Question

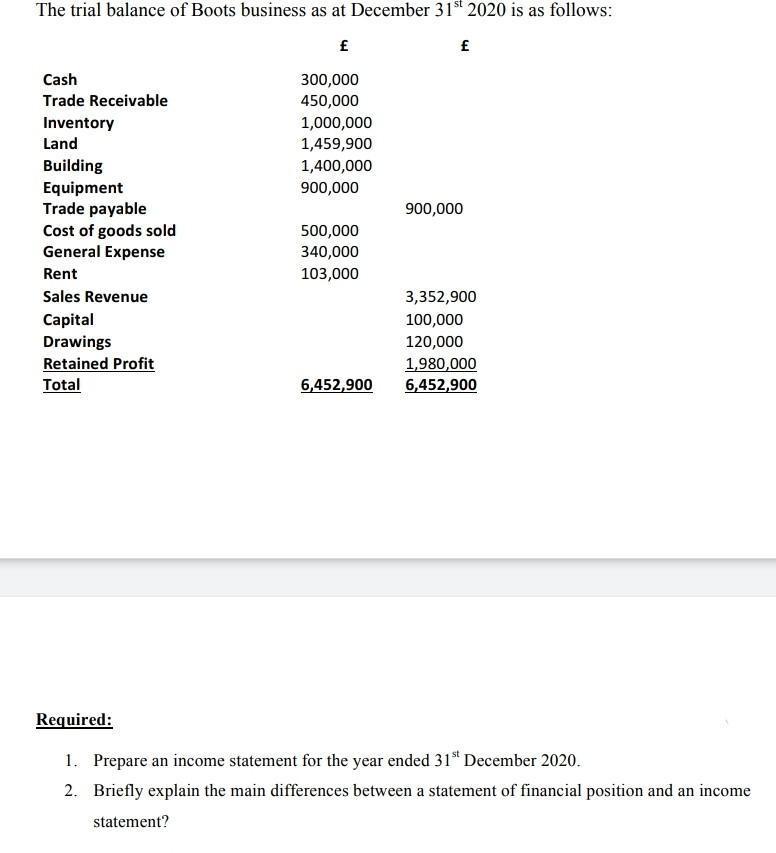

The trial balance of Boots business as at December 31st 2020 is as follows: Cash Trade Receivable 300,000 450,000 Inventory 1,000,000 Land 1,459,900 Building

The trial balance of Boots business as at December 31st 2020 is as follows: Cash Trade Receivable 300,000 450,000 Inventory 1,000,000 Land 1,459,900 Building 1,400,000 Equipment 900,000 Trade payable 900,000 Cost of goods sold 500,000 General Expense 340,000 Rent 103,000 Sales Revenue 3,352,900 Capital 100,000 Drawings 120,000 Retained Profit 1,980,000 Total 6,452,900 6,452,900 Required: 1. Prepare an income statement for the year ended 31st December 2020. 2. Briefly explain the main differences between a statement of financial position and an income statement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Income statement for the year ended 31st December 2020 Sales Revenue 3352900 Less Cost of goods so...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App