Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The three partners of Hawkdale Contractors agree to liquidate their partnership on August 8th, 2021. At that point, the accounting records show the following

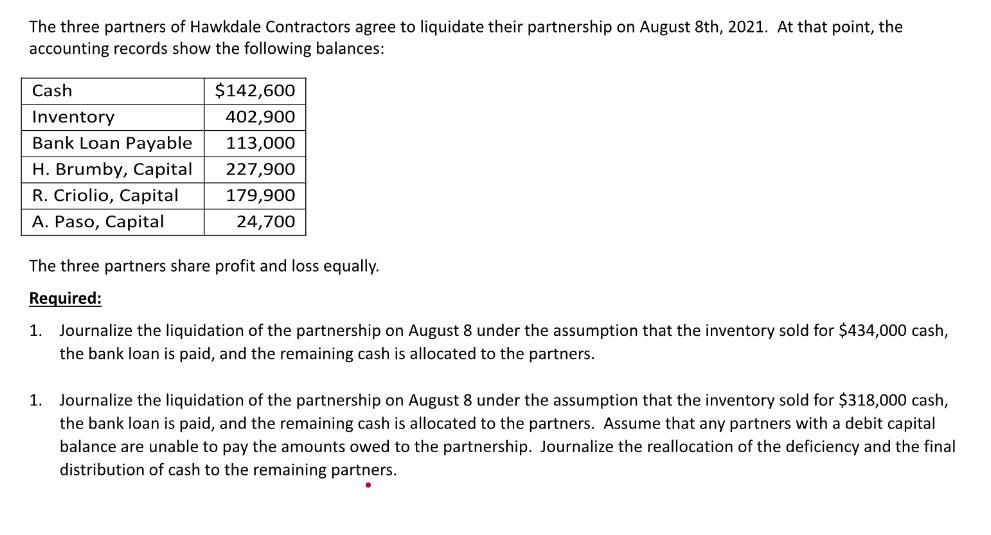

The three partners of Hawkdale Contractors agree to liquidate their partnership on August 8th, 2021. At that point, the accounting records show the following balances: Cash $142,600 Inventory 402,900 Bank Loan Payable 113,000 H. Brumby, Capital 227,900 R. Criolio, Capital 179,900 A. Paso, Capital 24,700 The three partners share profit and loss equally. Required: 1. 1. Journalize the liquidation of the partnership on August 8 under the assumption that the inventory sold for $434,000 cash, the bank loan is paid, and the remaining cash is allocated to the partners. Journalize the liquidation of the partnership on August 8 under the assumption that the inventory sold for $318,000 cash, the bank loan is paid, and the remaining cash is allocated to the partners. Assume that any partners with a debit capital balance are unable to pay the amounts owed to the partnership. Journalize the reallocation of the deficiency and the final distribution of cash to the remaining partners.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Lets journalize the liquidation of the partnership in both scenarios Scenario 1 Inventory sold for 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started