Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Toole Trust, a simple trust, has the receipts and expenditures listed below for the current year. Assume the Uniform Act governs an item's

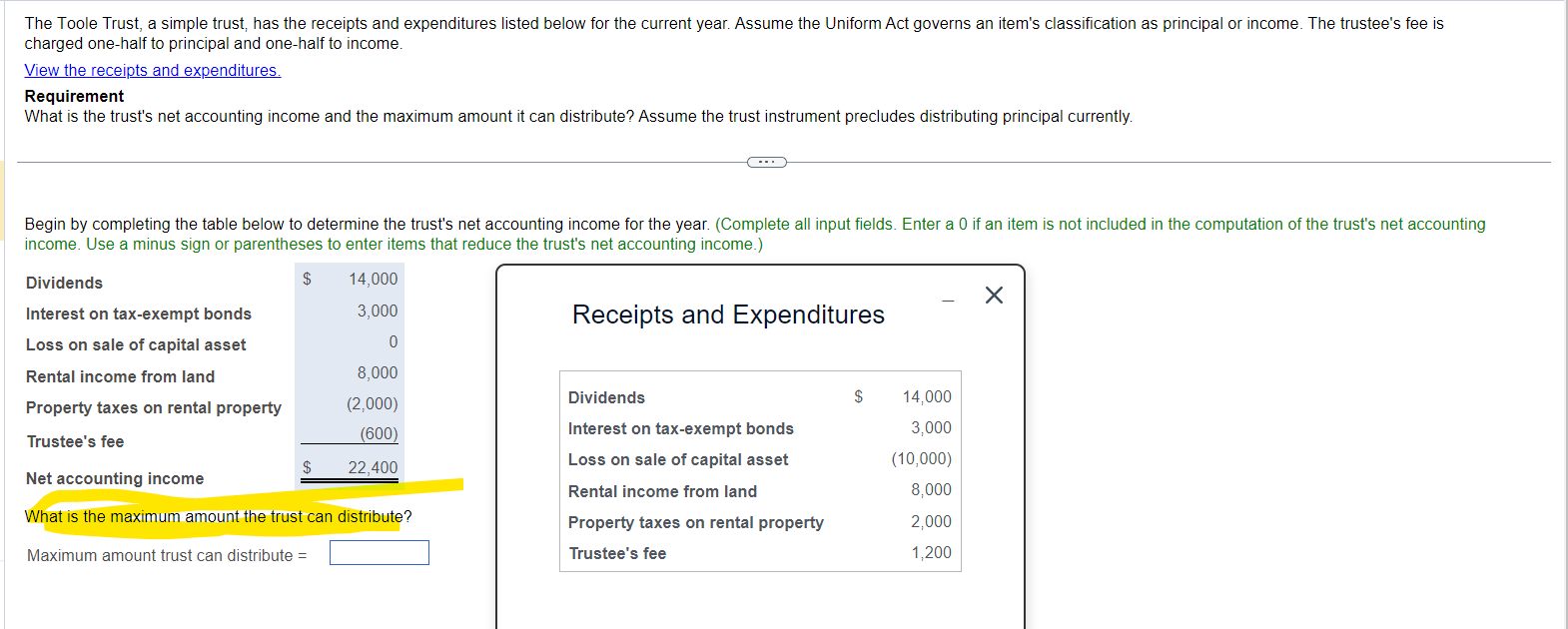

The Toole Trust, a simple trust, has the receipts and expenditures listed below for the current year. Assume the Uniform Act governs an item's classification as principal or income. The trustee's fee is charged one-half to principal and one-half to income. View the receipts and expenditures. Requirement What is the trust's net accounting income and the maximum amount it can distribute? Assume the trust instrument precludes distributing principal currently. Begin by completing the table below to determine the trust's net accounting income for the year. (Complete all input fields. Enter a 0 if an item is not included in the computation of the trust's net accounting income. Use a minus sign or parentheses to enter items that reduce the trust's net accounting income.) Dividends $ 14,000 Interest on tax-exempt bonds 3,000 Receipts and Expenditures Loss on sale of capital asset 0 Rental income from land 8,000 Property taxes on rental property (2,000) Trustee's fee (600) 22,400 Dividends Interest on tax-exempt bonds Loss on sale of capital asset $ 14,000 3,000 (10,000) Net accounting income Rental income from land 8,000 What is the maximum amount the trust can distribute? Property taxes on rental property 2,000 Maximum amount trust can distribute = Trustee's fee 1,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started