Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The text book example question and answer, below, is yielding a -33.05 result, however, when I build the equations into Excel, below, Excel yields a

The text book example question and answer, below, is yielding a -33.05 result, however, when I build the equations into Excel, below, Excel yields a result of -33.01. How can I get the equations in Excel to yield the same result as in the text book?

Excel Worksheet showing formatting:

Excel Worksheet showing formatting:

| Going back to Problem 1, what are the NPV and ENPV if the firm cost of capital is | 0.1 | but the average | |||||||

| reinvestment rate is | 0.13 | ||||||||

| Years | 5 | Year | Project | project Cost of Capital | =G24 | ||||

| What is the NPV? | =NPV(J26,G28:G33)+G27 | =(1+B25)/(1+J26) | 0 | -400 | =(G27*($D$27^J27))/((1+$G$24)^F27) | =ROUND(H27,2) | =$E$26-F27 | ||

| 1 | 105.52 | =(G28*($D$27^J28))/((1+$G$24)^F28) | =ROUND(H28,2) | =$E$26-F28 | |||||

| Should the project be accepted? | NPV | =IF(B27 | 2 | 105.52 | =(G29*($D$27^J29))/((1+$G$24)^F29) | =ROUND(H29,2) | =$E$26-F29 | ||

| 3 | 105.52 | =(G30*($D$27^J30))/((1+$G$24)^F30) | =ROUND(H30,2) | =$E$26-F30 | |||||

| Should the project be accepted? | ENPV | =IF(I34 | 4 | 105.52 | =(G31*($D$27^J31))/((1+$G$24)^F31) | =ROUND(H31,2) | =$E$26-F31 | ||

| 5 | 105.52 | =(G32*($D$27^J32))/((1+$G$24)^F32) | =ROUND(H32,2) | =$E$26-F32 | |||||

| Should Project be Accepted? | =IF(C31="No","No","Yes") | 6 | |||||||

| ENPV | =SUM(I27:I33) |

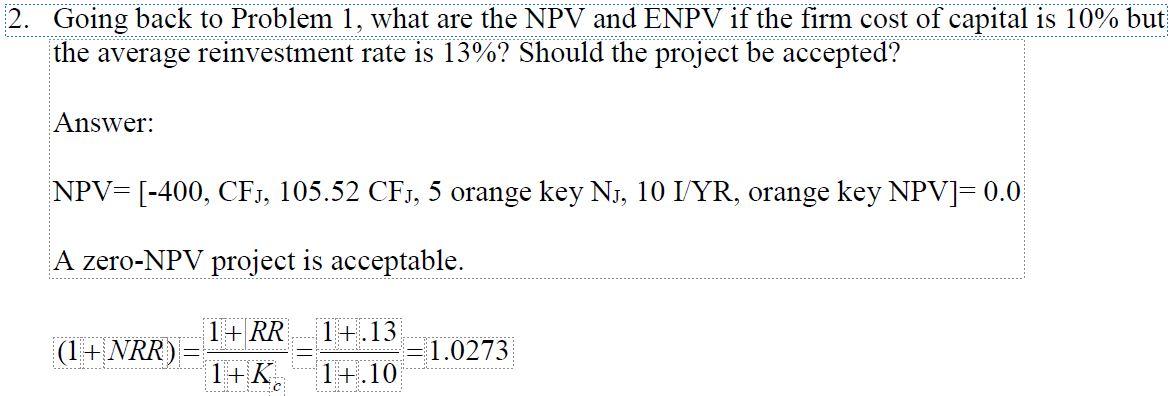

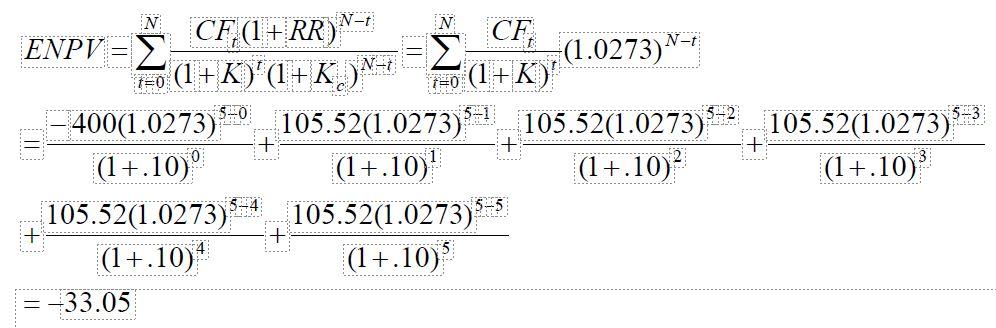

2. Going back to Problem 1, what are the NPV and ENPV if the firm cost of capital is 10% but the average reinvestment rate is 13%? Should the project be accepted? Answer: NPV= (-400, CFJ, 105.52 CFJ, 5 orange key NJ, 10 IYR, orange key NPV]= 0.0 A zero-NPV project is acceptable. (1 + NRR) 1+ RR 1+ K 1+.13 IT = 1.0273 1+.10 ................. IC N-t N -t ------- TEO (1+K) SHO 5=1 5-2 5-3 12:12 . + N CF, (1+RR) ENPV CE (1.0273)^ (1+K) 1+.)- 400(1.0273) 105.52(1.0273) 105.52(1.0273) (1+.10) (1+.10) (1+.10) 105.52(1.0273) 5-5 105.52(1.0273) (1+.10) (1+.10) 33.05 105.52(1.0273) (1+.10) .... 0 54 :: + + 2. Going back to Problem 1, what are the NPV and ENPV if the firm cost of capital is 10% but the average reinvestment rate is 13%? Should the project be accepted? Answer: NPV= (-400, CFJ, 105.52 CFJ, 5 orange key NJ, 10 IYR, orange key NPV]= 0.0 A zero-NPV project is acceptable. (1 + NRR) 1+ RR 1+ K 1+.13 IT = 1.0273 1+.10 ................. IC N-t N -t ------- TEO (1+K) SHO 5=1 5-2 5-3 12:12 . + N CF, (1+RR) ENPV CE (1.0273)^ (1+K) 1+.)- 400(1.0273) 105.52(1.0273) 105.52(1.0273) (1+.10) (1+.10) (1+.10) 105.52(1.0273) 5-5 105.52(1.0273) (1+.10) (1+.10) 33.05 105.52(1.0273) (1+.10) .... 0 54 :: + +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started