Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm has been engaged to examine the financial statements of Skysong Corporation for the year 2017. The bookkeeper who maintains the financial records

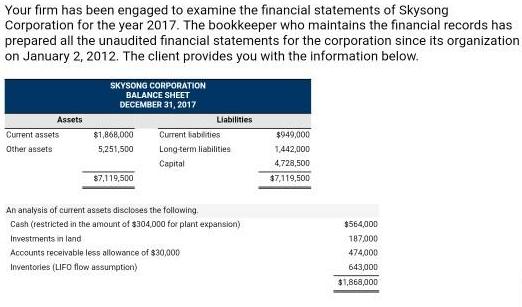

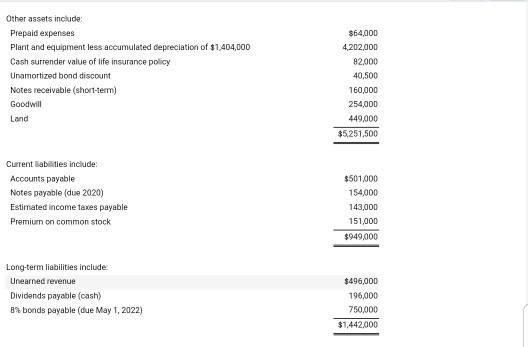

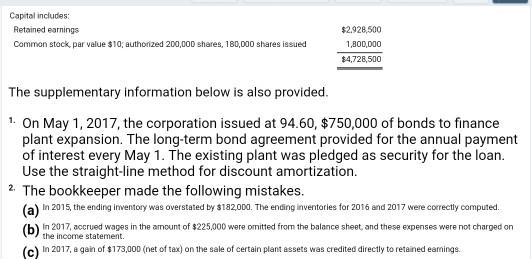

Your firm has been engaged to examine the financial statements of Skysong Corporation for the year 2017. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2012. The client provides you with the information below. SKYSONG CORPORATION BALANCE SHEET DECEMBER 31, 2017 Assets Liabilities Current assets $1,868,000 Current kablities $949,000 Other assets 5,251,500 Long-term liabilities 1,442,000 Capital 4,728,500 87,119,500 $7,119,500 An analysis of current assets discloses the following. Cash (restricted in the amount of $304,000 for plant expansion) $564,000 Investments in land 187,000 Accounts receivable less allowance of 30,000 474,000 Inventories (LIFO flow assumption) 643,000 $1,868,000 Other assets include: Prepaid expenses $64,000 Plant and equipment less accumulated depreciation of $1,404,000 4,202,000 Cash surrender value of life insurance policy 82,000 Unamortized bond discount 40,500 Notes receivable (short-term) 160,000 Goodwill 254,000 Land 449,000 $5,251,500 Current liabilities include: Accounts payable $501,000 Notes payable (due 2020) 154,000 Estimated income taxes payable 143,000 Premium on common stock 151,000 $949,000 Long-term liabilities include Unearned revenue $496,000 Dividends payable (cash) 196,000 8% bonds payable (due May 1, 2022) 750,000 $1,442,000 Capital includes: Retained earnings $2.928,500 Common stock, par value $10; authorized 200,000 shares, 180,000 shares issued 1,800,000 $4,728,500 The supplementary information below is also provided. 1. On May 1, 2017, the corporation issued at 94.60, $750,000 of bonds to finance plant expansion. The long-term bond agreement provided for the annual payment of interest every May 1. The existing plant was pledged as security for the loan. Use the straight-line method for discount amortization. 2 The bookkeeper made the following mistakes. (a) In 2015, the ending inventory was overstated by $182,000. The ending inventories for 2016 and 2017 were correctly computed. (b) in 2017, accrued wages in the amount of $225,000 were omitted from the balance sheet, and these expenses were not charged on the income statement. (c) In 2017, a gain of $173,000 (net of tax) on the sale of certain plant assets was credited directly to retained eamings. 3. A major competitor has introduced a line of products that will compete directly with Skysong's primary line, now being produced in a specially designed new plant. Because of manufacturing innovations, the competitor's line will be of comparable quality but priced 50% below Skysong's line. The competitor announced its new line on January 14, 2018. Skysong indicates that the company will meet the lower prices that are high enough to cover variable manufacturing and selling expenses, but permit recovery of only a portion of fixed costs. 4. You learned on January 28, 2018, prior to completion of the audit, of heavy damage because of a recent fire to one of Skysong's two plants; the loss will not be reimbursed by insurance. The newspapers described the event in detail. Analyze the above information to prepare a corrected balance sheet for Skysong in accordance with proper accounting and reporting principles. Prepare a description of any notes that might need to be prepared. The books are closed and adjustments to income are to be made through retained earnings. (List current assets in order of liquidity. Enter account name only and do not provide descriptive information.) Your firm has been engaged to examine the financial statements of Skysong Corporation for the year 2017. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2012. The client provides you with the information below. SKYSONG CORPORATION BALANCE SHEET DECEMBER 31, 2017 Assets Liabilities Current assets $1,868,000 Current kablities $949,000 Other assets 5,251,500 Long-term liabilities 1,442,000 Capital 4,728,500 87,119,500 $7,119,500 An analysis of current assets discloses the following. Cash (restricted in the amount of $304,000 for plant expansion) $564,000 Investments in land 187,000 Accounts receivable less allowance of 30,000 474,000 Inventories (LIFO flow assumption) 643,000 $1,868,000 Other assets include: Prepaid expenses $64,000 Plant and equipment less accumulated depreciation of $1,404,000 4,202,000 Cash surrender value of life insurance policy 82,000 Unamortized bond discount 40,500 Notes receivable (short-term) 160,000 Goodwill 254,000 Land 449,000 $5,251,500 Current liabilities include: Accounts payable $501,000 Notes payable (due 2020) 154,000 Estimated income taxes payable 143,000 Premium on common stock 151,000 $949,000 Long-term liabilities include Unearned revenue $496,000 Dividends payable (cash) 196,000 8% bonds payable (due May 1, 2022) 750,000 $1,442,000 Capital includes: Retained earnings $2.928,500 Common stock, par value $10; authorized 200,000 shares, 180,000 shares issued 1,800,000 $4,728,500 The supplementary information below is also provided. 1. On May 1, 2017, the corporation issued at 94.60, $750,000 of bonds to finance plant expansion. The long-term bond agreement provided for the annual payment of interest every May 1. The existing plant was pledged as security for the loan. Use the straight-line method for discount amortization. 2 The bookkeeper made the following mistakes. (a) In 2015, the ending inventory was overstated by $182,000. The ending inventories for 2016 and 2017 were correctly computed. (b) in 2017, accrued wages in the amount of $225,000 were omitted from the balance sheet, and these expenses were not charged on the income statement. (c) In 2017, a gain of $173,000 (net of tax) on the sale of certain plant assets was credited directly to retained eamings. 3. A major competitor has introduced a line of products that will compete directly with Skysong's primary line, now being produced in a specially designed new plant. Because of manufacturing innovations, the competitor's line will be of comparable quality but priced 50% below Skysong's line. The competitor announced its new line on January 14, 2018. Skysong indicates that the company will meet the lower prices that are high enough to cover variable manufacturing and selling expenses, but permit recovery of only a portion of fixed costs. 4. You learned on January 28, 2018, prior to completion of the audit, of heavy damage because of a recent fire to one of Skysong's two plants; the loss will not be reimbursed by insurance. The newspapers described the event in detail. Analyze the above information to prepare a corrected balance sheet for Skysong in accordance with proper accounting and reporting principles. Prepare a description of any notes that might need to be prepared. The books are closed and adjustments to income are to be made through retained earnings. (List current assets in order of liquidity. Enter account name only and do not provide descriptive information.) Your firm has been engaged to examine the financial statements of Skysong Corporation for the year 2017. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2012. The client provides you with the information below. SKYSONG CORPORATION BALANCE SHEET DECEMBER 31, 2017 Assets Liabilities Current assets $1,868,000 Current kablities $949,000 Other assets 5,251,500 Long-term liabilities 1,442,000 Capital 4,728,500 87,119,500 $7,119,500 An analysis of current assets discloses the following. Cash (restricted in the amount of $304,000 for plant expansion) $564,000 Investments in land 187,000 Accounts receivable less allowance of 30,000 474,000 Inventories (LIFO flow assumption) 643,000 $1,868,000 Other assets include: Prepaid expenses $64,000 Plant and equipment less accumulated depreciation of $1,404,000 4,202,000 Cash surrender value of life insurance policy 82,000 Unamortized bond discount 40,500 Notes receivable (short-term) 160,000 Goodwill 254,000 Land 449,000 $5,251,500 Current liabilities include: Accounts payable $501,000 Notes payable (due 2020) 154,000 Estimated income taxes payable 143,000 Premium on common stock 151,000 $949,000 Long-term liabilities include Unearned revenue $496,000 Dividends payable (cash) 196,000 8% bonds payable (due May 1, 2022) 750,000 $1,442,000 Capital includes: Retained earnings $2.928,500 Common stock, par value $10; authorized 200,000 shares, 180,000 shares issued 1,800,000 $4,728,500 The supplementary information below is also provided. 1. On May 1, 2017, the corporation issued at 94.60, $750,000 of bonds to finance plant expansion. The long-term bond agreement provided for the annual payment of interest every May 1. The existing plant was pledged as security for the loan. Use the straight-line method for discount amortization. 2 The bookkeeper made the following mistakes. (a) In 2015, the ending inventory was overstated by $182,000. The ending inventories for 2016 and 2017 were correctly computed. (b) in 2017, accrued wages in the amount of $225,000 were omitted from the balance sheet, and these expenses were not charged on the income statement. (c) In 2017, a gain of $173,000 (net of tax) on the sale of certain plant assets was credited directly to retained eamings. 3. A major competitor has introduced a line of products that will compete directly with Skysong's primary line, now being produced in a specially designed new plant. Because of manufacturing innovations, the competitor's line will be of comparable quality but priced 50% below Skysong's line. The competitor announced its new line on January 14, 2018. Skysong indicates that the company will meet the lower prices that are high enough to cover variable manufacturing and selling expenses, but permit recovery of only a portion of fixed costs. 4. You learned on January 28, 2018, prior to completion of the audit, of heavy damage because of a recent fire to one of Skysong's two plants; the loss will not be reimbursed by insurance. The newspapers described the event in detail. Analyze the above information to prepare a corrected balance sheet for Skysong in accordance with proper accounting and reporting principles. Prepare a description of any notes that might need to be prepared. The books are closed and adjustments to income are to be made through retained earnings. (List current assets in order of liquidity. Enter account name only and do not provide descriptive information.)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Vaughu corporation Balaume sheet Dee 31 2017 Curreut Ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started