Need help filling in the sheet below

Need help filling in the sheet below

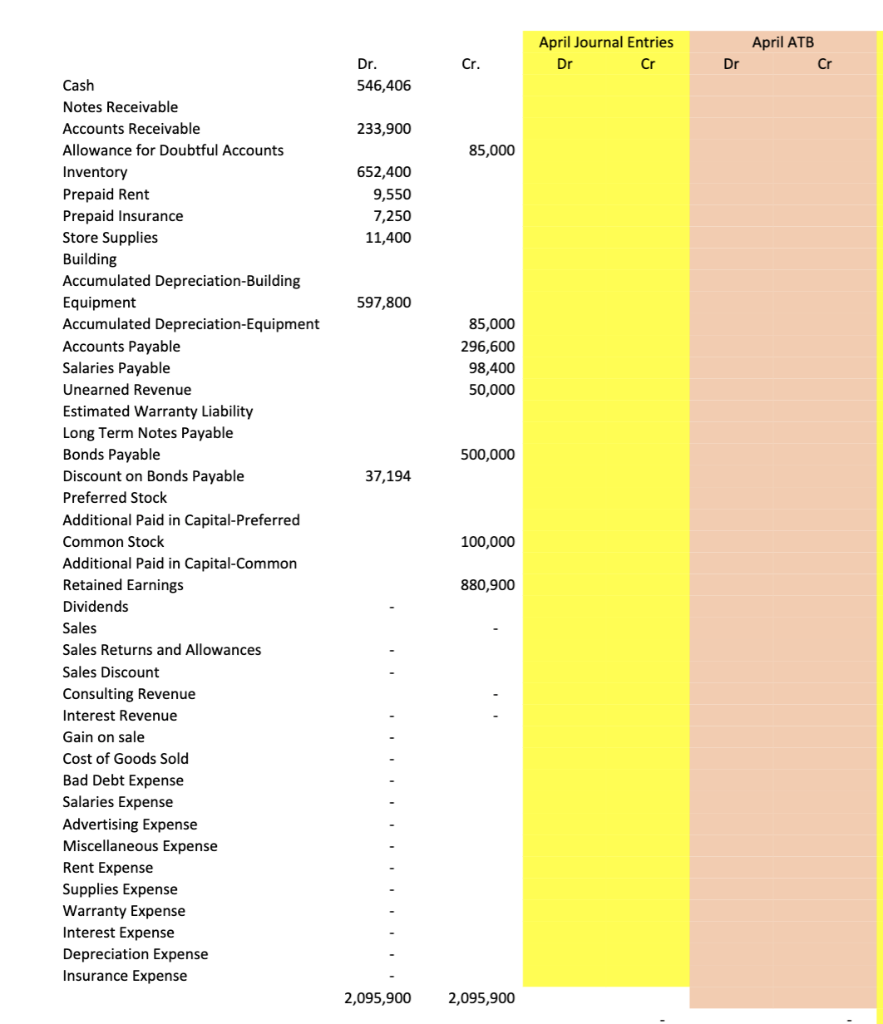

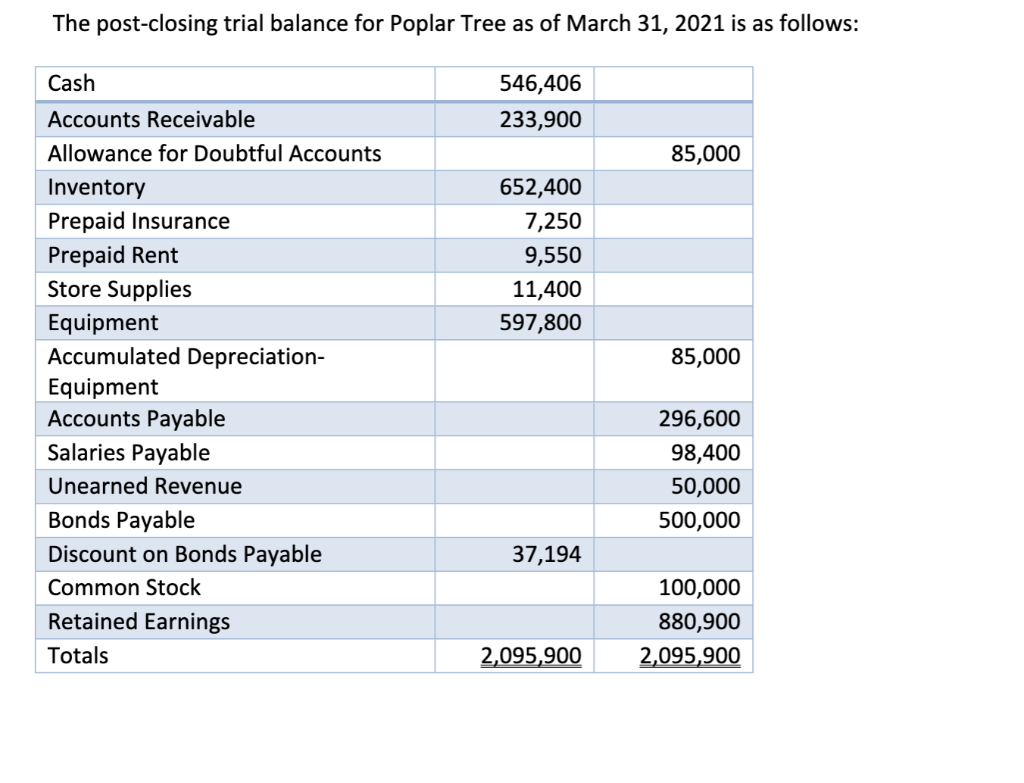

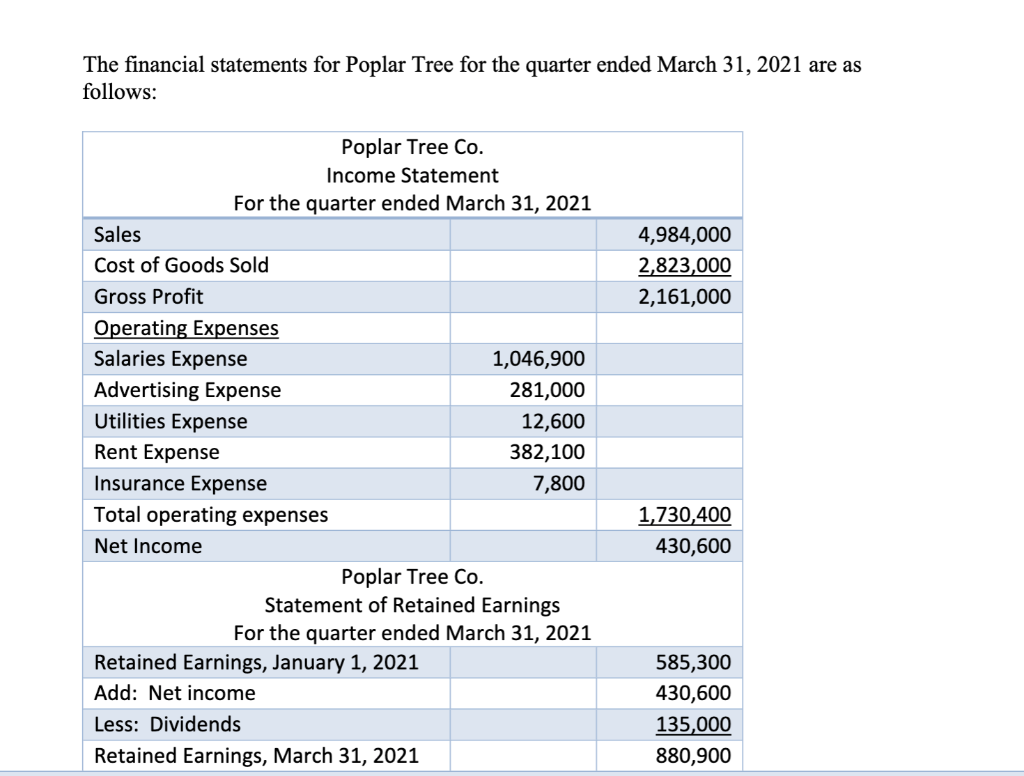

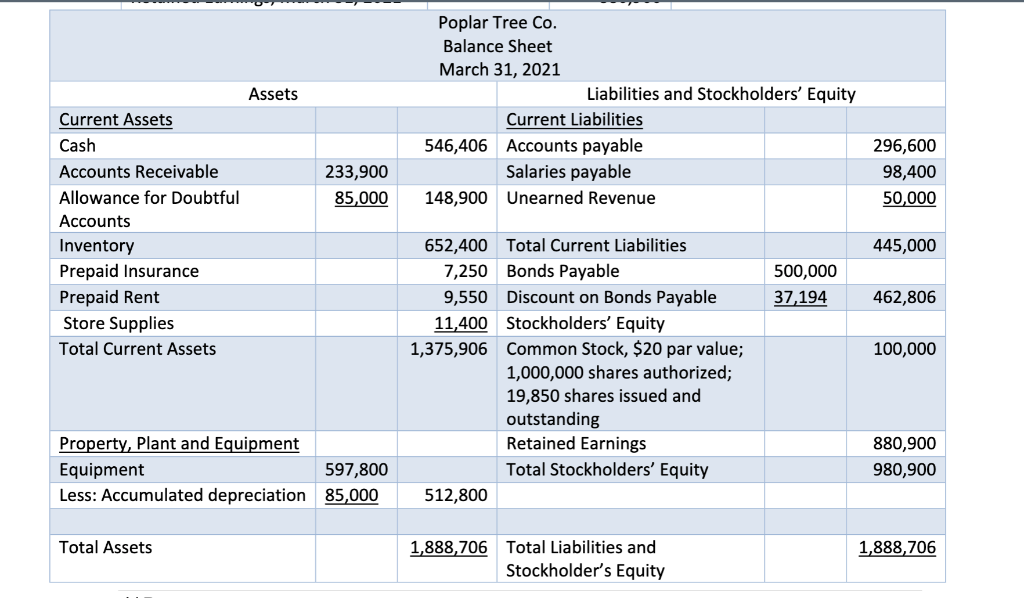

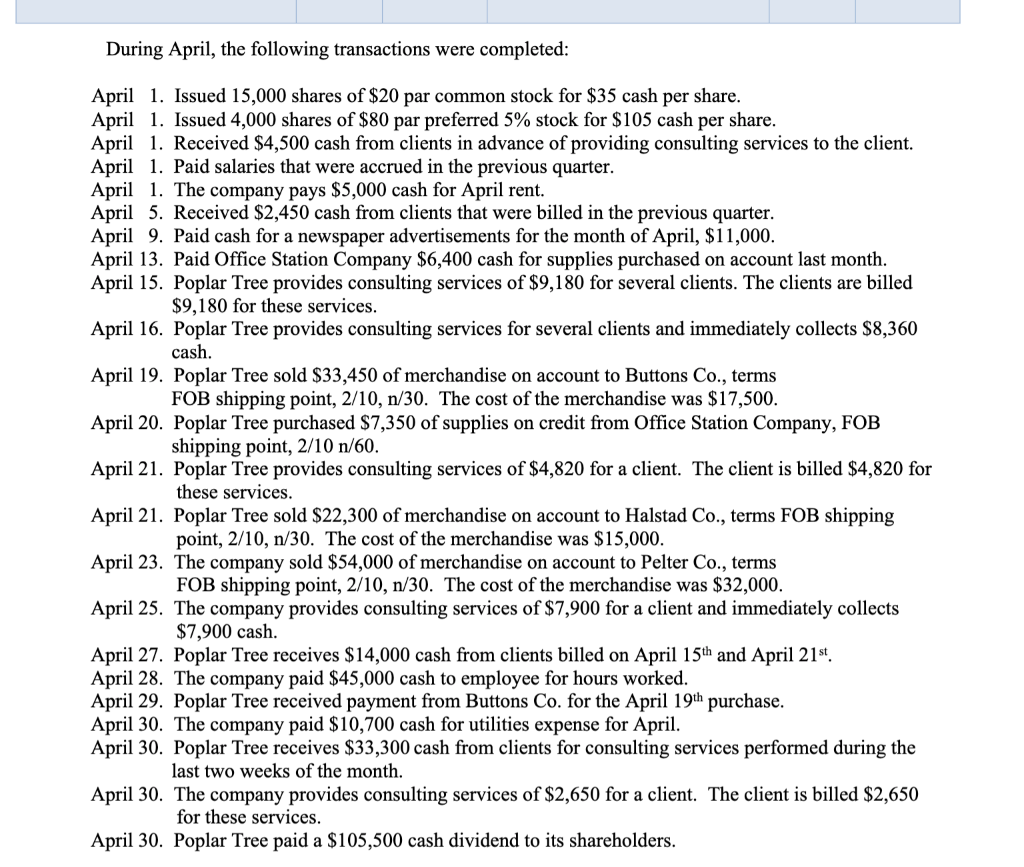

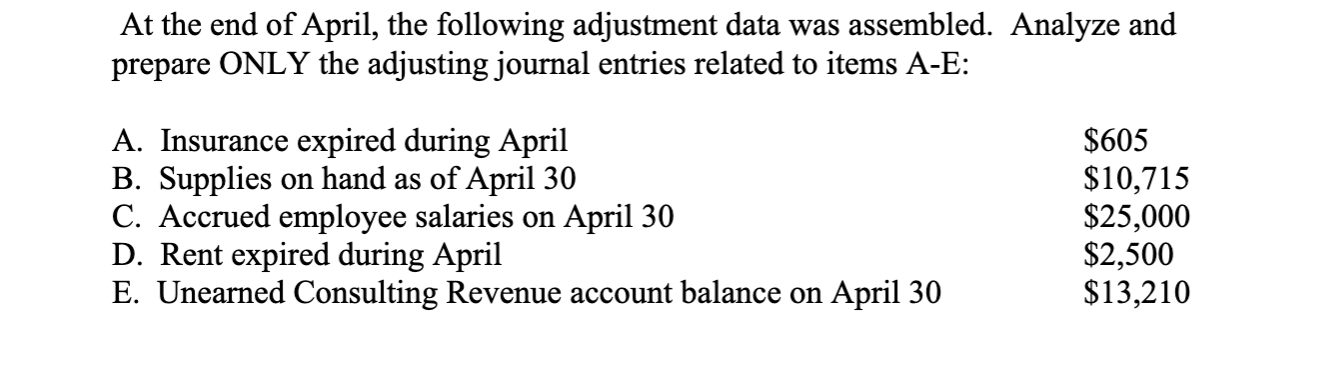

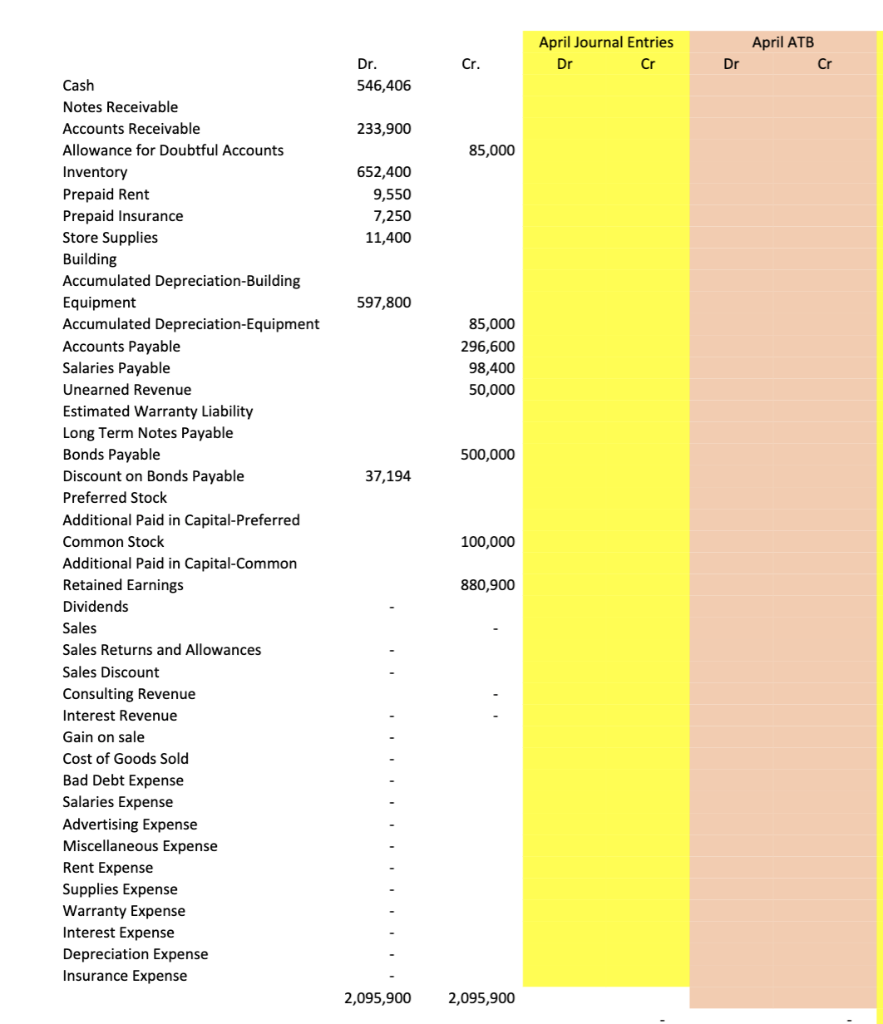

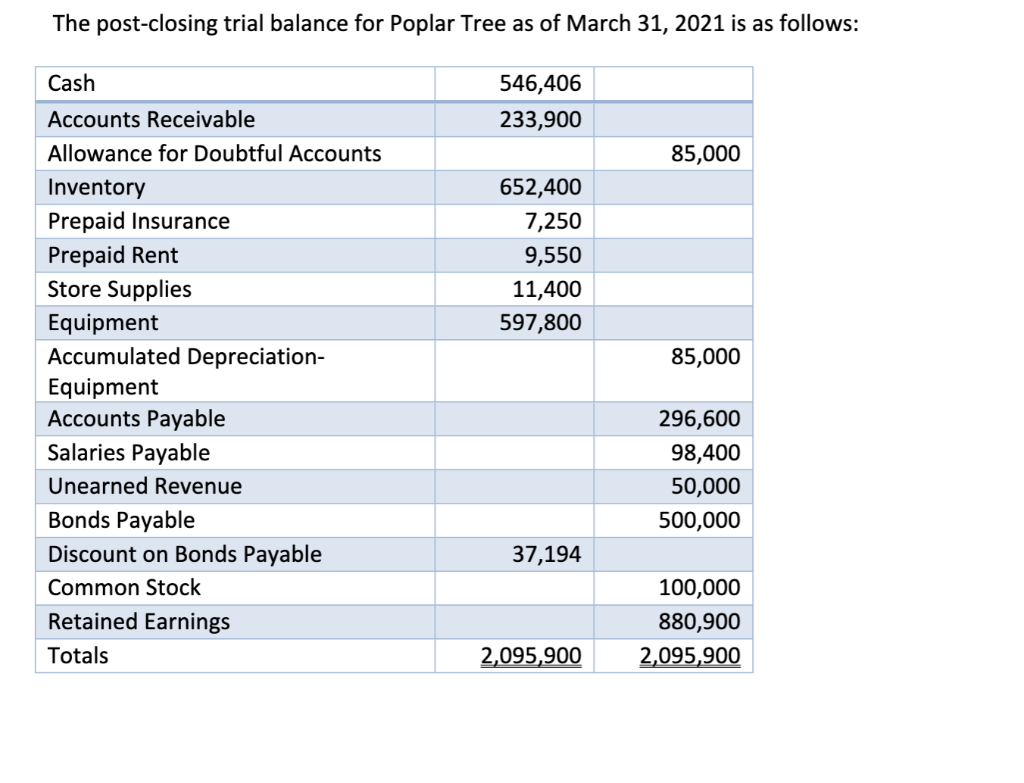

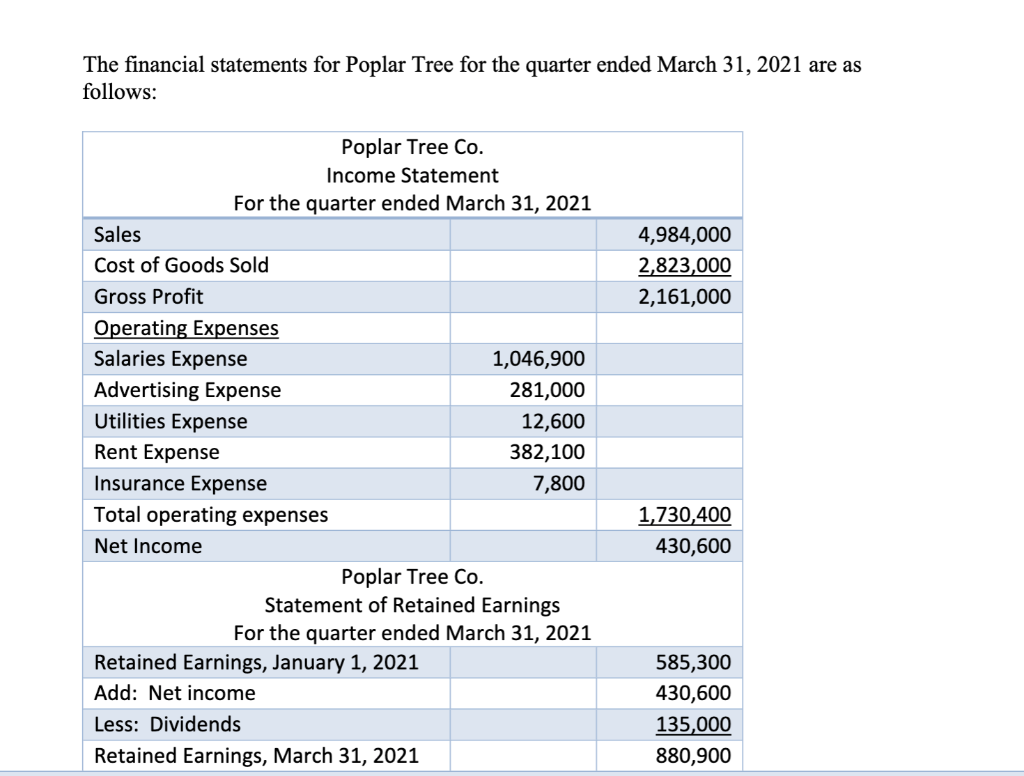

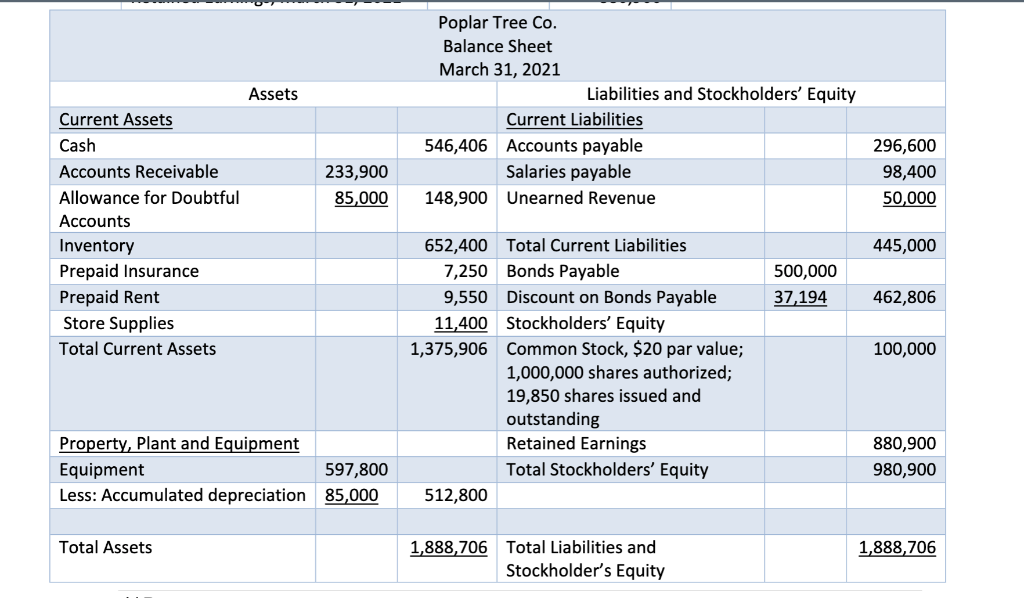

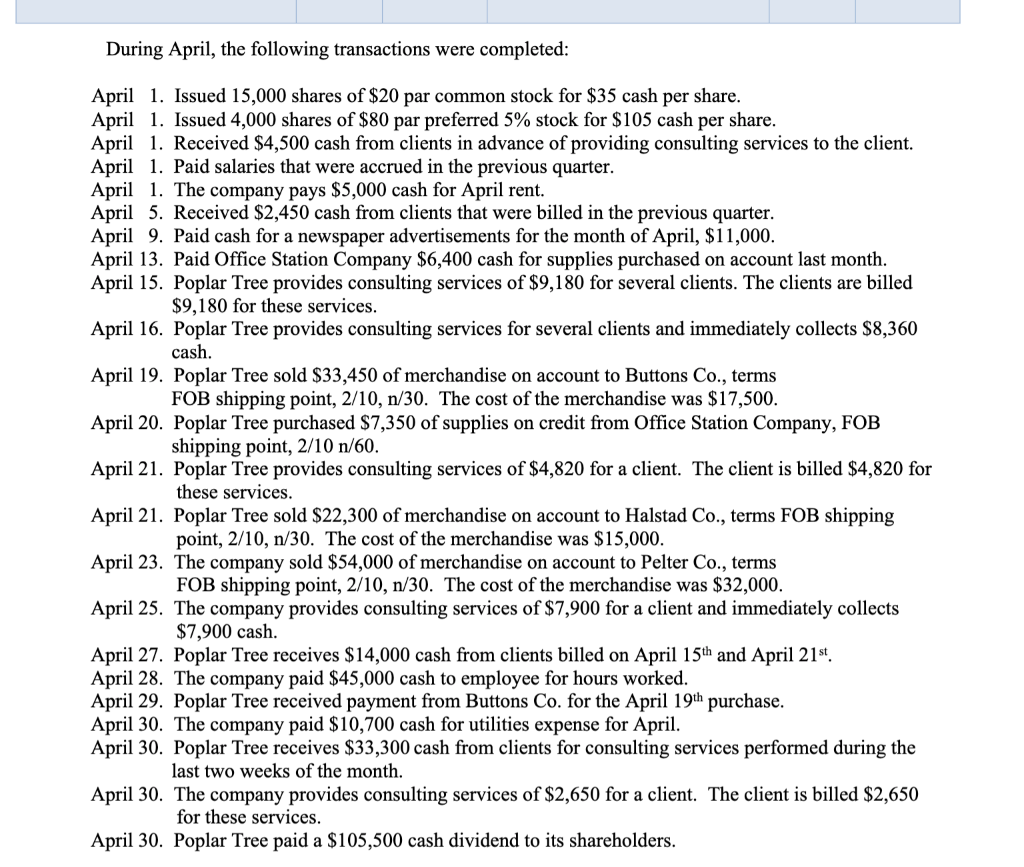

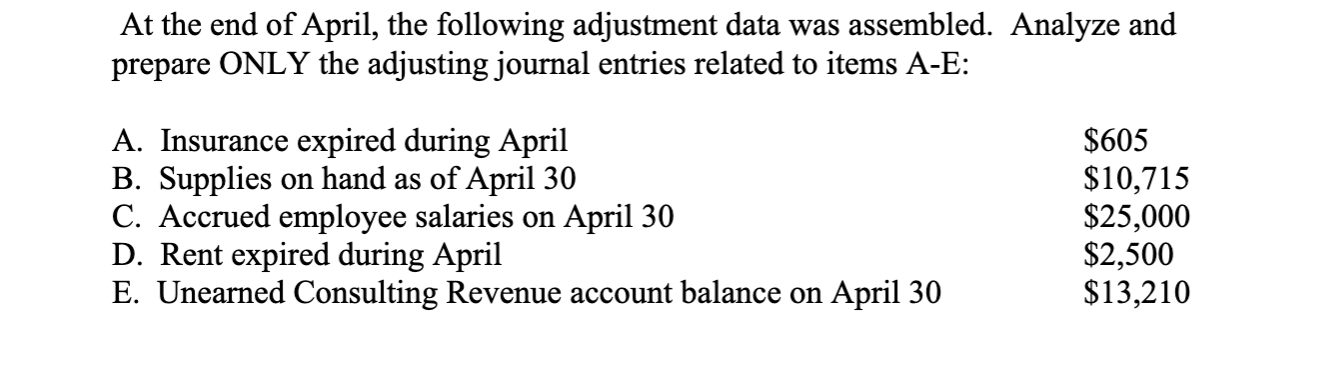

The post-closing trial balance for Poplar Tree as of March 31, 2021 is as follows: 546,406 233,900 85,000 652,400 7,250 9,550 11,400 597,800 85,000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Prepaid Rent Store Supplies Equipment Accumulated Depreciation- Equipment Accounts Payable Salaries Payable Unearned Revenue Bonds Payable Discount on Bonds Payable Common Stock Retained Earnings Totals 296,600 98,400 50,000 500,000 37,194 100,000 880,900 2,095,900 2,095,900 The financial statements for Poplar Tree for the quarter ended March 31, 2021 are as follows: 4,984,000 2,823,000 2,161,000 Poplar Tree Co. Income Statement For the quarter ended March 31, 2021 Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries Expense 1,046,900 Advertising Expense 281,000 Utilities Expense 12,600 Rent Expense 382,100 Insurance Expense 7,800 Total operating expenses Net Income Poplar Tree Co. Statement of Retained Earnings For the quarter ended March 31, 2021 Retained Earnings, January 1, 2021 Add: Net income Less: Dividends Retained Earnings, March 31, 2021 1,730,400 430,600 585,300 430,600 135,000 880,900 Assets Poplar Tree Co. Balance Sheet March 31, 2021 Liabilities and Stockholders' Equity Current Liabilities 546,406 Accounts payable Salaries payable 148,900 Unearned Revenue 233,900 85,000 296,600 98,400 50,000 Current Assets Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Prepaid Rent Store Supplies Total Current Assets 445,000 500,000 37,194 462,806 100,000 652,400 Total Current Liabilities 7,250 Bonds Payable 9,550 Discount on Bonds Payable 11,400 Stockholders' Equity 1,375,906 Common Stock, $20 par value; 1,000,000 shares authorized; 19,850 shares issued and outstanding Retained Earnings Total Stockholders' Equity 512,800 Property, Plant and Equipment Equipment 597,800 Less: Accumulated depreciation 85,000 880,900 980,900 Total Assets 1,888,706 Total Liabilities and Stockholder's Equity 1,888,706 During April, the following transactions were completed: April 1. Issued 15,000 shares of $20 par common stock for $35 cash per share. April 1. Issued 4,000 shares of $80 par preferred 5% stock for $105 cash per share. April 1. Received $4,500 cash from clients in advance of providing consulting services to the client. April 1. Paid salaries that were accrued in the previous quarter. April 1. The company pays $5,000 cash for April rent. April 5. Received $2,450 cash from clients that were billed in the previous quarter. April 9. Paid cash for a newspaper advertisements for the month of April, $11,000. April 13. Paid Office Station Company $6,400 cash for supplies purchased on account last month. April 15. Poplar Tree provides consulting services of $9,180 for several clients. The clients are billed $9,180 for these services. April 16. Poplar Tree provides consulting services for several clients and immediately collects $8,360 cash. April 19. Poplar Tree sold $33,450 of merchandise on account to Buttons Co., terms FOB shipping point, 2/10, n/30. The cost of the merchandise was $17,500. April 20. Poplar Tree purchased $7,350 of supplies on credit from Office Station Company, FOB shipping point, 2/10 n/60. April 21. Poplar Tree provides consulting services of $4,820 for a client. The client is billed $4,820 for these services. April 21. Poplar Tree sold $22,300 of merchandise on account to Halstad Co., terms FOB shipping point, 2/10, n/30. The cost of the merchandise was $15,000. April 23. The company sold $54,000 of merchandise on account to Pelter Co., terms FOB shipping point, 2/10, n/30. The cost of the merchandise was $32,000. April 25. The company provides consulting services of $7,900 for a client and immediately collects $7,900 cash. April 27. Poplar Tree receives $14,000 cash from clients billed on April 15th and April 21st April 28. The company paid $45,000 cash to employee for hours worked. April 29. Poplar Tree received payment from Buttons Co. for the April 19th purchase. April 30. The company paid $10,700 cash for utilities expense for April. April 30. Poplar Tree receives $33,300 cash from clients for consulting services performed during the last two weeks of the month. April 30. The company provides consulting services of $2,650 for a client. The client is billed $2,650 for these services. April 30. Poplar Tree paid a $105,500 cash dividend to its shareholders. At the end of April, the following adjustment data was assembled. Analyze and prepare ONLY the adjusting journal entries related to items A-E: A. Insurance expired during April B. Supplies on hand as of April 30 C. Accrued employee salaries on April 30 D. Rent expired during April E. Unearned Consulting Revenue account balance on April 30 $605 $10,715 $25,000 $2,500 $13,210 April Journal Entries Dr Cr April ATB Cr Cr. Dr Dr. 546,406 233,900 85,000 652,400 9,550 7,250 11,400 597,800 85,000 296,600 98,400 50,000 500,000 37,194 Cash Notes Receivable Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Rent Prepaid Insurance Store Supplies Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Estimated Warranty Liability Long Term Notes Payable Bonds Payable Discount on Bonds Payable Preferred Stock Additional Paid in Capital-Preferred Common Stock Additional Paid in Capital-Common Retained Earnings Dividends Sales Sales Returns and Allowances Sales Discount Consulting Revenue Interest Revenue Gain on sale Cost of Goods Sold Bad Debt Expense Salaries Expense Advertising Expense Miscellaneous Expense Rent Expense Supplies Expense Warranty Expense Interest Expense Depreciation Expense Insurance Expense 100,000 880,900 2,095,900 2,095,900

Need help filling in the sheet below

Need help filling in the sheet below