Answered step by step

Verified Expert Solution

Question

1 Approved Answer

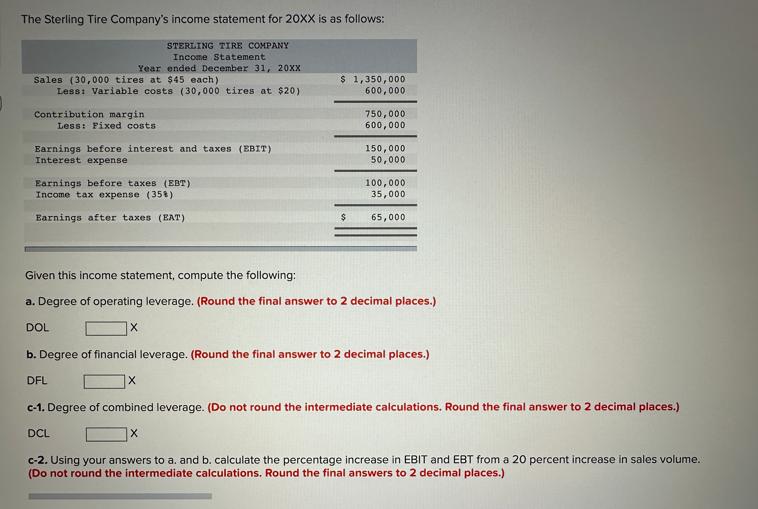

The Sterling Tire Company's income statement for 20XX is as follows: Year Sales (30,000 tires at $45 each) Less: Variable costs (30,000 tires at

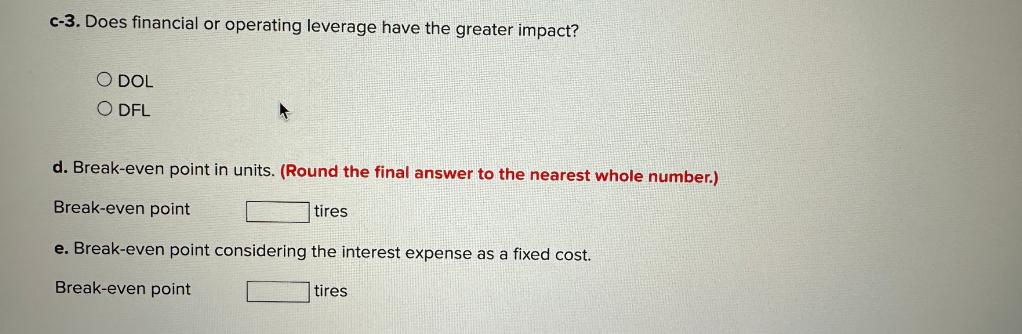

The Sterling Tire Company's income statement for 20XX is as follows: Year Sales (30,000 tires at $45 each) Less: Variable costs (30,000 tires at $20) Contribution margin Less: Fixed costs STERLING TIRE COMPANY Income Statement ended December 31, 20XX Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Income tax expense (358) Earnings after taxes (EAT) X $ 1,350,000 600,000 $ 750,000 600,000 150,000 50,000 100,000 35,000 65,000 Given this income statement, compute the following: a. Degree of operating leverage. (Round the final answer to 2 decimal places.) DOL b. Degree of financial leverage. (Round the final answer to 2 decimal places.) DFL X c-1. Degree of combined leverage. (Do not round the intermediate calculations. Round the final answer to 2 decimal places.) DCL X c-2. Using your answers to a. and b. calculate the percentage increase in EBIT and EBT from a 20 percent increase in sales volume. (Do not round the intermediate calculations. Round the final answers to 2 decimal places.) c-3. Does financial or operating leverage have the greater impact? O DOL ODFL d. Break-even point in units. (Round the final answer to the nearest whole number.) Break-even point e. Break-even point considering the interest expense as a fixed cost. Break-even point tires tires

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Degree of Operating Leverage DOL DOLContribution MarginEBIT 750000150000 5 b D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started