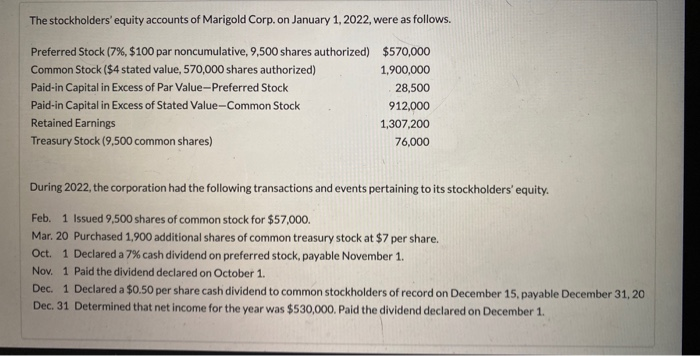

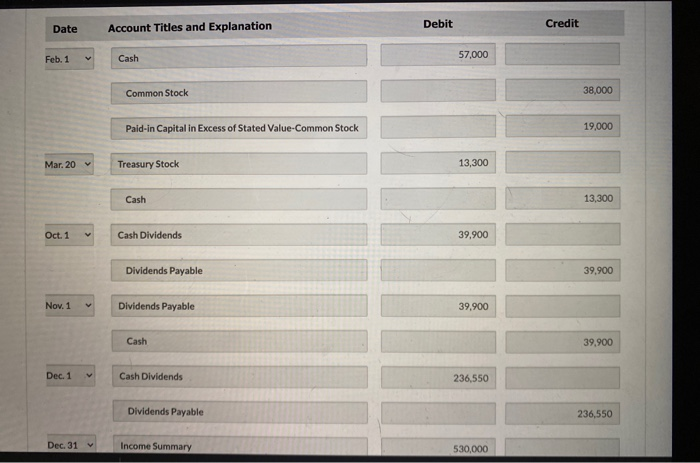

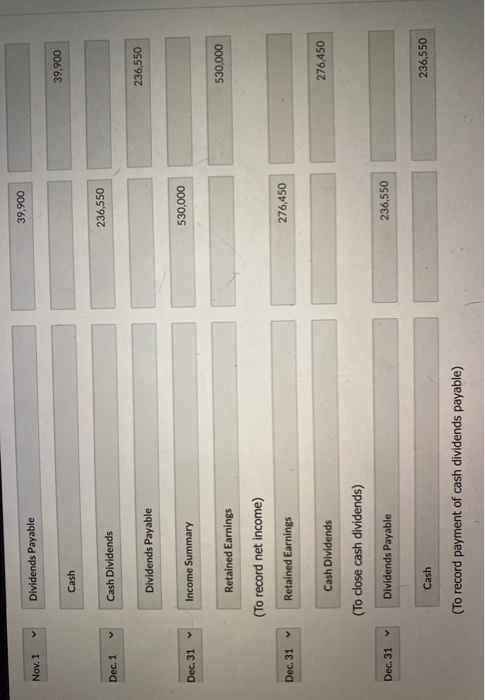

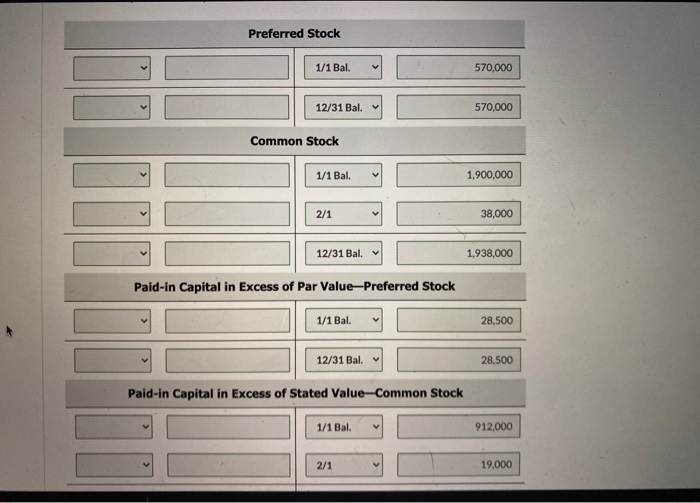

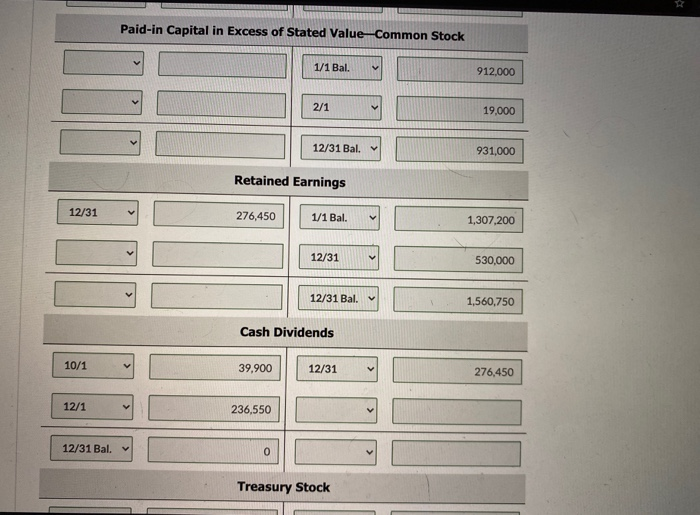

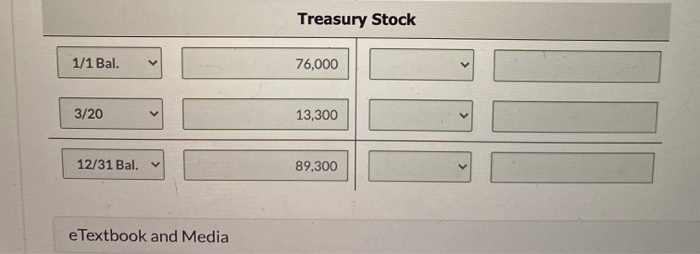

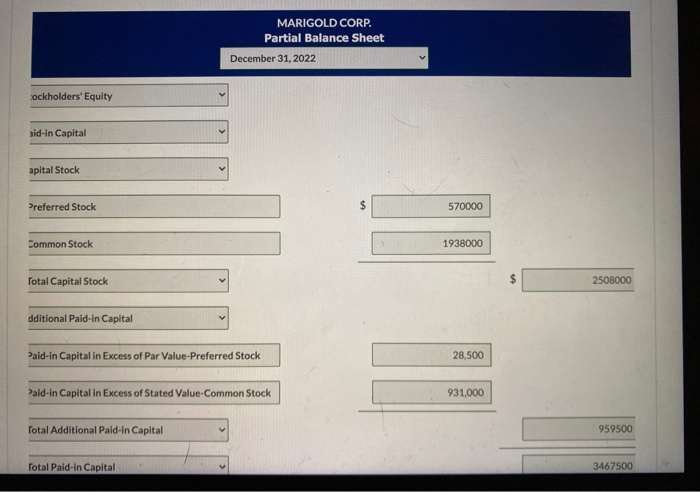

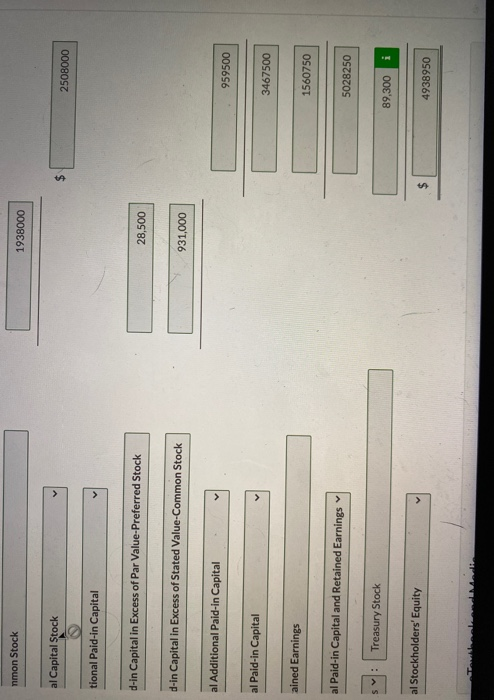

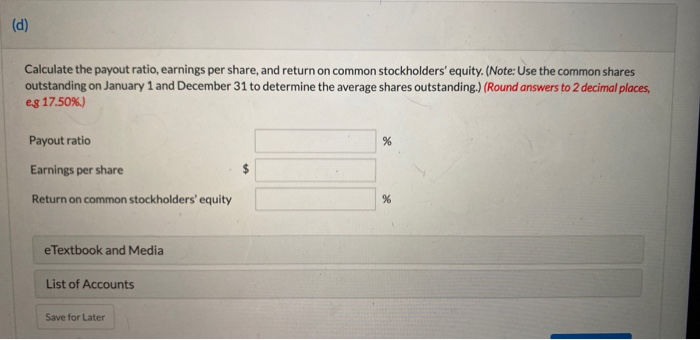

The stockholders' equity accounts of Marigold Corp. on January 1, 2022, were as follows. Preferred Stock (7%, $100 par noncumulative, 9,500 shares authorized) $570,000 Common Stock ($4 stated value, 570,000 shares authorized) 1,900,000 Paid-in Capital in Excess of Par Value-Preferred Stock 28,500 Paid-in Capital in Excess of Stated Value-Common Stock 912,000 Retained Earnings 1,307,200 Treasury Stock (9,500 common shares) 76,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 9,500 shares of common stock for $57,000. Mar. 20 Purchased 1,900 additional shares of common treasury stock at $7 per share. Oct. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 20 Dec. 31 Determined that net income for the year was $530,000. Paid the dividend declared on December 1. Debit Account Titles and Explanation Date Credit Feb. 1 Cash 57,000 Common Stock 38,000 Paid-in Capital in Excess of Stated Value-Common Stock 19,000 Mar. 20 Treasury Stock 13,300 Cash 13,300 Oct. 1 Cash Dividends 39,900 Dividends Payable 39,900 Nov. 1 Dividends Payable 39,900 Cash 39,900 Dec. 1 Cash Dividends 236,550 Dividends Payable 236,550 Dec. 31 Income Summary 530,000 39,900 Nov. 1 Dividends Payable 39,900 Cash 236,550 Dec. 1 Cash Dividends > 236,550 Dividends Payable 530,000 Dec. 31 V Income Summary 530,000 Retained Earnings (To record net income) Dec. 31 Retained Earnings 276,450 276,450 Cash Dividends (To close cash dividends) Dec. 31 Dividends Payable 236,550 Cash 236,550 (To record payment of cash dividends payable) Preferred Stock 1/1 Bal. 570,000 12/31 Bal. 570,000 Common Stock 1/1 Bal. 1,900,000 2/1 38,000 12/31 Bal. 1,938,000 Paid-in Capital in Excess of Par Value-Preferred Stock 1/1 Bal. 28,500 12/31 Bal. 28,500 Paid-in Capital in Excess of Stated Value-Common Stock 1/1 Bal. 912,000 2/1 19,000 Paid-in Capital in Excess of Stated Value Common Stock 1/1 Bal. 912,000 2/1 19.000 12/31 Bal. 931,000 Retained Earnings 12/31 276,450 1/1 Bal. 1,307,200 12/31 530,000 12/31 Bal. 1,560,750 Cash Dividends 10/1 39,900 12/31 276,450 12/1 236,550 12/31 Bal. 0 Treasury Stock Treasury Stock 1/1 Bal. 76,000 3/20 13,300 12/31 Bal. 89,300 e Textbook and Media MARIGOLD CORP. Partial Balance Sheet December 31, 2022 sockholders' Equity aid-in Capital apital Stock Preferred Stock $ 570000 Common Stock 1938000 Total Capital Stock $ 2508000 dditional Pald-in Capital Paid-in Capital in Excess of Par Value-Preferred Stock 28,500 Paid-in Capital in Excess of Stated Value-Common Stock 931,000 Total Additional Pald-in Capital 959500 Total Pald-in Capital 3467500 nmon Stock 1938000 al Capital Stock $ 2508000 tional Paid-in Capital d-in Capital in Excess of Par Value-Preferred Stock 28,500 d-in Capital in Excess of Stated Value-Common Stock 931,000 al Additional Paid-in Capital 959500 al Paid-in Capital 3467500 ained Earnings 1560750 al Paid-in Capital and Retained Earnings 5028250 Sv: Treasury Stock 89,300 al Stockholders' Equity 4938950 (d) Calculate the payout ratio, earnings per share, and return on common stockholders' equity. (Note: Use the common shares outstanding on January 1 and December 31 to determine the average shares outstanding.) (Round answers to 2 decimal places, eg 17.50%) Payout ratio % Earnings per share Return on common stockholders' equity % eTextbook and Media List of Accounts Save for Later