Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the top part says a firm undertakes a five year project that requires an initial investment of $100,000. The project is thrn expected to provide

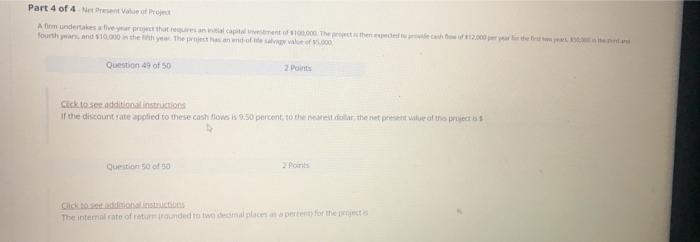

the top part says a firm undertakes a five year project that requires an initial investment of $100,000. The project is thrn expected to provide cash flow of 12,000 per year for the first two years, 50,000 in the third and fourth years and 10,000 in the fifth year. the project has an end of life salvage value of $5,000

Part 4 of 4 Netto A firm undertakes tvey protein 100. The then 12.000 fourths and 10.000 the year. There and ef.000 Question 49 of 50 2 points Click to see additional instructions if the discountate polied to these cash flows is 0.50 percent to the the networth proiect Question of 30 Pontes The internal rate of return iraunded to two complacement for the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started