Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The tax is 25% Joint text on questions 4 - 5 The company Vindskydd AB manufactures and sells two different types of wind protection. One

The tax is 25%

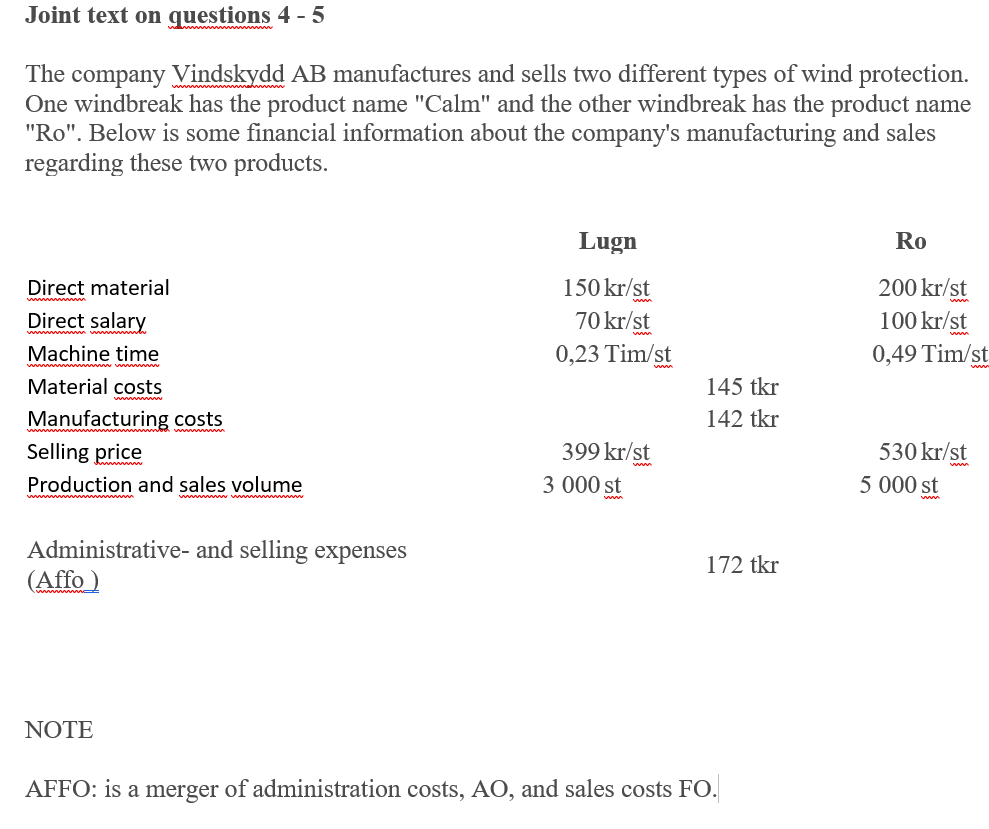

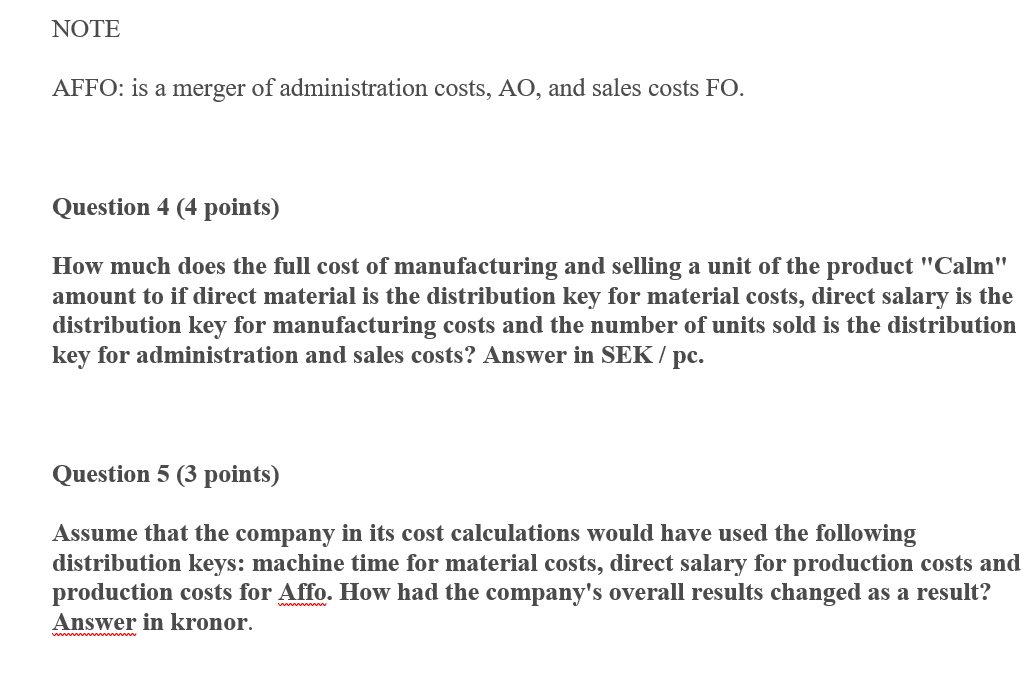

Joint text on questions 4 - 5 The company Vindskydd AB manufactures and sells two different types of wind protection. One windbreak has the product name "Calm" and the other windbreak has the product name "Ro". Below is some financial information about the company's manufacturing and sales regarding these two products. Lugn Ro Direct material Direct salary 150 kr/st 70 kr/st 0,23 Tim/st 200 kr/st 100 kr/st 0,49 Tim/st Machine time 145 tkr 142 tkr Material costs Manufacturing costs Selling price Production and sales volume 399 kr/st 530 kr/st 3 000 st 5 000 st Administrative- and selling expenses (Affo 172 tkr NOTE AFFO: is a merger of administration costs, AO, and sales costs FO. NOTE AFFO: is a merger of administration costs, AO, and sales costs FO. Question 4 (4 points) How much does the full cost of manufacturing and selling a unit of the product "Calm" amount to if direct material is the distribution key for material costs, direct salary is the distribution key for manufacturing costs and the number of units sold is the distribution key for administration and sales costs? Answer in SEK /pc. Question 5 (3 points) Assume that the company in its cost calculations would have used the following distribution keys: machine time for material costs, direct salary for production costs and production costs for Affo. How had the company's overall results changed as a result? Answer in kronor. Joint text on questions 4 - 5 The company Vindskydd AB manufactures and sells two different types of wind protection. One windbreak has the product name "Calm" and the other windbreak has the product name "Ro". Below is some financial information about the company's manufacturing and sales regarding these two products. Lugn Ro Direct material Direct salary 150 kr/st 70 kr/st 0,23 Tim/st 200 kr/st 100 kr/st 0,49 Tim/st Machine time 145 tkr 142 tkr Material costs Manufacturing costs Selling price Production and sales volume 399 kr/st 530 kr/st 3 000 st 5 000 st Administrative- and selling expenses (Affo 172 tkr NOTE AFFO: is a merger of administration costs, AO, and sales costs FO. NOTE AFFO: is a merger of administration costs, AO, and sales costs FO. Question 4 (4 points) How much does the full cost of manufacturing and selling a unit of the product "Calm" amount to if direct material is the distribution key for material costs, direct salary is the distribution key for manufacturing costs and the number of units sold is the distribution key for administration and sales costs? Answer in SEK /pc. Question 5 (3 points) Assume that the company in its cost calculations would have used the following distribution keys: machine time for material costs, direct salary for production costs and production costs for Affo. How had the company's overall results changed as a result? Answer in kronorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started