Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stockmarket in Fairyland exists out of two stocks only. It is possible to trade in shares Wasp and shares Butterfly. In addition, it is

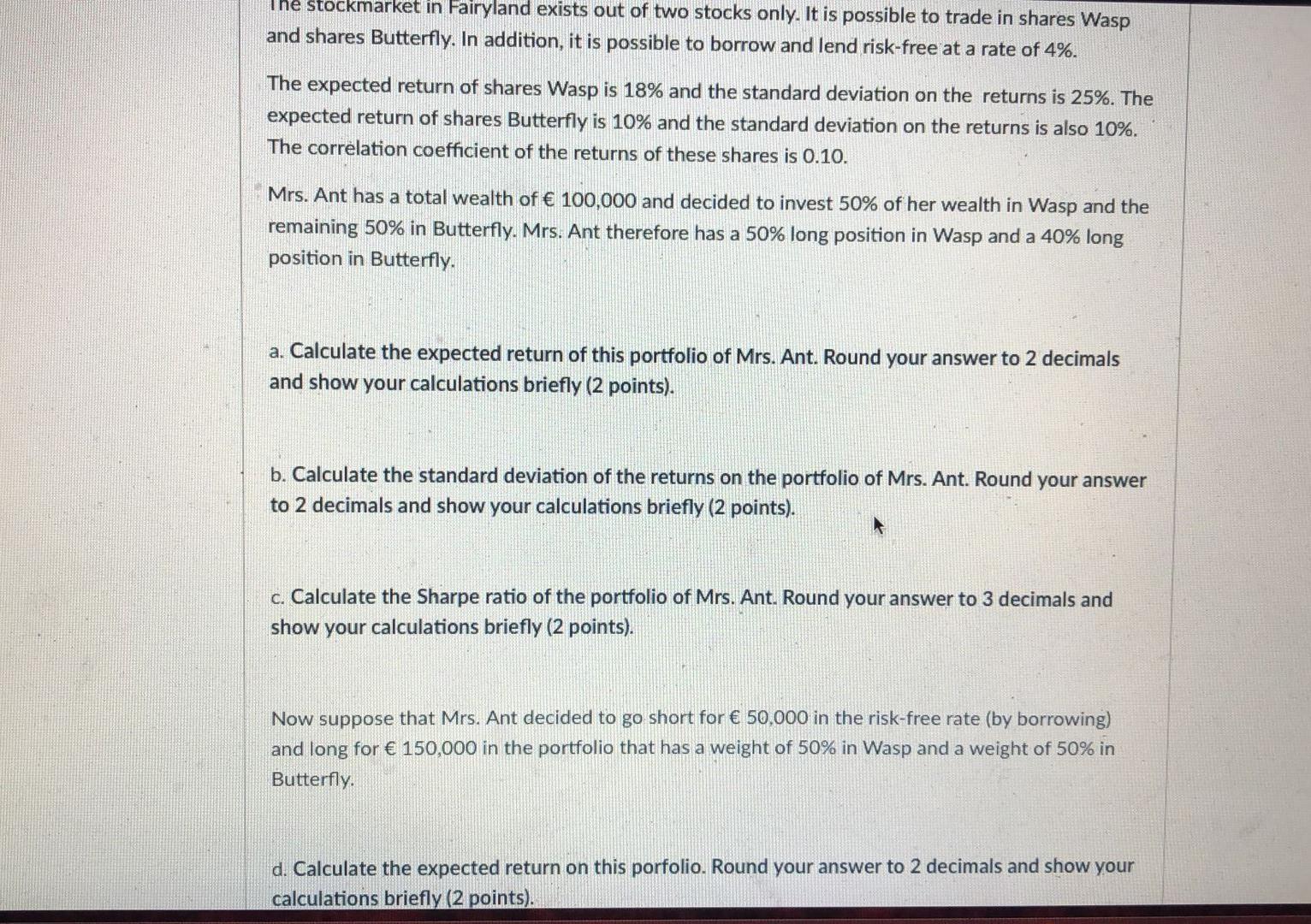

The stockmarket in Fairyland exists out of two stocks only. It is possible to trade in shares Wasp and shares Butterfly. In addition, it is possible to borrow and lend risk-free at a rate of 4%. The expected return of shares Wasp is 18% and the standard deviation on the returns is 25%. The expected return of shares Butterfly is 10% and the standard deviation on the returns is also 10%. The correlation coefficient of the returns of these shares is 0.10. Mrs. Ant has a total wealth of 100,000 and decided to invest 50% of her wealth in Wasp and the remaining 50% in Butterfly. Mrs. Ant therefore has a 50% long position in Wasp and a 40% long position in Butterfly. a. Calculate the expected return of this portfolio of Mrs. Ant. Round your answer to 2 decimals and show your calculations briefly (2 points). b. Calculate the standard deviation of the returns on the portfolio of Mrs. Ant. Round your answer to 2 decimals and show your calculations briefly (2 points). c. Calculate the Sharpe ratio of the portfolio of Mrs. Ant. Round your answer to 3 decimals and show your calculations briefly (2 points). Now suppose that Mrs. Ant decided to go short for 50,000 in the risk-free rate (by borrowing) and long for 150,000 in the por lio that has a weight of 50% in Wasp and a weight of 50% in Butterfly. d. Calculate the expected return on this porfolio. Round your answer to 2 decimals and show your calculations briefly (2 points). e. Calculate the standard deviation of the returns of this porfolio. Round your answer to 2 decimals and show your calculations briefly (2 points) Edit View Insert Format Tools Table 12pt v Paragraph BT I U A Ave Tv 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started