Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The taxpayer was married and under the system of absolute community of property. He died on January 2, 2020. He left the following properties

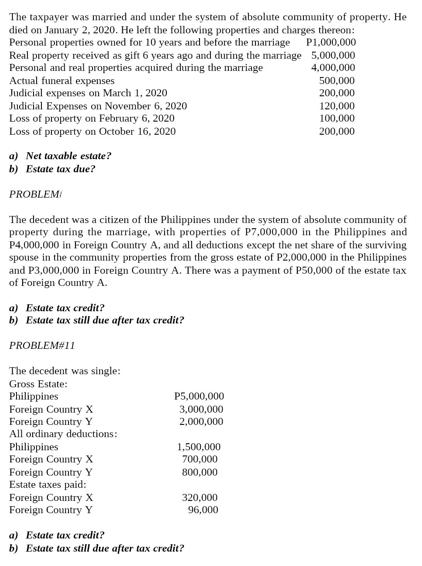

The taxpayer was married and under the system of absolute community of property. He died on January 2, 2020. He left the following properties and charges thereon: Personal properties owned for 10 years and before the marriage Real property received as gift 6 years ago and during the marriage Personal and real properties acquired during the marriage Actual funeral expenses Judicial expenses on March 1, 2020 Judicial Expenses on November 6, 2020 Loss of property on February 6, 2020 Loss of property on October 16, 2020 a) Net taxable estate? b) Estate tax due? PROBLEM a) Estate tax credit? b) Estate tax still due after tax credit? PROBLEM#11 The decedent was a citizen of the Philippines under the system of absolute community of property during the marriage, with properties of P7,000,000 in the Philippines and P4,000,000 in Foreign Country A, and all deductions except the net share of the surviving spouse in the community properties from the gross estate of P2,000,000 in the Philippines and P3,000,000 in Foreign Country A. There was a payment of P50,000 of the estate tax of Foreign Country A. The decedent was single: Gross Estate: Philippines Foreign Country X Foreign Country Y All ordinary deductions: Philippines Foreign Country X Foreign Country Y Estate taxes paid: Foreign Country X Foreign Country Y P5,000,000 3,000,000 2,000,000 1,500,000 700,000 800,000 320,000 96,000 P1,000,000 5,000,000 4,000,000 500,000 200,000 a) Estate tax credit? b) Estate tax still due after tax credit? 120,000 100,000 200,000

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1jay Net taxable estate Personal properties before marriage Real property received as gift personal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started