Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The StW corp decides to buy a farm to produce organic corn. Beyond the purchase price, going organic will cost 5 million dollars. You

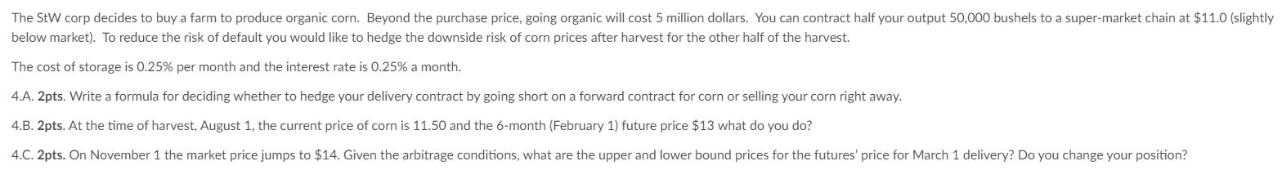

The StW corp decides to buy a farm to produce organic corn. Beyond the purchase price, going organic will cost 5 million dollars. You can contract half your output 50,000 bushels to a super-market chain at $11.0 (slightly below market). To reduce the risk of default you would like to hedge the downside risk of corn prices after harvest for the other half of the harvest. The cost of storage is 0.25% per month and the interest rate is 0.25% a month. 4.A. 2pts. Write a formula for deciding whether to hedge your delivery contract by going short on a forward contract for corn or selling your corn right away. 4.B. 2pts. At the time of harvest, August 1, the current price of corn is 11.50 and the 6-month (February 1) future price $13 what do you do? 4.C. 2pts. On November 1 the market price jumps to $14. Given the arbitrage conditions, what are the upper and lower bound prices for the futures' price for March 1 delivery? Do you change your position?

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

4A To decide whether to hedge the delivery contract by going short on a forward contract for corn or ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started