Question

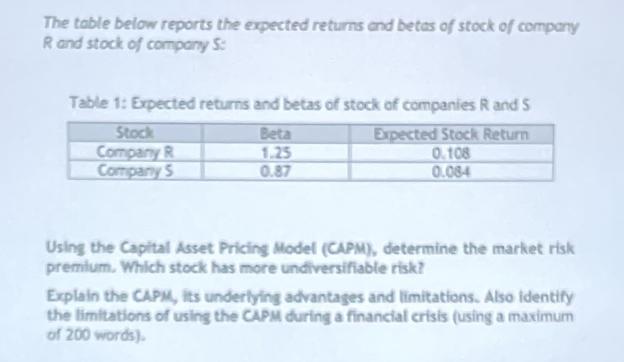

The table below reports the expected returns and betas of stock of company R and stock of company S: Table 1: Expected returns and

The table below reports the expected returns and betas of stock of company R and stock of company S: Table 1: Expected returns and betas of stock of companies R and S Beta Expected Stock Return 0.108 1.25 0.87 0.084 Stock Company R Company S Using the Capital Asset Pricing Model (CAPM), determine the market risk premium. Which stock has more undiversifiable risk? Explain the CAPM, its underlying advantages and limitations. Also identify the limitations of using the CAPM during a financial crisis (using a maximum of 200 words).

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To solve this question well assume that the CAPM formula is applicable and can be used to estimate the expected returns of stocks The CAPM formula is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

11th edition

324422870, 324422873, 978-0324302691

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App