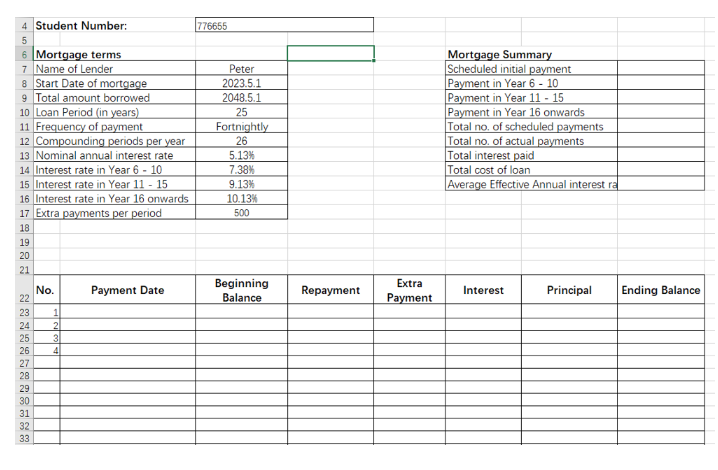

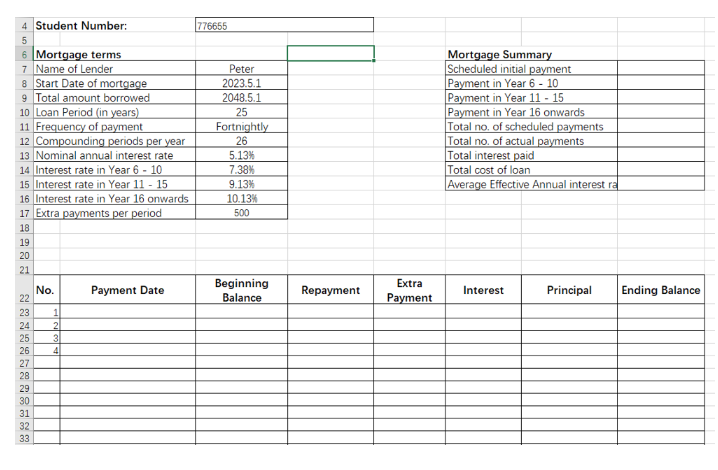

The student number is same as the amount borrowed is $776655,1.Use Excel fomular to fill up the empty space and show the steps that how to use excel fomular to calculate:

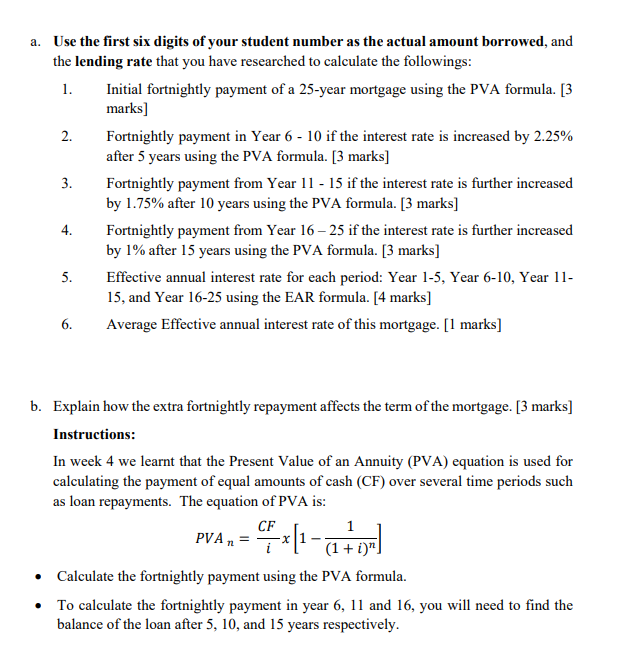

2.finish question a and b

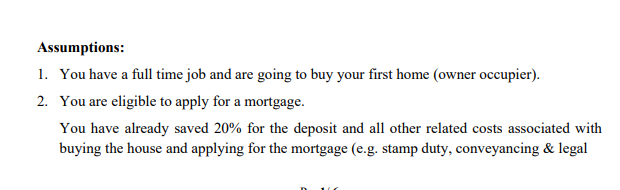

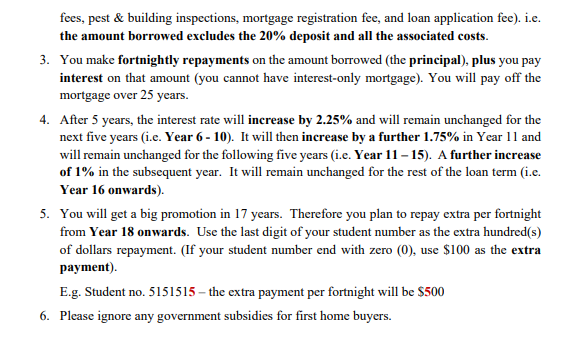

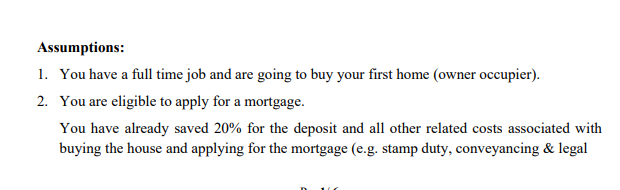

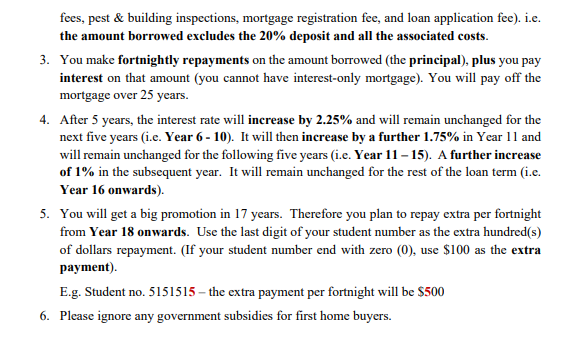

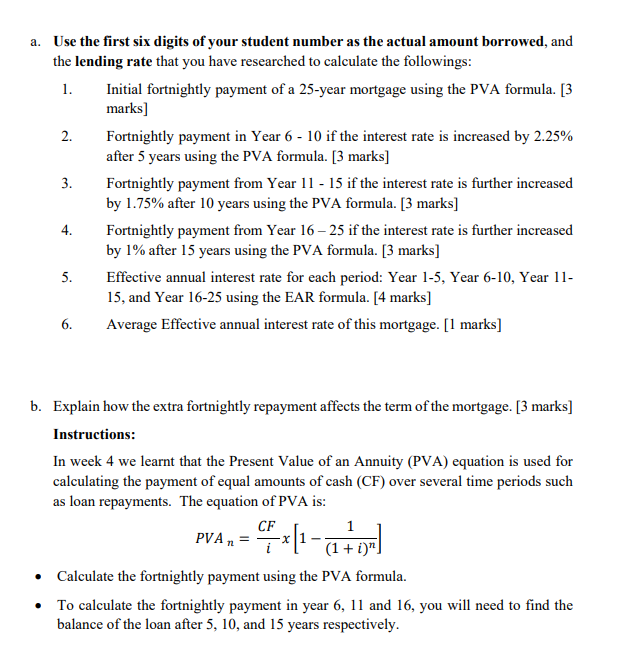

Assumptions: 1. You have a full time job and are going to buy your first home (owner occupier). 2. You are eligible to apply for a mortgage. You have already saved 20% for the deposit and all other related costs associated with buying the house and applying for the mortgage (e.g. stamp duty, conveyancing \& legal fees, pest \& building inspections, mortgage registration fee, and loan application fee). i.e. the amount borrowed excludes the 20% deposit and all the associated costs. 3. You make fortnightly repayments on the amount borrowed (the principal), plus you pay interest on that amount (you cannot have interest-only mortgage). You will pay off the mortgage over 25 years. 4. After 5 years, the interest rate will increase by 2.25% and will remain unchanged for the next five years (i.e. Year 6-10). It will then increase by a further 1.75% in Year 11 and will remain unchanged for the following five years (i.e. Year 11-15). A further increase of 1% in the subsequent year. It will remain unchanged for the rest of the loan term (i.e. Year 16 onwards). 5. You will get a big promotion in 17 years. Therefore you plan to repay extra per fortnight from Year 18 onwards. Use the last digit of your student number as the extra hundred(s) of dollars repayment. (If your student number end with zero (0), use $100 as the extra payment). E.g. Student no. 5151515 - the extra payment per fortnight will be $500 6. Please ignore any government subsidies for first home buyers. a. Use the first six digits of your student number as the actual amount borrowed, and the lending rate that you have researched to calculate the followings: 1. Initial fortnightly payment of a 25-year mortgage using the PVA formula. [3 marks] 2. Fortnightly payment in Year 6 - 10 if the interest rate is increased by 2.25% after 5 years using the PVA formula. [3 marks] 3. Fortnightly payment from Year 1115 if the interest rate is further increased by 1.75% after 10 years using the PVA formula. [ 3 marks] 4. Fortnightly payment from Year 1625 if the interest rate is further increased by 1% after 15 years using the PVA formula. [ 3 marks] 5. Effective annual interest rate for each period: Year 1-5, Year 6-10, Year 1115, and Year 16-25 using the EAR formula. [4 marks] 6. Average Effective annual interest rate of this mortgage. [1 marks] b. Explain how the extra fortnightly repayment affects the term of the mortgage. [3 marks] Instructions: In week 4 we learnt that the Present Value of an Annuity (PVA) equation is used for calculating the payment of equal amounts of cash (CF) over several time periods such as loan repayments. The equation of PVA is: PVAn=iCFx[1(1+i)n1] - Calculate the fortnightly payment using the PVA formula. - To calculate the fortnightly payment in year 6,11 and 16 , you will need to find the balance of the loan after 5,10 , and 15 years respectively. Assumptions: 1. You have a full time job and are going to buy your first home (owner occupier). 2. You are eligible to apply for a mortgage. You have already saved 20% for the deposit and all other related costs associated with buying the house and applying for the mortgage (e.g. stamp duty, conveyancing \& legal fees, pest \& building inspections, mortgage registration fee, and loan application fee). i.e. the amount borrowed excludes the 20% deposit and all the associated costs. 3. You make fortnightly repayments on the amount borrowed (the principal), plus you pay interest on that amount (you cannot have interest-only mortgage). You will pay off the mortgage over 25 years. 4. After 5 years, the interest rate will increase by 2.25% and will remain unchanged for the next five years (i.e. Year 6-10). It will then increase by a further 1.75% in Year 11 and will remain unchanged for the following five years (i.e. Year 11-15). A further increase of 1% in the subsequent year. It will remain unchanged for the rest of the loan term (i.e. Year 16 onwards). 5. You will get a big promotion in 17 years. Therefore you plan to repay extra per fortnight from Year 18 onwards. Use the last digit of your student number as the extra hundred(s) of dollars repayment. (If your student number end with zero (0), use $100 as the extra payment). E.g. Student no. 5151515 - the extra payment per fortnight will be $500 6. Please ignore any government subsidies for first home buyers. a. Use the first six digits of your student number as the actual amount borrowed, and the lending rate that you have researched to calculate the followings: 1. Initial fortnightly payment of a 25-year mortgage using the PVA formula. [3 marks] 2. Fortnightly payment in Year 6 - 10 if the interest rate is increased by 2.25% after 5 years using the PVA formula. [3 marks] 3. Fortnightly payment from Year 1115 if the interest rate is further increased by 1.75% after 10 years using the PVA formula. [ 3 marks] 4. Fortnightly payment from Year 1625 if the interest rate is further increased by 1% after 15 years using the PVA formula. [ 3 marks] 5. Effective annual interest rate for each period: Year 1-5, Year 6-10, Year 1115, and Year 16-25 using the EAR formula. [4 marks] 6. Average Effective annual interest rate of this mortgage. [1 marks] b. Explain how the extra fortnightly repayment affects the term of the mortgage. [3 marks] Instructions: In week 4 we learnt that the Present Value of an Annuity (PVA) equation is used for calculating the payment of equal amounts of cash (CF) over several time periods such as loan repayments. The equation of PVA is: PVAn=iCFx[1(1+i)n1] - Calculate the fortnightly payment using the PVA formula. - To calculate the fortnightly payment in year 6,11 and 16 , you will need to find the balance of the loan after 5,10 , and 15 years respectively