Question

The table below contains a sample of annual rate of return data for the stocks of the Alpha and Beta companies. Calculate the average return,

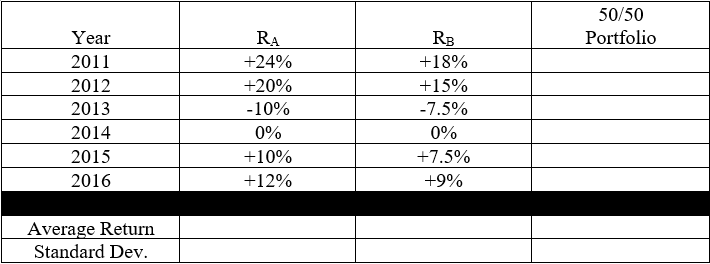

The table below contains a sample of annual rate of return data for the stocks of the Alpha and Beta companies. Calculate the average return, and the standard deviation of the annual returns, for each stock. Now assume a portfolio containing 50% investment in Alpha stock and 50% investment in Beta stock is created for these years. What is what is the return on the portfolio each year? What is the average return, and the standard deviation of the annual returns, for the portfolio? Does diversification reduce risk in this case? Why or why not?

Please help, Thank You.

50/50 Portfolio Year 2011 2012 2013 2014 2015 2016 RA +24% +20% -10% 0% +10% +12% RB +18% +15% -7.5% 0% +7.5% +9% Average Return Standard DevStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started