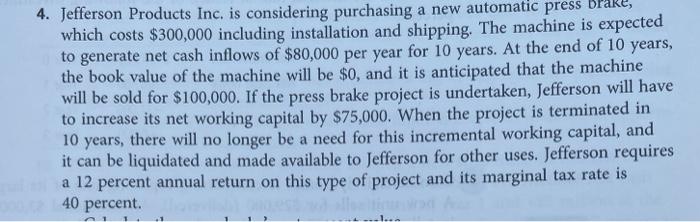

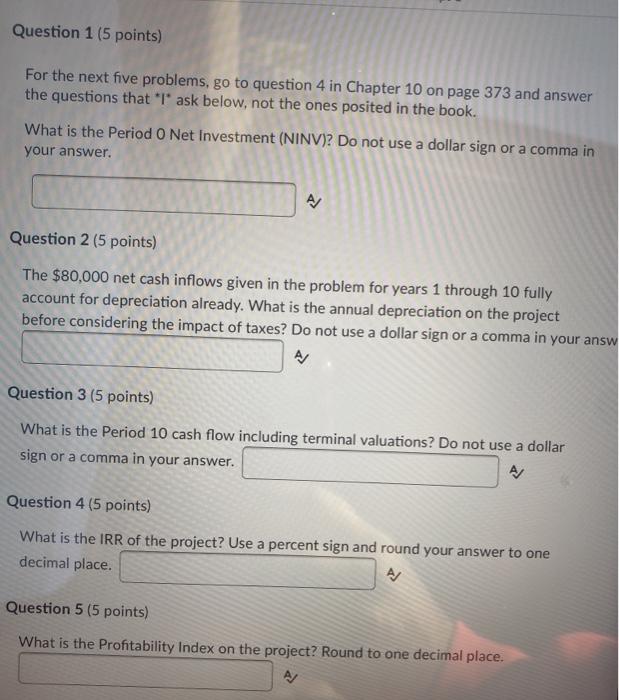

4. Jefferson Products Inc. is considering purchasing a new automatic press which costs $300,000 including installation and shipping. The machine is expected to generate net cash inflows of $80,000 per year for 10 years. At the end of 10 years, the book value of the machine will be $0, and it is anticipated that the machine will be sold for $100,000. If the press brake project is undertaken, Jefferson will have to increase its net working capital by $75,000. When the project is terminated in 10 years, there will no longer be a need for this incremental working capital, and it can be liquidated and made available to Jefferson for other uses. Jefferson requires a 12 percent annual return on this type of project and its marginal tax rate is 40 percent. Question 1 (5 points) For the next five problems, go to question 4 in Chapter 10 on page 373 and answer the questions that 'l' ask below, not the ones posited in the book. What is the Period 0 Net Investment (NINV)? Do not use a dollar sign or a comma in your answer. A Question 2 (5 points) The $80,000 net cash inflows given in the problem for years 1 through 10 fully account for depreciation already. What is the annual depreciation on the project before considering the impact of taxes? Do not use a dollar sign or a comma in your answ AJ Question 3 (5 points) What is the Period 10 cash flow including terminal valuations? Do not use a dollar sign or a comma in your answer. A/ Question 4 (5 points) What is the IRR of the project? Use a percent sign and round your answer to one decimal place. A Question 5 (5 points) What is the Profitability Index on the project? Round to one decimal place. AJ 4. Jefferson Products Inc. is considering purchasing a new automatic press which costs $300,000 including installation and shipping. The machine is expected to generate net cash inflows of $80,000 per year for 10 years. At the end of 10 years, the book value of the machine will be $0, and it is anticipated that the machine will be sold for $100,000. If the press brake project is undertaken, Jefferson will have to increase its net working capital by $75,000. When the project is terminated in 10 years, there will no longer be a need for this incremental working capital, and it can be liquidated and made available to Jefferson for other uses. Jefferson requires a 12 percent annual return on this type of project and its marginal tax rate is 40 percent. Question 1 (5 points) For the next five problems, go to question 4 in Chapter 10 on page 373 and answer the questions that 'l' ask below, not the ones posited in the book. What is the Period 0 Net Investment (NINV)? Do not use a dollar sign or a comma in your answer. A Question 2 (5 points) The $80,000 net cash inflows given in the problem for years 1 through 10 fully account for depreciation already. What is the annual depreciation on the project before considering the impact of taxes? Do not use a dollar sign or a comma in your answ AJ Question 3 (5 points) What is the Period 10 cash flow including terminal valuations? Do not use a dollar sign or a comma in your answer. A/ Question 4 (5 points) What is the IRR of the project? Use a percent sign and round your answer to one decimal place. A Question 5 (5 points) What is the Profitability Index on the project? Round to one decimal place. AJ