Answered step by step

Verified Expert Solution

Question

1 Approved Answer

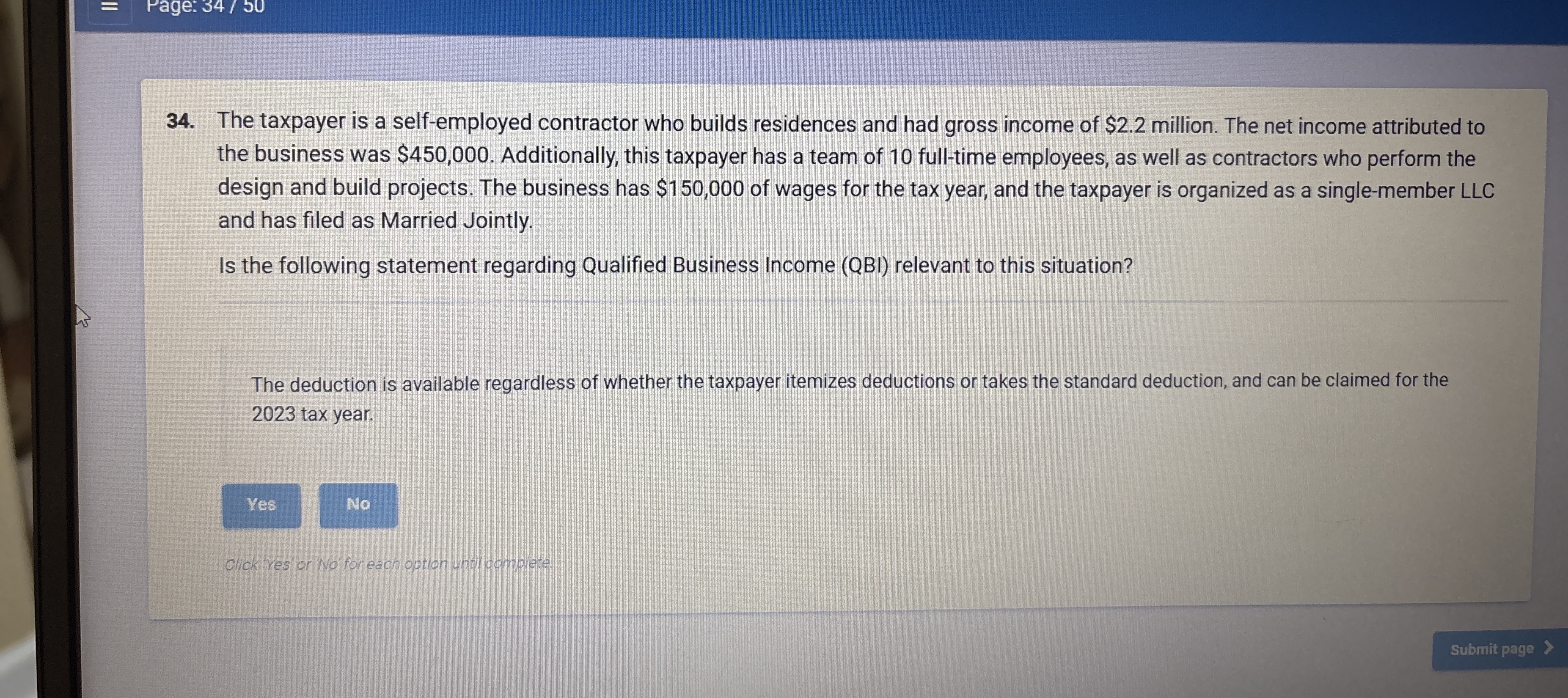

The taxpayer is a self - employed contractor who builds residences and had gross income of $ 2 . 2 million. The net income attributed

The taxpayer is a selfemployed contractor who builds residences and had gross income of $ million. The net income attributed to

the business was $ Additionally, this taxpayer has a team of fulltime employees, as well as contractors who perform the

design and build projects. The business has $ of wages for the tax year, and the taxpayer is organized as a singlemember LLC

and has filed as Married Jointly.

Is the following statement regarding Qualified Business Income relevant to this situation?

The deduction is available regardless of whether the taxpayer itemizes deductions or takes the standard deduction, and can be claimed for the

tax year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started