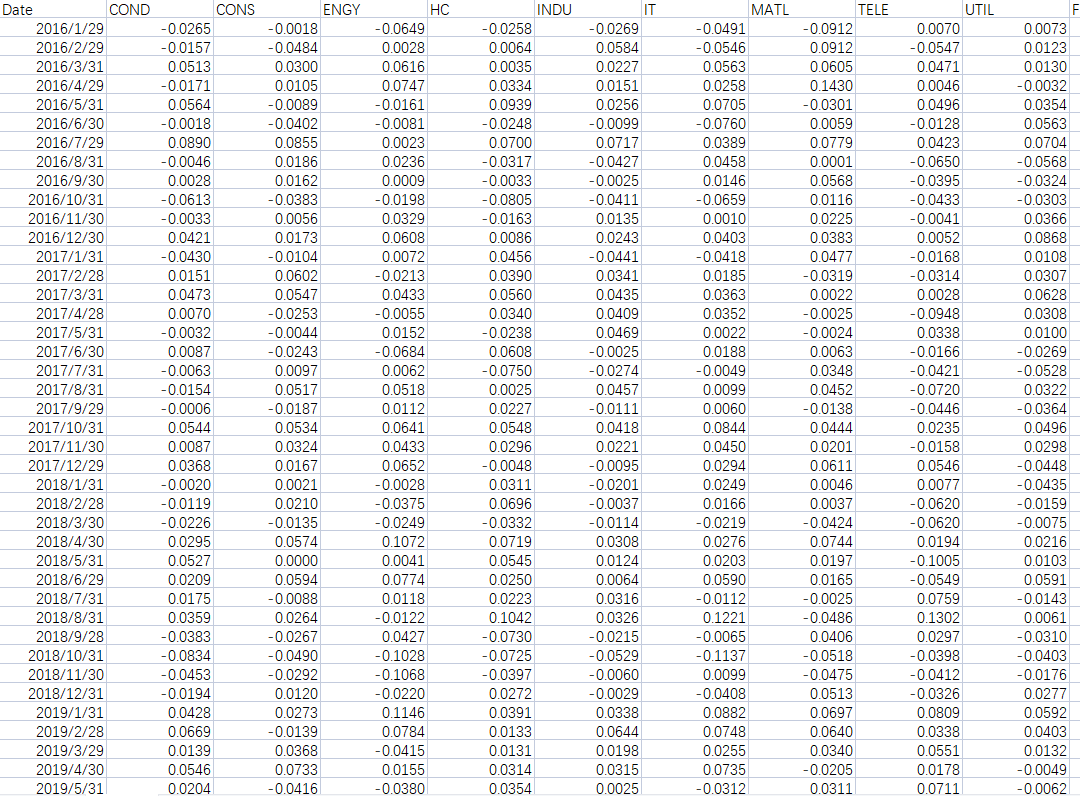

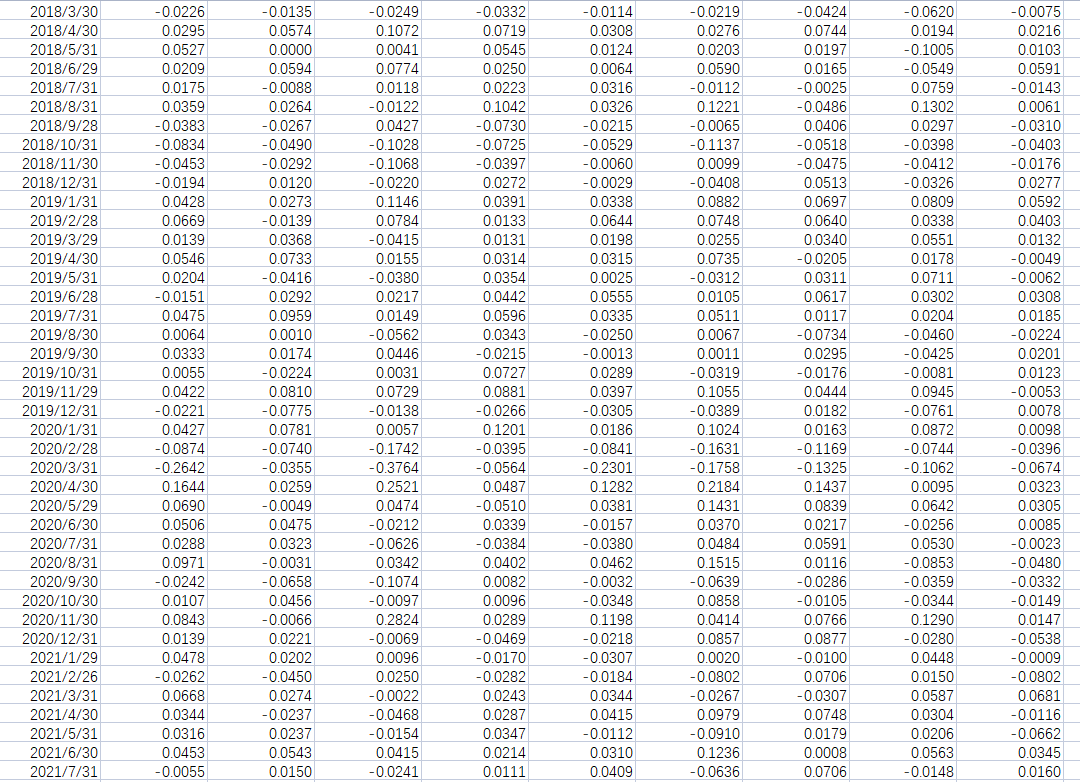

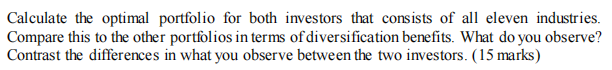

The spreadsheet Group Report Data.xlsx contains monthly returns on ten Australian industry indices from January 2016 to July 2021. The industry abbreviations are in the table below. Investor utility is represented by: U = E(R) 72A0?. There are two investors with different risk aversion coefficients (A). Angela has a risk aversion coefficient of 5 and Boris has a risk aversion coefficient of 2. Investors are able to short-sell each industry throughout the report. Investors are unable to borrow or lend at the risk-free rate except for part 5 of the report. The expected returns per month to be used throughout the report are in the following table. Industry Consumer Discretionary Consumer Staples Energy Health Care Industrials Information Technology Materials Telecom Utilities Financials Real Estate Abbreviation COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE Expected Return 0.96% 0.83% 1.09% 0.86% 0.92% 1.00% 0.87% 0.90% 0.80% 0.90% 0.96% CONS -0.0265 -0.0157 0.0513 -0.0171 0.0564 -0.0018 0.0890 -0.0046 0.0028 -0.0613 Date COND 2016/1/29 2016/2/29 2016/3/31 2016/4/29 2016/5/31 2016/6/30 2016/7/29 2016/8/31 2016/9/30 2016/10/31 2016/11/30 2016/12/30 2017/1/31 2017/2/28 2017/3/31 2017/4/28 2017/5/31 2017/6/30 2017/7/31 2017/8/31 2017/9/29 2017/10/31 2017/11/30 2017/12/29 2018/1/31 2018/2/28 2018/3/30 2018/4/30 2018/5/31 2018/6/29 2018/7/31 2018/8/31 2018/9/28 2018/10/31 2018/11/30 2018/12/31 2019/1/31 2019/2/28 2019/3/29 2019/4/30 2019/5/31 -0.0033 0.0421 -0.0430 0.0151 0.0473 0.0070 -0.0032 0.0087 -0.0063 -0.0154 -0.0006 0.0544 0.0087 0.0368 -0.0020 -0.0119 -0.0226 0.0295 0.0527 0.0209 0.0175 0.0359 -0.0383 -0.0834 -0.0453 -0.0194 0.0428 0.0669 0.0139 0.0546 0.0204 ENGY -0.0018 -0.0484 0.0300 0.0105 -0.0089 -0.0402 0.0855 0.0186 0.0162 -0.0383 0.0056 0.0173 -0.0104 0.0602 0.0547 -0.0253 -0.0044 -0.0243 0.0097 0.0517 -0.0187 0.0534 0.0324 0.0167 0.0021 0.0210 -0.0135 0.0574 0.0000 0.0594 -0.0088 0.0264 -0.0267 -0.0490 -0.0292 0.0120 0.0273 -0.0139 0.0368 0.0733 -0.0416 HC -0.0649 0.0028 0.0616 0.0747 -0.0161 -0.0081 0.0023 0.0236 0.0009 -0.0198 0.0329 0.0608 0.0072 -0.0213 0.0433 -0.0055 0.0152 -0.0684 0.0062 0.0518 0.0112 0.0641 0.0433 0.0652 -0.0028 -0.0375 -0.0249 0.1072 0.0041 0.0774 0.0118 -0.0122 0.0427 -0.1028 -0.1068 -0.0220 0.1146 0.0784 -0.0415 0.0155 -0.0380 INDU -0.0258 0.0064 0.0035 0.0334 0.0939 -0.0248 0.0700 -0.0317 -0.0033 -0.0805 -0.0163 0.0086 0.0456 0.0390 0.0560 0.0340 -0.0238 0.0608 -0.0750 0.0025 0.0227 0.0548 0.0296 -0.0048 0.0311 0.0696 -0.0332 0.0719 0.0545 0.0250 0.0223 0.1042 -0.0730 -0.0725 -0.0397 0.0272 0.0391 0.0133 0.0131 0.0314 0.0354 IT -0.0269 0.0584 0.0227 0.0151 0.0256 -0.0099 0.0717 -0.0427 -0.0025 -0.0411 0.0135 0.0243 -0.0441 0.0341 0.0435 0.0409 0.0469 -0.0025 -0.0274 0.0457 -0.0111 0.0418 0.0221 -0.0095 -0.0201 -0.0037 -0.0114 0.0308 0.0124 0.0064 0.0316 0.0326 -0.0215 -0.0529 -0.0060 -0.0029 0.0338 0.0644 0.0198 0.0315 0.0025 MATL -0.0491 -0.0546 0.0563 0.0258 0.0705 -0.0760 0.0389 0.0458 0.0146 -0.0659 0.0010 0.0403 -0.0418 0.0185 0.0363 0.0352 0.0022 0.0188 -0.0049 0.0099 0.0060 0.0844 0.0450 0.0294 0.0249 0.0166 -0.0219 0.0276 0.0203 0.0590 -0.0112 0.1221 -0.0065 -0.1137 0.0099 -0.0408 0.0882 0.0748 0.0255 0.0735 -0.0312 TELE -0.0912 0.0912 0.0605 0.1430 -0.0301 0.0059 0.0779 0.0001 0.0568 0.0116 0.0225 0.0383 0.0477 -0.0319 0.0022 -0.0025 -0.0024 0.0063 0.0348 0.0452 -0.0138 0.0444 0.0201 0.0611 0.0046 0.0037 -0.0424 0.0744 0.0197 0.0165 -0.0025 -0.0486 0.0406 -0.0518 -0.0475 0.0513 0.0697 0.0640 0.0340 -0.0205 0.0311 UTIL 0.0070 -0.0547 0.0471 0.0046 0.0496 -0.0128 0.0423 -0.0650 -0.0395 -0.0433 -0.0041 0.0052 -0.0168 -0.0314 0.0028 -0.0948 0.0338 -0.0166 -0.0421 -0.0720 -0.0446 0.0235 -0.0158 0.0546 0.0077 -0.0620 -0.0620 0.0194 -0.1005 -0.0549 0.0759 0.1302 0.0297 -0.0398 -0.0412 -0.0326 0.0809 0.0338 0.0551 0.0178 0.0711 0.0073 0.0123 0.0130 -0.0032 0.0354 0.0563 0.0704 -0.0568 -0.0324 -0.0303 0.0366 0.0868 0.0108 0.0307 0.0628 0.0308 0.0100 -0.0269 -0.0528 0.0322 -0.0364 0.0496 0.0298 -0.0448 -0.0435 -0.0159 -0.0075 0.0216 0.0103 0.0591 -0.0143 0.0061 -0.0310 -0.0403 -0.0176 0.0277 0.0592 0.0403 0.0132 -0.0049 -0.0062 2018/3/30 2018/4/30 2018/5/31 2018/6/29 2018/7/31 2018/8/31 2018/9/28 2018/10/31 2018/11/30 2018/12/31 2019/1/31 2019/2/28 2019/3/29 2019/4/30 2019/5/31 2019/6/28 2019/7/31 2019/8/30 2019/9/30 2019/10/31 2019/11/29 2019/12/31 2020/1/31 2020/2/28 2020/3/31 2020/4/30 2020/5/29 2020/6/30 2020/7/31 2020/8/31 2020/9/30 2020/10/30 2020/11/30 2020/12/31 2021/1/29 2021/2/26 2021/3/31 2021/4/30 2021/5/31 2021/6/30 2021/7/31 -0.0226 0.0295 0.0527 0.0209 0.0175 0.0359 -0.0383 -0.0834 -0.0453 -0.0194 0.0428 0.0669 0.0139 0.0546 0.0204 -0.0151 0.0475 0.0064 0.0333 0.0055 0.0422 -0.0221 0.0427 -0.0874 -0.2642 0.1644 0.0690 0.0506 0.0288 0.0971 -0.0242 0.0107 0.0843 0.0139 0.0478 -0.0262 0.0668 0.0344 0.0316 0.0453 -0.0055 -0.0135 0.0574 0.0000 0.0594 -0.0088 0.0264 -0.0267 -0.0490 -0.0292 0.0120 0.0273 -0.0139 0.0368 0.0733 -0.0416 0.0292 0.0959 0.0010 0.0174 -0.0224 0.0810 -0.0775 0.0781 -0.0740 -0.0355 0.0259 -0.0049 0.0475 0.0323 -0.0031 -0.0658 0.0456 -0.0066 0.0221 0.0202 -0.0450 0.0274 -0.0237 0.0237 0.0543 0.0150 -0.0249 0.1072 0.0041 0.0774 0.0118 -0.0122 0.0427 -0.1028 -0.1068 -0.0220 0.1146 0.0784 -0.0415 0.0155 -0.0380 0.0217 0.0149 -0.0562 0.0446 0.0031 0.0729 -0.0138 0.0057 -0.1742 -0.3764 0.2521 0.0474 -0.0212 -0.0626 0.0342 -0.1074 -0.0097 0.2824 -0.0069 0.0096 0.0250 -0.0022 -0.0468 -0.0154 0.0415 -0.0241 -0.0332 0.0719 0.0545 0.0250 0.0223 0.1042 -0.0730 -0.0725 -0.0397 0.0272 0.0391 0.0133 0.0131 0.0314 0.0354 0.0442 0.0596 0.0343 -0.0215 0.0727 0.0881 -0.0266 0.1201 -0.0395 -0.0564 0.0487 -0.0510 0.0339 -0.0384 0.0402 0.0082 0.0096 0.0289 -0.0469 -0.0170 -0.0282 0.0243 0.0287 0.0347 0.0214 0.0111 -0.0114 0.0308 0.0124 0.0064 0.0316 0.0326 -0.0215 -0.0529 -0.0060 -0.0029 0.0338 0.0644 0.0198 0.0315 0.0025 0.0555 0.0335 -0.0250 -0.0013 0.0289 0.0397 -0.0305 0.0186 -0.0841 -0.2301 0.1282 0.0381 -0.0157 -0.0380 0.0462 -0.0032 -0.0348 0.1198 -0.0218 -0.0307 -0.0184 0.0344 0.0415 -0.0112 0.0310 0.0409 -0.0219 0.0276 0.0203 0.0590 -0.0112 0.1221 -0.0065 -0.1137 0.0099 -0.0408 0.0882 0.0748 0.0255 0.0735 -0.0312 0.0105 0.0511 0.0067 0.0011 -0.0319 0.1055 -0.0389 0.1024 -0.1631 -0.1758 0.2184 0.1431 0.0370 0.0484 0.1515 -0.0639 0.0858 0.0414 0.0857 0.0020 -0.0802 -0.0267 0.0979 -0.0910 0.1236 -0.0636 -0.0424 0.0744 0.0197 0.0165 -0.0025 -0.0486 0.0406 -0.0518 -0.0475 0.0513 0.0697 0.0640 0.0340 -0.0205 0.0311 0.0617 0.0117 -0.0734 0.0295 -0.0176 0.0444 0.0182 0.0163 -0.1169 -0.1325 0.1437 0.0839 0.0217 0.0591 0.0116 -0.0286 -0.0105 0.0766 0.0877 -0.0100 0.0706 -0.0307 0.0748 0.0179 0.0008 0.0706 -0.0620 0.0194 -0.1005 -0.0549 0.0759 0.1302 0.0297 -0.0398 -0.0412 -0.0326 0.0809 0.0338 0.0551 0.0178 0.0711 0.0302 0.0204 -0.0460 -0.0425 -0.0081 0.0945 -0.0761 0.0872 -0.0744 -0.1062 0.0095 0.0642 -0.0256 0.0530 -0.0853 -0.0359 -0.0344 0.1290 -0.0280 0.0448 0.0150 0.0587 0.0304 0.0206 0.0563 -0.0148 -0.0075 0.0216 0.0103 0.0591 -0.0143 0.0061 -0.0310 -0.0403 -0.0176 0.0277 0.0592 0.0403 0.0132 -0.0049 -0.0062 0.0308 0.0185 -0.0224 0.0201 0.0123 -0.0053 0.0078 0.0098 -0.0396 -0.0674 0.0323 0.0305 0.0085 -0.0023 -0.0480 -0.0332 -0.0149 0.0147 -0.0538 -0.0009 -0.0802 0.0681 -0.0116 -0.0662 0.0345 0.0160 Calculate the optimal portfolio for both investors that consists of all eleven industries. Compare this to the other portfolios in terms of diversification benefits. What do you observe? Contrast the differences in what you observe between the two investors. (15 marks) The spreadsheet Group Report Data.xlsx contains monthly returns on ten Australian industry indices from January 2016 to July 2021. The industry abbreviations are in the table below. Investor utility is represented by: U = E(R) 72A0?. There are two investors with different risk aversion coefficients (A). Angela has a risk aversion coefficient of 5 and Boris has a risk aversion coefficient of 2. Investors are able to short-sell each industry throughout the report. Investors are unable to borrow or lend at the risk-free rate except for part 5 of the report. The expected returns per month to be used throughout the report are in the following table. Industry Consumer Discretionary Consumer Staples Energy Health Care Industrials Information Technology Materials Telecom Utilities Financials Real Estate Abbreviation COND CONS ENGY HC INDU IT MATL TELE UTIL FIN RE Expected Return 0.96% 0.83% 1.09% 0.86% 0.92% 1.00% 0.87% 0.90% 0.80% 0.90% 0.96% CONS -0.0265 -0.0157 0.0513 -0.0171 0.0564 -0.0018 0.0890 -0.0046 0.0028 -0.0613 Date COND 2016/1/29 2016/2/29 2016/3/31 2016/4/29 2016/5/31 2016/6/30 2016/7/29 2016/8/31 2016/9/30 2016/10/31 2016/11/30 2016/12/30 2017/1/31 2017/2/28 2017/3/31 2017/4/28 2017/5/31 2017/6/30 2017/7/31 2017/8/31 2017/9/29 2017/10/31 2017/11/30 2017/12/29 2018/1/31 2018/2/28 2018/3/30 2018/4/30 2018/5/31 2018/6/29 2018/7/31 2018/8/31 2018/9/28 2018/10/31 2018/11/30 2018/12/31 2019/1/31 2019/2/28 2019/3/29 2019/4/30 2019/5/31 -0.0033 0.0421 -0.0430 0.0151 0.0473 0.0070 -0.0032 0.0087 -0.0063 -0.0154 -0.0006 0.0544 0.0087 0.0368 -0.0020 -0.0119 -0.0226 0.0295 0.0527 0.0209 0.0175 0.0359 -0.0383 -0.0834 -0.0453 -0.0194 0.0428 0.0669 0.0139 0.0546 0.0204 ENGY -0.0018 -0.0484 0.0300 0.0105 -0.0089 -0.0402 0.0855 0.0186 0.0162 -0.0383 0.0056 0.0173 -0.0104 0.0602 0.0547 -0.0253 -0.0044 -0.0243 0.0097 0.0517 -0.0187 0.0534 0.0324 0.0167 0.0021 0.0210 -0.0135 0.0574 0.0000 0.0594 -0.0088 0.0264 -0.0267 -0.0490 -0.0292 0.0120 0.0273 -0.0139 0.0368 0.0733 -0.0416 HC -0.0649 0.0028 0.0616 0.0747 -0.0161 -0.0081 0.0023 0.0236 0.0009 -0.0198 0.0329 0.0608 0.0072 -0.0213 0.0433 -0.0055 0.0152 -0.0684 0.0062 0.0518 0.0112 0.0641 0.0433 0.0652 -0.0028 -0.0375 -0.0249 0.1072 0.0041 0.0774 0.0118 -0.0122 0.0427 -0.1028 -0.1068 -0.0220 0.1146 0.0784 -0.0415 0.0155 -0.0380 INDU -0.0258 0.0064 0.0035 0.0334 0.0939 -0.0248 0.0700 -0.0317 -0.0033 -0.0805 -0.0163 0.0086 0.0456 0.0390 0.0560 0.0340 -0.0238 0.0608 -0.0750 0.0025 0.0227 0.0548 0.0296 -0.0048 0.0311 0.0696 -0.0332 0.0719 0.0545 0.0250 0.0223 0.1042 -0.0730 -0.0725 -0.0397 0.0272 0.0391 0.0133 0.0131 0.0314 0.0354 IT -0.0269 0.0584 0.0227 0.0151 0.0256 -0.0099 0.0717 -0.0427 -0.0025 -0.0411 0.0135 0.0243 -0.0441 0.0341 0.0435 0.0409 0.0469 -0.0025 -0.0274 0.0457 -0.0111 0.0418 0.0221 -0.0095 -0.0201 -0.0037 -0.0114 0.0308 0.0124 0.0064 0.0316 0.0326 -0.0215 -0.0529 -0.0060 -0.0029 0.0338 0.0644 0.0198 0.0315 0.0025 MATL -0.0491 -0.0546 0.0563 0.0258 0.0705 -0.0760 0.0389 0.0458 0.0146 -0.0659 0.0010 0.0403 -0.0418 0.0185 0.0363 0.0352 0.0022 0.0188 -0.0049 0.0099 0.0060 0.0844 0.0450 0.0294 0.0249 0.0166 -0.0219 0.0276 0.0203 0.0590 -0.0112 0.1221 -0.0065 -0.1137 0.0099 -0.0408 0.0882 0.0748 0.0255 0.0735 -0.0312 TELE -0.0912 0.0912 0.0605 0.1430 -0.0301 0.0059 0.0779 0.0001 0.0568 0.0116 0.0225 0.0383 0.0477 -0.0319 0.0022 -0.0025 -0.0024 0.0063 0.0348 0.0452 -0.0138 0.0444 0.0201 0.0611 0.0046 0.0037 -0.0424 0.0744 0.0197 0.0165 -0.0025 -0.0486 0.0406 -0.0518 -0.0475 0.0513 0.0697 0.0640 0.0340 -0.0205 0.0311 UTIL 0.0070 -0.0547 0.0471 0.0046 0.0496 -0.0128 0.0423 -0.0650 -0.0395 -0.0433 -0.0041 0.0052 -0.0168 -0.0314 0.0028 -0.0948 0.0338 -0.0166 -0.0421 -0.0720 -0.0446 0.0235 -0.0158 0.0546 0.0077 -0.0620 -0.0620 0.0194 -0.1005 -0.0549 0.0759 0.1302 0.0297 -0.0398 -0.0412 -0.0326 0.0809 0.0338 0.0551 0.0178 0.0711 0.0073 0.0123 0.0130 -0.0032 0.0354 0.0563 0.0704 -0.0568 -0.0324 -0.0303 0.0366 0.0868 0.0108 0.0307 0.0628 0.0308 0.0100 -0.0269 -0.0528 0.0322 -0.0364 0.0496 0.0298 -0.0448 -0.0435 -0.0159 -0.0075 0.0216 0.0103 0.0591 -0.0143 0.0061 -0.0310 -0.0403 -0.0176 0.0277 0.0592 0.0403 0.0132 -0.0049 -0.0062 2018/3/30 2018/4/30 2018/5/31 2018/6/29 2018/7/31 2018/8/31 2018/9/28 2018/10/31 2018/11/30 2018/12/31 2019/1/31 2019/2/28 2019/3/29 2019/4/30 2019/5/31 2019/6/28 2019/7/31 2019/8/30 2019/9/30 2019/10/31 2019/11/29 2019/12/31 2020/1/31 2020/2/28 2020/3/31 2020/4/30 2020/5/29 2020/6/30 2020/7/31 2020/8/31 2020/9/30 2020/10/30 2020/11/30 2020/12/31 2021/1/29 2021/2/26 2021/3/31 2021/4/30 2021/5/31 2021/6/30 2021/7/31 -0.0226 0.0295 0.0527 0.0209 0.0175 0.0359 -0.0383 -0.0834 -0.0453 -0.0194 0.0428 0.0669 0.0139 0.0546 0.0204 -0.0151 0.0475 0.0064 0.0333 0.0055 0.0422 -0.0221 0.0427 -0.0874 -0.2642 0.1644 0.0690 0.0506 0.0288 0.0971 -0.0242 0.0107 0.0843 0.0139 0.0478 -0.0262 0.0668 0.0344 0.0316 0.0453 -0.0055 -0.0135 0.0574 0.0000 0.0594 -0.0088 0.0264 -0.0267 -0.0490 -0.0292 0.0120 0.0273 -0.0139 0.0368 0.0733 -0.0416 0.0292 0.0959 0.0010 0.0174 -0.0224 0.0810 -0.0775 0.0781 -0.0740 -0.0355 0.0259 -0.0049 0.0475 0.0323 -0.0031 -0.0658 0.0456 -0.0066 0.0221 0.0202 -0.0450 0.0274 -0.0237 0.0237 0.0543 0.0150 -0.0249 0.1072 0.0041 0.0774 0.0118 -0.0122 0.0427 -0.1028 -0.1068 -0.0220 0.1146 0.0784 -0.0415 0.0155 -0.0380 0.0217 0.0149 -0.0562 0.0446 0.0031 0.0729 -0.0138 0.0057 -0.1742 -0.3764 0.2521 0.0474 -0.0212 -0.0626 0.0342 -0.1074 -0.0097 0.2824 -0.0069 0.0096 0.0250 -0.0022 -0.0468 -0.0154 0.0415 -0.0241 -0.0332 0.0719 0.0545 0.0250 0.0223 0.1042 -0.0730 -0.0725 -0.0397 0.0272 0.0391 0.0133 0.0131 0.0314 0.0354 0.0442 0.0596 0.0343 -0.0215 0.0727 0.0881 -0.0266 0.1201 -0.0395 -0.0564 0.0487 -0.0510 0.0339 -0.0384 0.0402 0.0082 0.0096 0.0289 -0.0469 -0.0170 -0.0282 0.0243 0.0287 0.0347 0.0214 0.0111 -0.0114 0.0308 0.0124 0.0064 0.0316 0.0326 -0.0215 -0.0529 -0.0060 -0.0029 0.0338 0.0644 0.0198 0.0315 0.0025 0.0555 0.0335 -0.0250 -0.0013 0.0289 0.0397 -0.0305 0.0186 -0.0841 -0.2301 0.1282 0.0381 -0.0157 -0.0380 0.0462 -0.0032 -0.0348 0.1198 -0.0218 -0.0307 -0.0184 0.0344 0.0415 -0.0112 0.0310 0.0409 -0.0219 0.0276 0.0203 0.0590 -0.0112 0.1221 -0.0065 -0.1137 0.0099 -0.0408 0.0882 0.0748 0.0255 0.0735 -0.0312 0.0105 0.0511 0.0067 0.0011 -0.0319 0.1055 -0.0389 0.1024 -0.1631 -0.1758 0.2184 0.1431 0.0370 0.0484 0.1515 -0.0639 0.0858 0.0414 0.0857 0.0020 -0.0802 -0.0267 0.0979 -0.0910 0.1236 -0.0636 -0.0424 0.0744 0.0197 0.0165 -0.0025 -0.0486 0.0406 -0.0518 -0.0475 0.0513 0.0697 0.0640 0.0340 -0.0205 0.0311 0.0617 0.0117 -0.0734 0.0295 -0.0176 0.0444 0.0182 0.0163 -0.1169 -0.1325 0.1437 0.0839 0.0217 0.0591 0.0116 -0.0286 -0.0105 0.0766 0.0877 -0.0100 0.0706 -0.0307 0.0748 0.0179 0.0008 0.0706 -0.0620 0.0194 -0.1005 -0.0549 0.0759 0.1302 0.0297 -0.0398 -0.0412 -0.0326 0.0809 0.0338 0.0551 0.0178 0.0711 0.0302 0.0204 -0.0460 -0.0425 -0.0081 0.0945 -0.0761 0.0872 -0.0744 -0.1062 0.0095 0.0642 -0.0256 0.0530 -0.0853 -0.0359 -0.0344 0.1290 -0.0280 0.0448 0.0150 0.0587 0.0304 0.0206 0.0563 -0.0148 -0.0075 0.0216 0.0103 0.0591 -0.0143 0.0061 -0.0310 -0.0403 -0.0176 0.0277 0.0592 0.0403 0.0132 -0.0049 -0.0062 0.0308 0.0185 -0.0224 0.0201 0.0123 -0.0053 0.0078 0.0098 -0.0396 -0.0674 0.0323 0.0305 0.0085 -0.0023 -0.0480 -0.0332 -0.0149 0.0147 -0.0538 -0.0009 -0.0802 0.0681 -0.0116 -0.0662 0.0345 0.0160 Calculate the optimal portfolio for both investors that consists of all eleven industries. Compare this to the other portfolios in terms of diversification benefits. What do you observe? Contrast the differences in what you observe between the two investors. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started