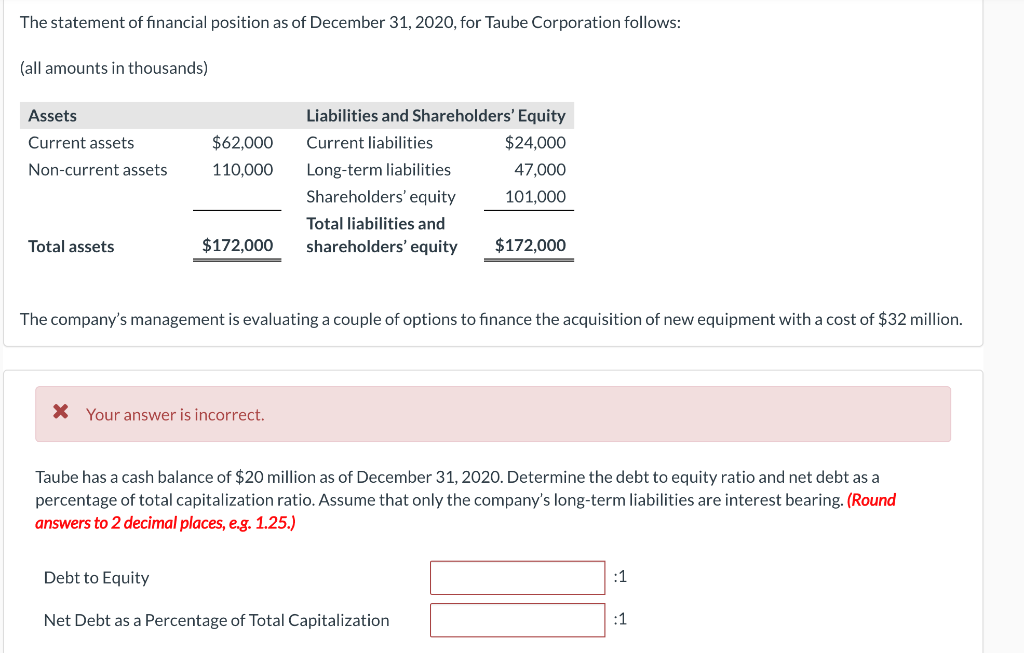

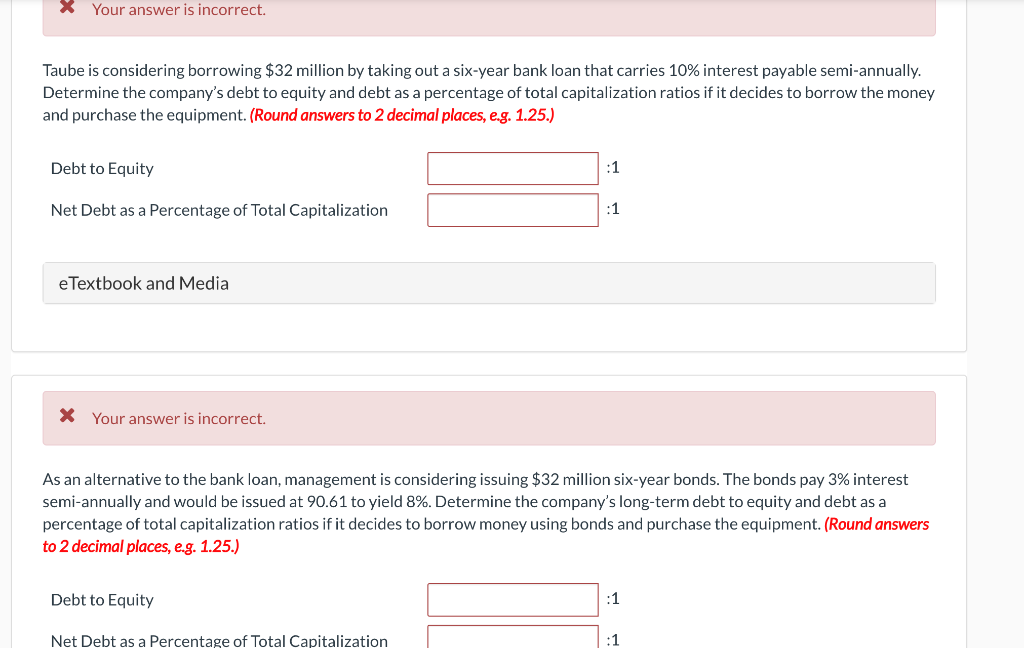

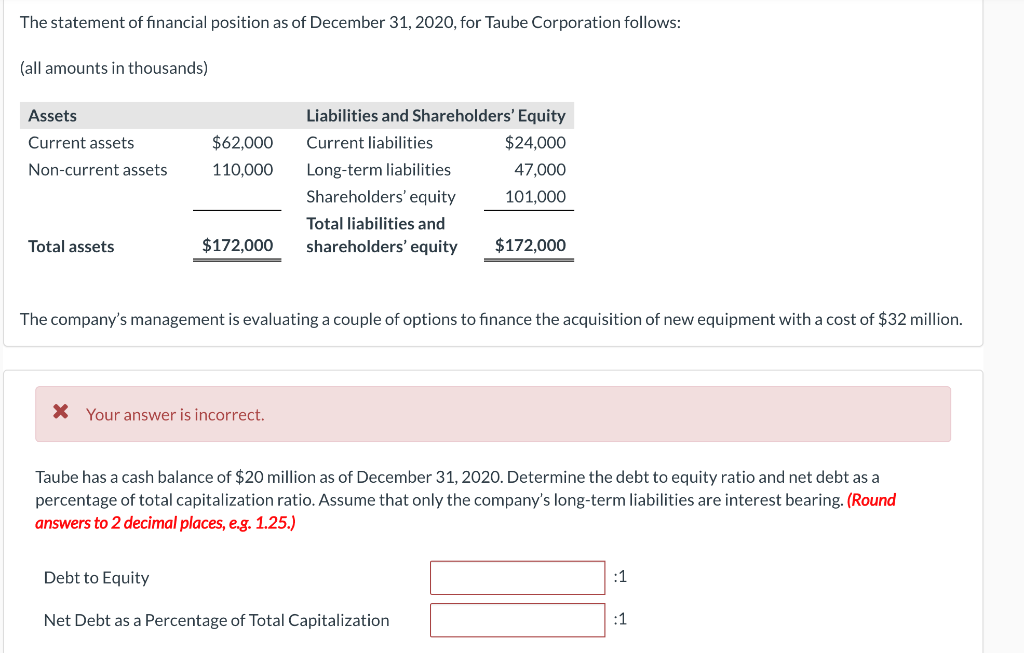

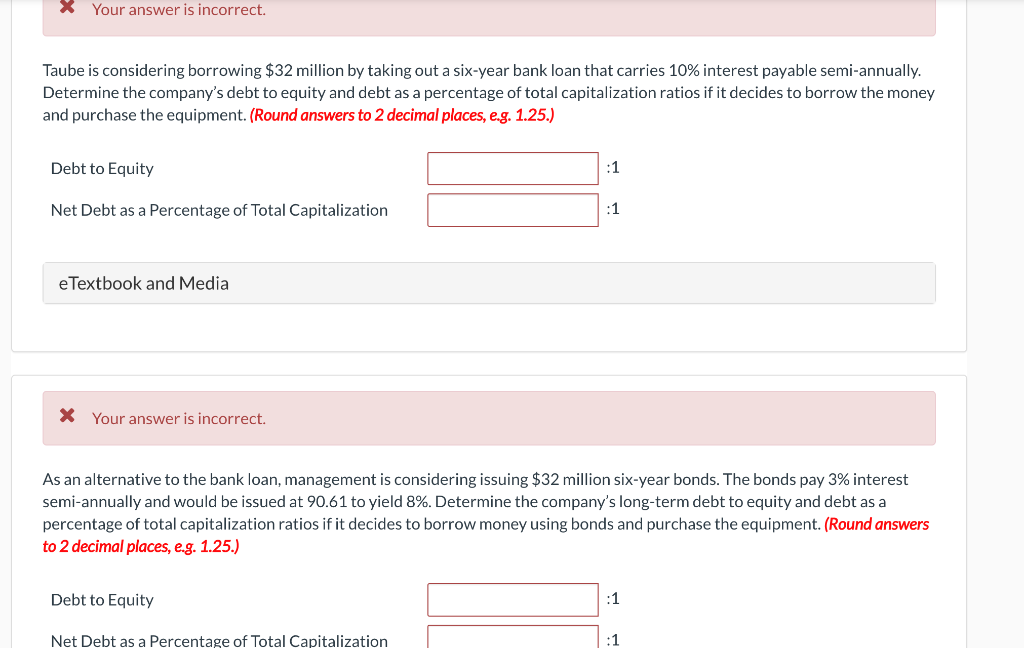

The statement of financial position as of December 31, 2020, for Taube Corporation follows: (all amounts in thousands) Assets Current assets Non-current assets $62,000 110,000 Liabilities and Shareholders' Equity Current liabilities $24,000 Long-term liabilities 47,000 Shareholders' equity 101,000 Total liabilities and shareholders' equity $172,000 Total assets $172,000 The company's management is evaluating a couple of options to finance the acquisition of new equipment with a cost of $32 million. * Your answer is incorrect. Taube has a cash balance of $20 million as of December 31, 2020. Determine the debt to equity ratio and net debt as a percentage of total capitalization ratio. Assume that only the company's long-term liabilities are interest bearing. (Round answers to 2 decimal places, e.g. 1.25.) Debt to Equity :1 Net Debt as a Percentage of Total Capitalization :1 X Your answer is incorrect. Taube is considering borrowing $32 million by taking out a six-year bank loan that carries 10% interest payable semi-annually. Determine the company's debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow the money and purchase the equipment. (Round answers to 2 decimal places, e.g. 1.25.) Debt to Equity :1 Net Debt as a Percentage of Total Capitalization :1 e Textbook and Media X Your answer is incorrect. As an alternative to the bank loan, management is considering issuing $32 million six-year bonds. The bonds pay 3% interest semi-annually and would be issued at 90.61 to yield 8%. Determine the company's long-term debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow money using bonds and purchase the equipment. (Round answers to 2 decimal places, e.g. 1.25.) Debt to Equity :1 Net Debt as a Percentage of Total Capitalization :1 The statement of financial position as of December 31, 2020, for Taube Corporation follows: (all amounts in thousands) Assets Current assets Non-current assets $62,000 110,000 Liabilities and Shareholders' Equity Current liabilities $24,000 Long-term liabilities 47,000 Shareholders' equity 101,000 Total liabilities and shareholders' equity $172,000 Total assets $172,000 The company's management is evaluating a couple of options to finance the acquisition of new equipment with a cost of $32 million. * Your answer is incorrect. Taube has a cash balance of $20 million as of December 31, 2020. Determine the debt to equity ratio and net debt as a percentage of total capitalization ratio. Assume that only the company's long-term liabilities are interest bearing. (Round answers to 2 decimal places, e.g. 1.25.) Debt to Equity :1 Net Debt as a Percentage of Total Capitalization :1 X Your answer is incorrect. Taube is considering borrowing $32 million by taking out a six-year bank loan that carries 10% interest payable semi-annually. Determine the company's debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow the money and purchase the equipment. (Round answers to 2 decimal places, e.g. 1.25.) Debt to Equity :1 Net Debt as a Percentage of Total Capitalization :1 e Textbook and Media X Your answer is incorrect. As an alternative to the bank loan, management is considering issuing $32 million six-year bonds. The bonds pay 3% interest semi-annually and would be issued at 90.61 to yield 8%. Determine the company's long-term debt to equity and debt as a percentage of total capitalization ratios if it decides to borrow money using bonds and purchase the equipment. (Round answers to 2 decimal places, e.g. 1.25.) Debt to Equity :1 Net Debt as a Percentage of Total Capitalization :1