Answered step by step

Verified Expert Solution

Question

1 Approved Answer

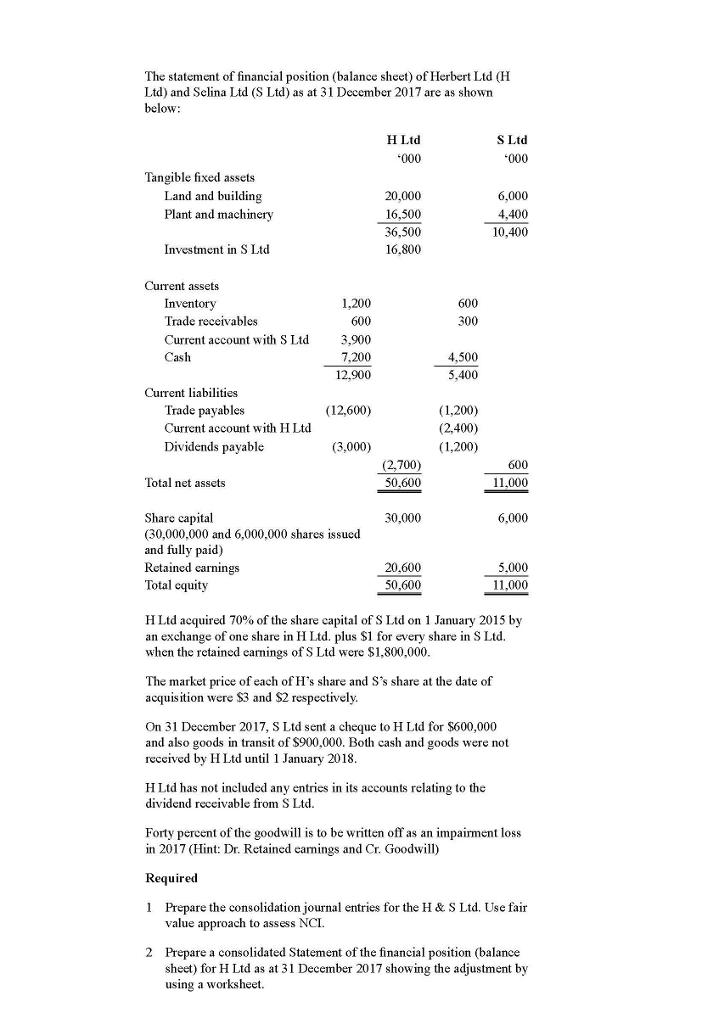

The statement of financial position (balance sheet) of Herbert Ltd (H Ltd) and Selina Ltd (S Ltd) as at 31 December 2017 are as

The statement of financial position (balance sheet) of Herbert Ltd (H Ltd) and Selina Ltd (S Ltd) as at 31 December 2017 are as shown below: H Ltd S Ltd *000 *000 Tangible fixed assets Land and building 20,000 6,000 Plant and machinery 16,500 4,400 36,500 10,400 Investment in S Ltd 16,800 Current assets Inventory 1,200 Trade receivables 600 3,900 Current account with S Ltd Cash 7,200 12.900 Current liabilities Trade payables (12,600) Current account with H Ltd Dividends payable (3,000) (2,700) 600 Total net assets 50,600 11,000 Share capital 30,000 6.000 (30,000,000 and 6,000,000 shares issued and fully paid) Retained earnings 20,600 5.000 Total equity 50,600 11,000 H Ltd acquired 70% of the share capital of S Ltd on 1 January 2015 by an exchange of one share in H Ltd. plus $1 for every share in S Ltd. when the retained earnings of S Ltd were $1,800,000. The market price of each of H's share and S's share at the date of acquisition were $3 and $2 respectively. On 31 December 2017, S Ltd sent a cheque to H Ltd for $600,000 and also goods in transit of $900,000. Both cash and goods were not received by H Ltd until 1 January 2018. H Ltd has not included any entries in its accounts relating to the dividend receivable from S Ltd. Forty percent of the goodwill is to be written off as an impairment loss in 2017 (Hint: Dr. Retained earnings and Cr. Goodwill) Required 1 Prepare the consolidation journal entries for the H & S Ltd. Use fair value approach to assess NCI. 2 Prepare a consolidated Statement of the financial position (balance sheet) for H Ltd as at 31 December 2017 showing the adjustment by using a worksheet. 600 300 4,500 5,400 (1,200) (2,400) (1,200)

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Any ii Journal Entry Land AIC Goodwich Ace Building Plan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started