Question

The table below shows the last 5 days of a futures contract on corn. Suppose we take a long position in the futures contract on

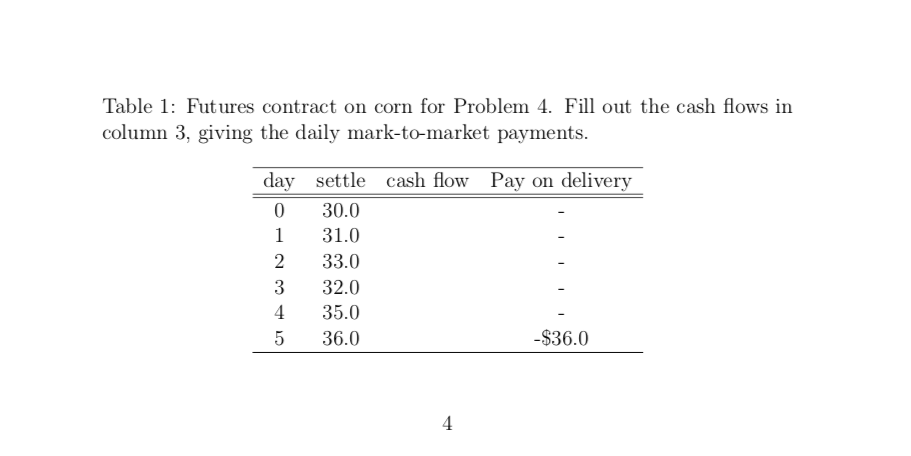

The table below shows the last 5 days of a futures contract on corn. Suppose we take a long position in the futures contract on day 0. Delivery is on day 5: on this day the long futures contract holder pays the settlement price on that day, and receives physical delivery of corn. The settlement prices of the contract on each day are shown in the second column.

i) Fill out the cash flows on each day in the third column. These are the mark-to-market payments.

ii) Assuming that interest rates vanish, explain how the result obtained agrees with the statement that "futures and forward prices are equal if in- terest rates are deterministic".

Table 1: Futures contract on corn for Problem 4. Fill out the cash flows in column 3, giving the daily mark-to-market payments. day settle cash flow Pay on delivery 0 30.0 1 31.0 2 33.0 3 32.0 4 35.0 5 36.0 4 -$36.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

based on the information provided Cash Flows MarktoMarket Payments Day Settlement Price Cash Flow 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started