Question

The St. Lawrence Instruments Company uses the decentralized form of organizational structure and considers each of its divisions as an investment center. The Victoria division

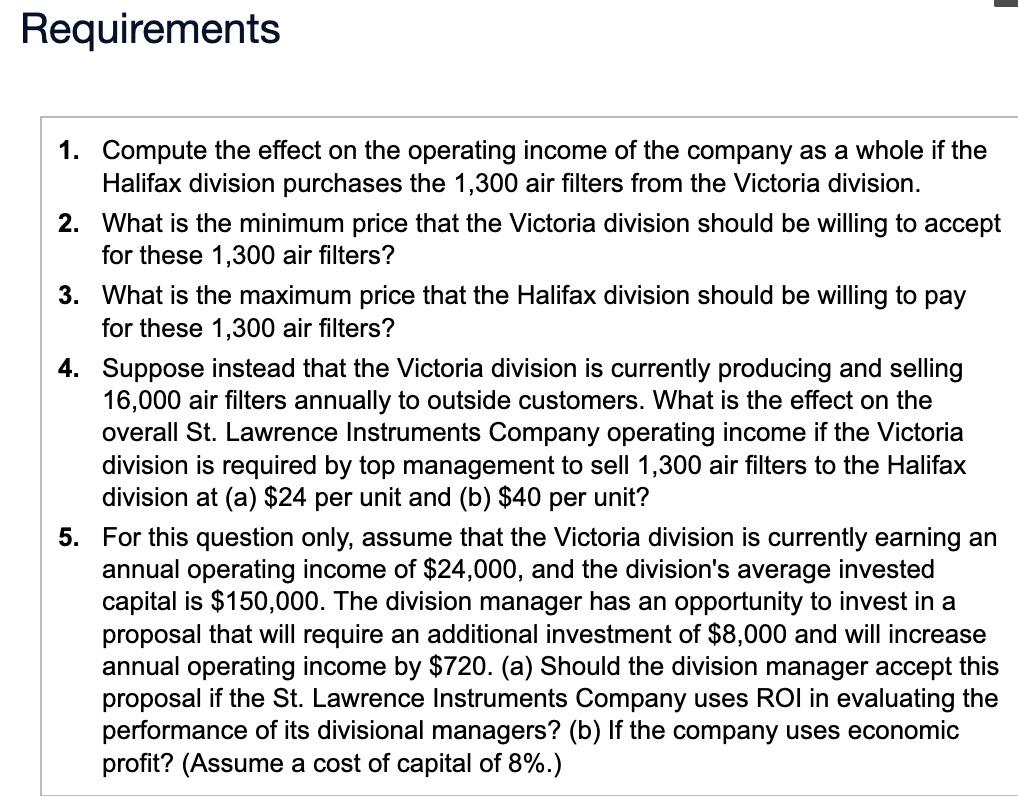

The St. Lawrence Instruments Company uses the decentralized form of organizational structure and considers each of its divisions as an investment center. The Victoria division is currently selling 12,000 air filters annually, although it has sufficient productive capacity to produce 16,000 units per year. Variable manufacturing costs amount to $24 per unit, while the total fixed costs amount to $50,000. These 12,000 air filters are sold to outside customers at $70 per unit. The Halifax division, also a part of St. Lawrence Instruments, has indicated that it would like to buy 1,300 air filters from the Victoria division, but at a price of $40 per unit. This is the price the Halifax division is currently paying an outside supplier.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started