Question

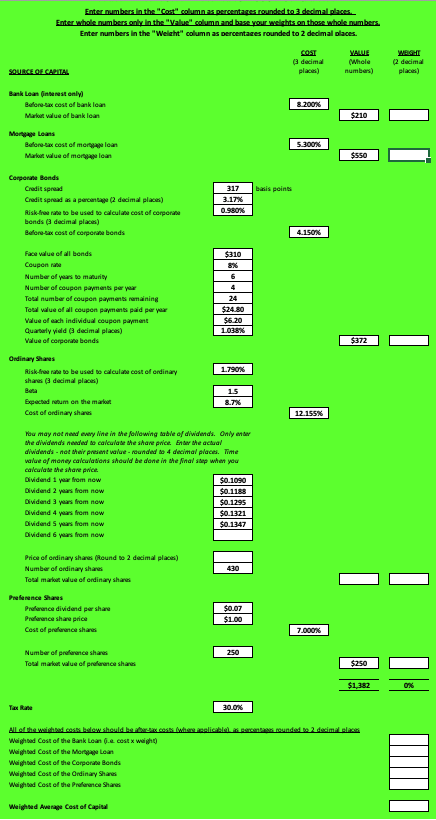

The Tax Rate: 30% The 10-year risk free rate: 1.79% The 6-year risk free rate: .98% USING THE INFORMATION shown and attached above, Please find

The Tax Rate: 30%

The 10-year risk free rate: 1.79%

The 6-year risk free rate: .98%

USING THE INFORMATION shown and attached above,

Please find and show calculations for:

(ROUND ALL ANSWERS TO THE THIRD DECIMAL PLACE)

Bank Loan Weight:

Mortgage Loans Weight:

Corporate Bonds Weight

Price of Ordinary Shares:

Market Value of Ordinary Shares:

Ordinary Shares Weight:

AFTER CALCULATING ABOVE, PLEASE FIND THE ANSWERS BELOW (ROUND TO THIRD DECIMAL PLACE)

All weighted costs after-tax costs (Tax rate 30%)

Weighted Cost of the Bank loan (i.e. cost x weight):

Weighted Cost of the Mortgage Loan

Weighted Cost of the Corporate Bonds

Weighted Cost of the Ordinary Shares

Weighted Cost of the Preference Shares

Weighted Average Cost of Capital:

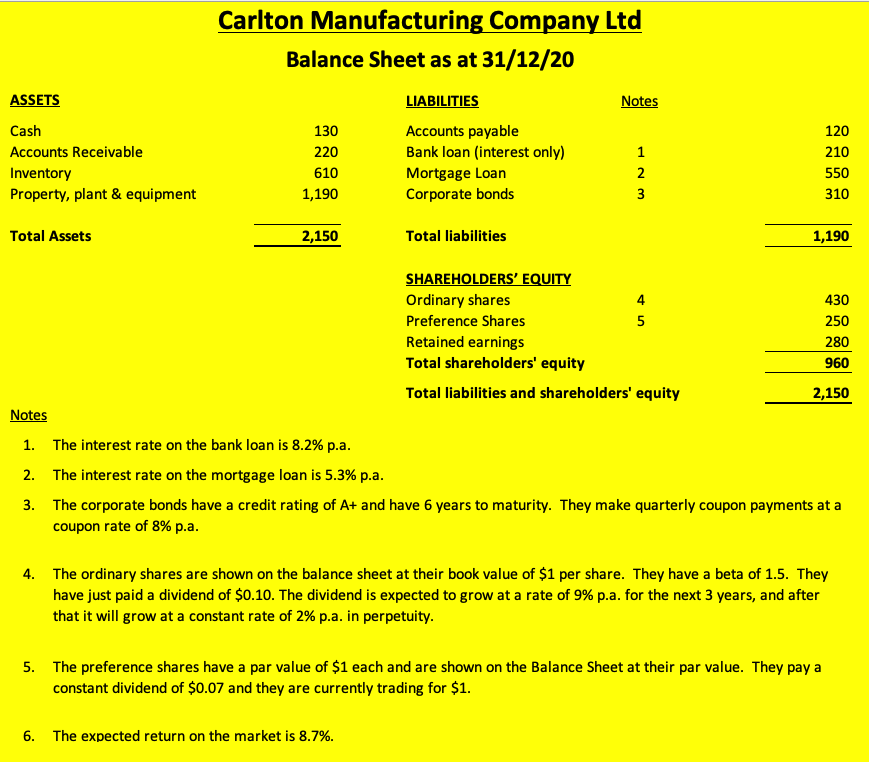

Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/20 ASSETS Notes Cash Accounts Receivable Inventory Property, plant & equipment 130 220 610 1,190 LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds 1 2 3 120 210 550 310 Total Assets 2,150 Total liabilities 1,190 4 0 SHAREHOLDERS' EQUITY Ordinary shares 4 430 Preference Shares 5 250 Retained earnings 280 Total shareholders' equity 960 Total liabilities and shareholders' equity 2,150 Notes 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.3% p.a. 3. The corporate bonds have a credit rating of A+ and have 6 years to maturity. They make quarterly coupon payments at a coupon rate of 8% p.a. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.5. They have just paid a dividend of $0.10. The dividend is expected to grow at a rate of 9% p.a. for the next 3 years, and after that it will grow at a constant rate of 2% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.07 and they are currently trading for $1. 6. The expected return on the market is 8.7%. Enter numbers in the "Cost" columnas percentages rounded to 3 decimal places Enter whole numbers only in the "Value"column and base your weights on those whole numbers Enter numbers in the "Weight column as percentages rounded to 2 decimal places. VALUE decimal (Whole SOURCE OF CAPITAL places) numbers) COS WEIGHT (2 dacima places) 3.200% $210 Bank Loan interest only Bore-tax cost of bank loan Markoit value of bank loan Mortgage Loans Before-tax cost of more on Market value of more on 5.300% $550 basis points Corporate Bonds Creditspraad Credit spread as a percentage 2 decimal place) Risk-free rare to be used to calculate cost of corporate bonds (a decimal places) Before-tax cost of corporate bonds 317 3.17% 0.980% 4.150% $372 Face value of all bonds $310 Couponnal 8% Number of years to maturity 5 Number of coupon payment per year 4 Total number of coupon payments remaining 24 Total value of all coupon payments paid per ye $24.80 Value of each individual coupon payment $6.20 Quarterly vidd decimal places) 1.03.3% Value of corporate bonds Ordinary Shares Risk free to be used to calculate cost of ordinary 1.790% shaw (decimal places) 15 Epactadum on the mark 8.7% Cost of ordinay shares You may not need eway line in the following table of dividends. Only and the diwidenda nanded to calculate the share price. Ender the actual diwidends - not their present value - rounded to 4 decimal places. Time value of money calculations should be done in the final step when you calculate the share awice Dividend i you from now $0.1090 Dividend 2 years from now $0.1136 Dividend 3 years from now $0.1295 Dividend 4 years from now $0.1321 Dividend 5 years from now $0.1347 Dividend 6 years from new 12.15% 12.155 Price of ordinary shares (Round to 2 decimal places) Number of ordinary shares Total market value of ordinay shaxs Preference Shares Price dividend per share Preference share price Cost of preference shares $0.07 $1.00 17.01 7.000% 250 Number of peace shares Total market value of preference shares $250 $1,382 0% 30.06 30.0 All of the wished costs below should be becosis where reliable as parents founded to 2 decimal places Weighted cost of the Bank Loan (e cost weight Waighted Cost of the Mortgage Loan Weighted Cost of the Corporate Bonds Weighted cost of the Ordinay Shares Weighted Cost of the Praca Shares Weighted Average cost of capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started