Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $ 3 8 . 5 million and having a four -

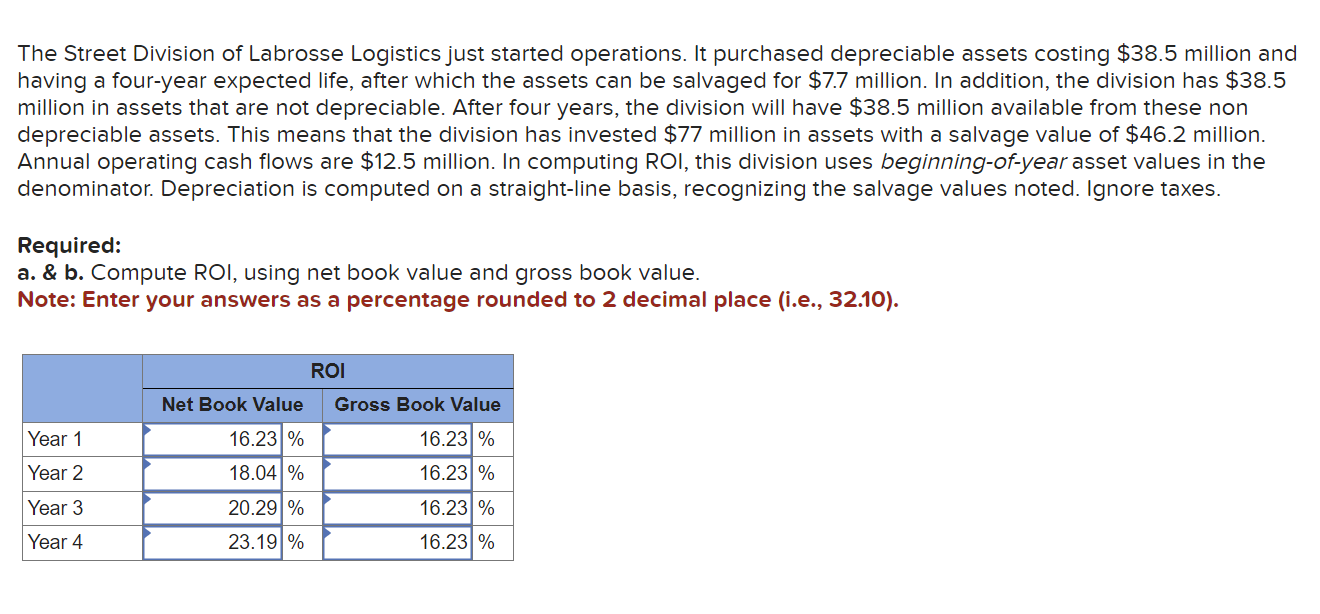

The Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $ million and having a fouryear expected life, after which the assets can be salvaged for $ million. In addition, the division has $ million in assets that are not depreciable. After four years, the division will have $ million available from these non depreciable assets. This means that the division has invested $ million in assets with a salvage value of $ million. Annual operating cash flows are $ million. In computing ROI, this division uses beginningofyear asset values in the denominator. Depreciation is computed on a straightline basis, recognizing the salvage values noted. Ignore taxes.

Required:

a & b Compute ROI, using net book value and gross book value.

Note: Enter your answers as a percentage rounded to decimal place ieThe Street Division of Labrosse Logistics just started operations. It purchased depreciable assets costing $ million and

having a fouryear expected life, after which the assets can be salvaged for $ million. In addition, the division has $

million in assets that are not depreciable. After four years, the division will have $ million available from these non

depreciable assets. This means that the division has invested $ million in assets with a salvage value of $ million.

Annual operating cash flows are $ million. In computing ROI, this division uses beginningofyear asset values in the

denominator. Depreciation is computed on a straightline basis, recognizing the salvage values noted. Ignore taxes.

Required:

a & b Compute ROI, using net book value and gross book value.

Note: Enter your answers as a percentage rounded to decimal place ie

The answers here are incorrect. none of the answers should be or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started