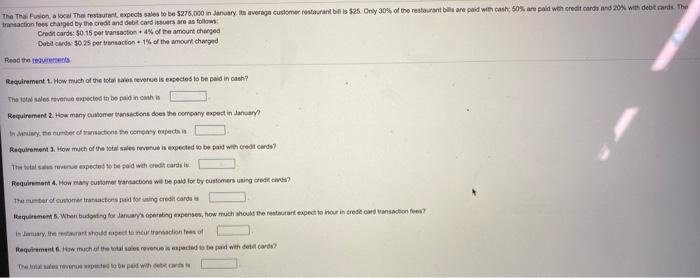

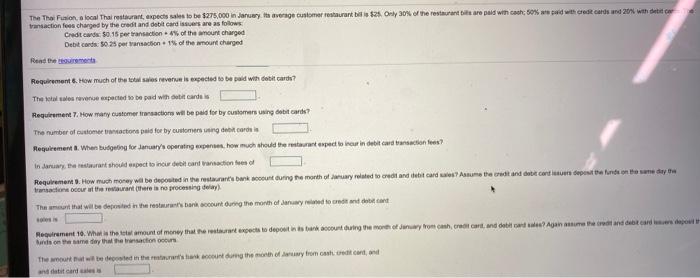

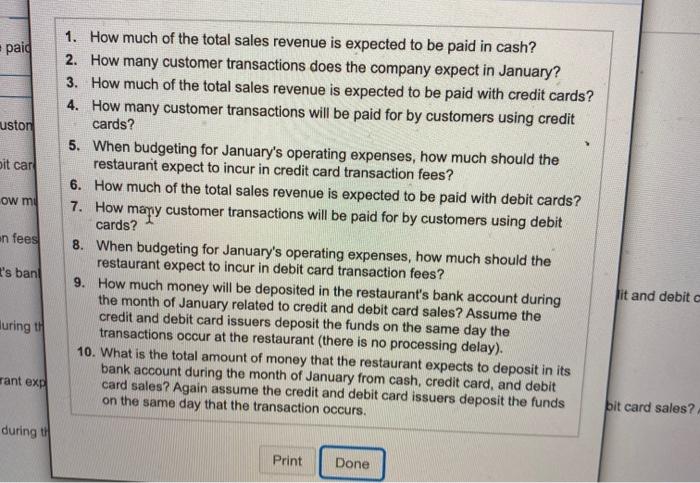

The Thai Fusion, a local Threstaurant, expects sales to be $275,000 in January. Ita verage customer restaurant bills $25. Only 30% of the restaurant bills are paid with cash 60% are paid with credit cards and 20% with debt rare. The transaction fees charged by the credit and debit card issors are as follows: Credit cards $0.15 por transaction +4% of the amount charged Debit card 0.25 peransaction 1% of the amount charged Read the Requirement 1. How much of the totales revenue is expected to be paid in cath? The sales revenue expected to be paid in the Requirement 2. How many customer transactions does the company expect in January In wynbee of action the company expect Requirement. How much of the total revenue as expected to be paid with credit cards The total se expected to head with credit cards is Requirement. How many customer traction will be paid for by customers using credit carda? Theater for transactionsneding credit cards Requirements. When budget for January's operating expenses. how much should restaurant expect to our inary, the should tapeta neutractions of Requirement. How much of the trovate de ped with des? The event with The Thaion, a local That restaurant, expect is to be $275,000 in Januaryta average customer restaurant is $. Only 30% of the restaurant tittare als winca 60% ad redit cards and 20% with the transaction fees charged by the credit and debit card issues are as follows Creditcard $0.15 per transaction of the amount charged Debit cards: 50.25 per transaction of the mount charged Read themes Requirement. How much of the lies revenue is expected to be paid with debit card? The le revence expected to be paid with cotit card is Requirement. How many customer reaction will be paid for by customers using debit cards? The number of customer actors paid for by customers in de cordis Requirement. When budgeting for January's operating how much should the restaurant expect to train debit card trans? In January, the restaurant should expect to our debit can action for Requirements. How much money will be deposited in the restaurant's bank account during the month of way posted to credit and debit card ? Astuma the credit and do concept fundon to ne day transaction or the restauranter is no processing delay) The meant that will be posted in the restaurants aroundong the month of Januarytied to credite Movirament 16. What the mount of money that start expect to deposit its bark scouting more of day from cath, credit cart, and debit card An er det end and on the same day that the action or The weated in the count on the holy from stand and and sales paid uston bit car ow mil 1. How much of the total sales revenue is expected to be paid in cash? 2. How many customer transactions does the company expect in January? 3. How much of the total sales revenue is expected to be paid with credit cards? 4. How many customer transactions will be paid for by customers using credit cards? 5. When budgeting for January's operating expenses, how much should the restaurant expect to incur in credit card transaction fees? 6. How much of the total sales revenue is expected to be paid with debit cards? 7. How customer transactions will be paid for by customers using debit cards? 8. When budgeting for January's operating expenses, how much should the restaurant expect to incur in debit card transaction fees? 9. How much money will be deposited in the restaurant's bank account during the month of January related to credit and debit card sales? Assume the credit and debit card issuers deposit the funds on the same day the transactions occur at the restaurant (there is no processing delay). 10. What is the total amount of money that the restaurant expects to deposit in its bank account during the month of January from cash, credit card, and debit card sales? Again assume the credit and debit card issuers deposit the funds on the same day that the transaction occurs. mary en fees s ban it and debit during rant exp bit card sales? during til Print Done