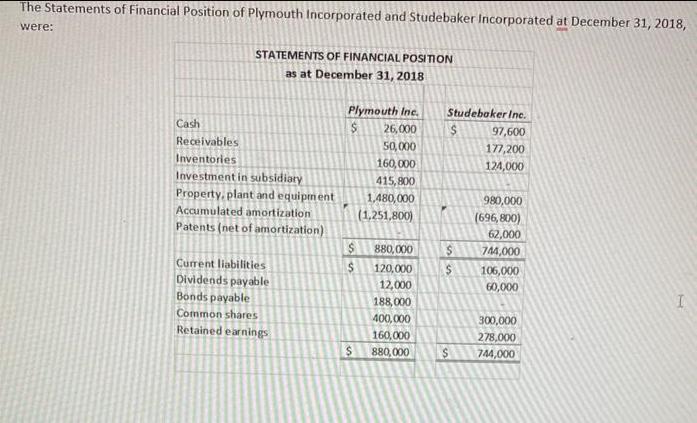

The Statements of Financial Position of Plymouth Incorporated and Studebaker Incorporated at December 31, 2018, were: STATEMENTS OF FINANCIAL POSITION as at December 31,

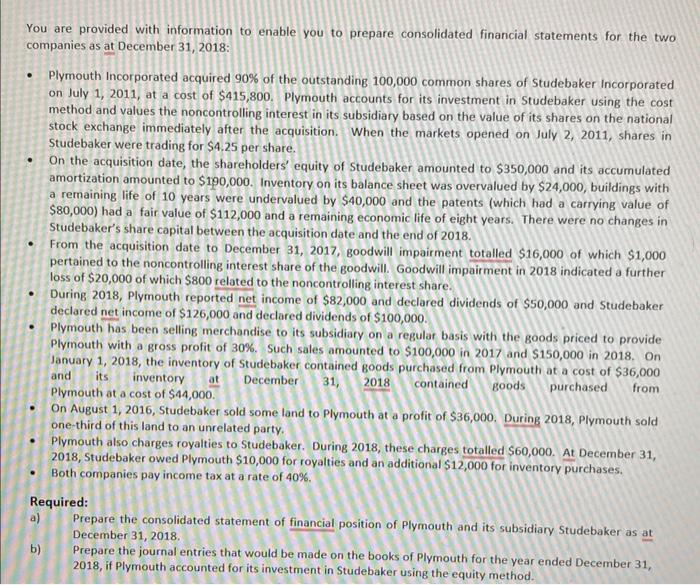

The Statements of Financial Position of Plymouth Incorporated and Studebaker Incorporated at December 31, 2018, were: STATEMENTS OF FINANCIAL POSITION as at December 31, 2018 Cash Receivables Inventories Investment in subsidiary Property, plant and equipment Accumulated amortization Patents (net of amortization) Current liabilities Dividends payable Bonds payable Common shares Retained earnings Plymouth Inc. $ 26,000 50,000 160,000 415,800 1,480,000 (1,251,800) $ $ $ 880,000 120,000 12,000 188,000 400,000 160,000 880,000 Studebaker Inc. $ 97,600 177,200 124,000 $ $ 980,000 (696,800) 62,000 744,000 106,000 60,000 300,000 278,000 744,000 You are provided with information to enable you to prepare consolidated financial statements for the two companies as at December 31, 2018: . Plymouth Incorporated acquired 90% of the outstanding 100,000 common shares of Studebaker Incorporated on July 1, 2011, at a cost of $415,800. Plymouth accounts for its investment in Studebaker using the cost method and values the noncontrolling interest in its subsidiary based on the value of its shares on the national stock exchange immediately after the acquisition. When the markets opened on July 2, 2011, shares in Studebaker were trading for $4.25 per share. On the acquisition date, the shareholders' equity of Studebaker amounted to $350,000 and its accumulated amortization amounted to $190,000. Inventory on its balance sheet was overvalued by $24,000, buildings with a remaining life of 10 years were undervalued by $40,000 and the patents (which had a carrying value of $80,000) had a fair value of $112,000 and a remaining economic life of eight years. There were no changes in Studebaker's share capital between the acquisition date and the end of 2018. From the acquisition date to December 31, 2017, goodwill impairment totalled $16,000 of which $1,000 pertained to the noncontrolling interest share of the goodwill. Goodwill impairment in 2018 indicated a further loss of $20,000 of which $800 related to the noncontrolling interest share. . During 2018, Plymouth reported net income of $82,000 and declared dividends of $50,000 and Studebaker declared net income of $126,000 and declared dividends of $100,000. Plymouth has been selling merchandise to its subsidiary on a regular basis with the goods priced to provide Plymouth with a gross profit of 30%. Such sales amounted to $100,000 in 2017 and $150,000 in 2018. On January 1, 2018, the inventory of Studebaker contained goods purchased from Plymouth at a cost of $36,000 inventory at December 31, 2018 contained goods purchased from Plymouth at a cost of $44,000. and its On August 1, 2016, Studebaker sold some land to Plymouth at a profit of $36,000. During 2018, Plymouth sold one-third of this land to an unrelated party. Plymouth also charges royalties to Studebaker. During 2018, these charges totalled $60,000. At December 31, 2018, Studebaker owed Plymouth $10,000 for royalties and an additional $12,000 for inventory purchases. Both companies pay income tax at a rate of 40%. Required: a) b) Prepare the consolidated statement of financial position of Plymouth and its subsidiary Studebaker as at December 31, 2018. Prepare the journal entries that would be made on the books of Plymouth for the year ended December 31, 2018, if Plymouth accounted for its investment in Studebaker using the equity method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Consolidated Statement of Financial Position as at December 31 2018 Consolidated Statement of Financial Position As at December 31 2018 Assets Curre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started