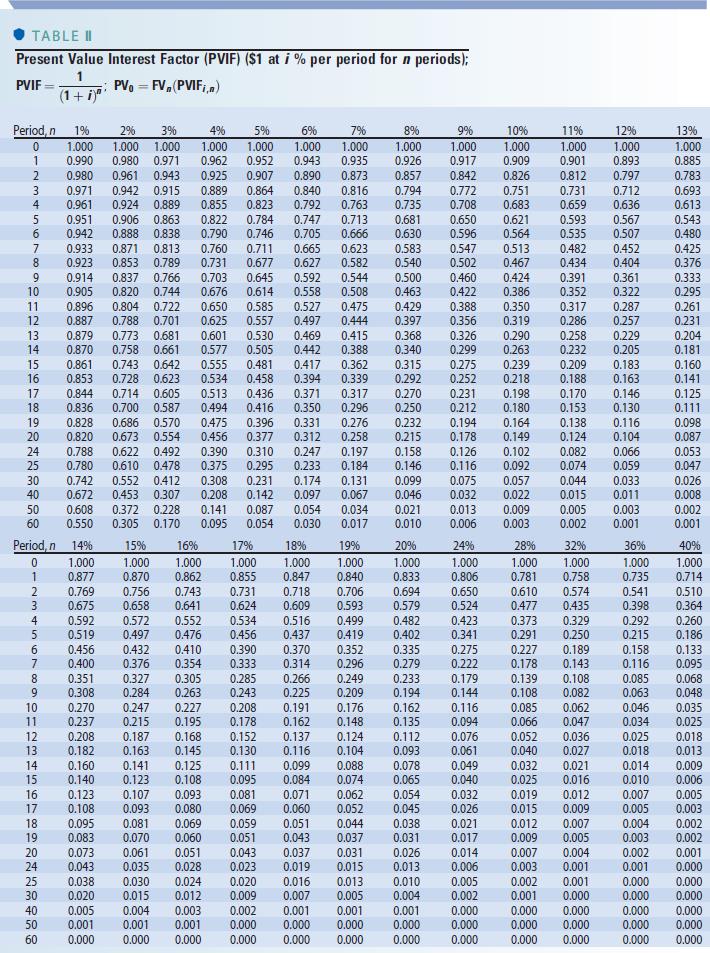

The stock of Dravo Corporation currently pays a dividend (D0) at the rate of $1.5 per share. This dividend is expected to increase at a 11 percent annual rate for the next 3 years, at a 9 percent annual rate for the following 2 years, and then at 5 percent per year thereafter. What is the value of a share of stock of Dravo to an investor who demands a 24 percent rate of return on this stock? UseTable IIto answer the question. Do not round the intermediate calculations. Round your answer to the nearest cent.

TABLE II Present Value Interest Factor (PVIF) ($1 at / % per period for n periods); PVIF = (1 + in PVo = FV, (PVIF;,") Period, n 1% 2% 3% 4% 5% 6% 79% 8% 99% 10% 11% 12% 13% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.00 1.000 1.000 1.000 1.000 1.000 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.75 0.731 0.712 0.693 0.961 0.924 0.889 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 JOUOWN 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.942 0.888 0.838 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 19 0.828 0.686 0.570 0.475 0.396 0.331 0.276 0.232 0.194 0.164 0.138 0.116 0.098 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 0.002 50 0.550 0.305 0.170 0.095 0.054 0.030 0.017 0.010 0.006 0.003 0.002 0.001 0.001 Period n 14% 15% 16% 17% 18% 19% 20% 24% 28% 32% 36% 40% 0 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.806 0.781 0.758 0.735 0.714 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.650 0.610 0.574 0.541 0.510 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.524 0.477 0.435 0.398 0.364 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.423 0.373 0.329 0.292 0.260 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.341 0.291 0.250 0.215 0.186 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.275 0.227 0.189 0.158 0.133 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.222 0.178 0.143 0.116 0.095 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.179 0.139 0.108 0.085 0.068 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.144 0.108 0.082 0.063 0.048 10 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.116 0.085 0.062 0.046 0.035 11 0.215 0.195 0.178 0.162 0.148 0.135 0.094 0.066 0.047 0.034 0.025 12 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.076 0.052 0.036 0.025 0.018 13 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.040 0.027 0.018 0.013 14 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.049 0.032 0.021 0.014 0.009 15 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.040 0.025 0.016 0.010 0.006 16 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.032 0.019 0.012 0.007 0.005 17 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.026 0.015 0.009 0.005 0.003 18 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.021 0.012 0.007 0.004 0.002 19 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.017 0.009 0.005 0.003 0.002 20 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.014 0.007 0.004 0.002 0.001 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.006 0.003 0.001 0.001 0.000 0.038 0.030 0.024 0.020 0.016 0.013 0.010 D.005 0.002 0.001 0.000 0.000 30 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.002 0.001 0.000 0.000 0.000 40 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 50 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 60 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000