Answered step by step

Verified Expert Solution

Question

1 Approved Answer

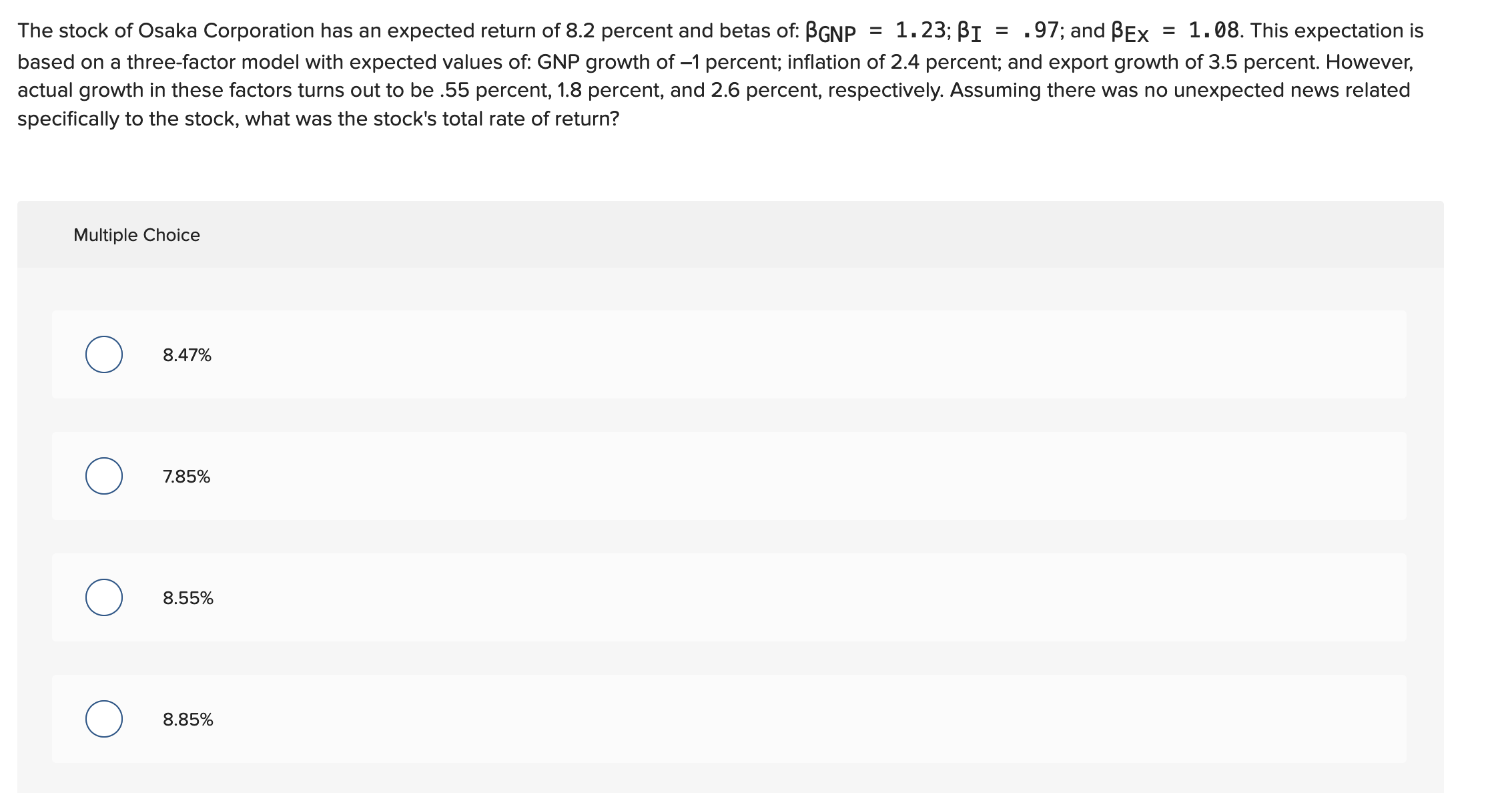

The stock of Osaka Corporation has an expected return of 8 . 2 percent and betas of: G N P = 1 . 2 3

The stock of Osaka Corporation has an expected return of percent and betas of: ;; and This expectation is

based on a threefactor model with expected values of: GNP growth of percent; inflation of percent; and export growth of percent. However,

actual growth in these factors turns out to be percent, percent, and percent, respectively. Assuming there was no unexpected news related

specifically to the stock, what was the stock's total rate of return?

Multiple Choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started