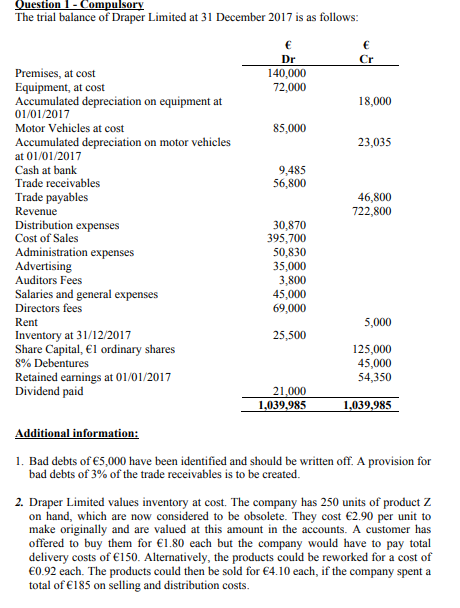

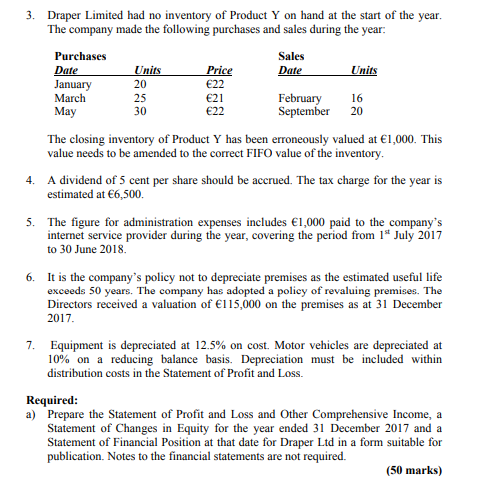

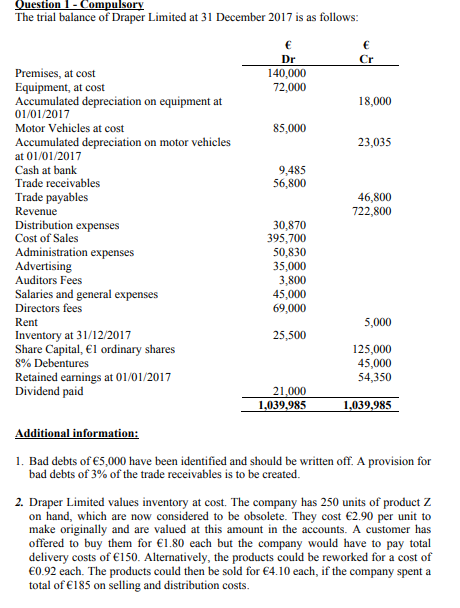

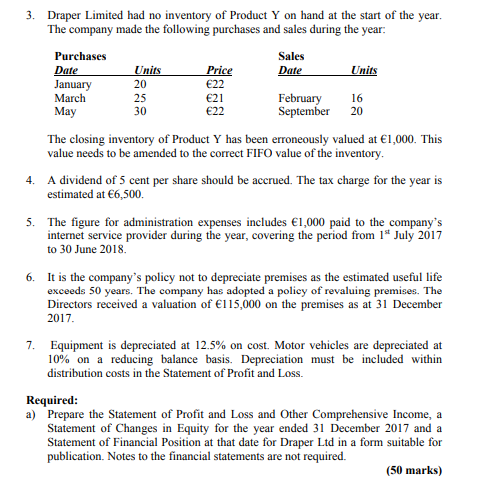

The trial balance of Draper Limited at 31 December 2017 is as follows Dr 140,000 72,000 Premises, at cost Equipment, at cost Accumulated depreciation on equipment at 01/01/2017 Motor Vehicles at cost 18,000 85,000 Accumulated depreciation on motor vehicles at 01/01/2017 Cash at bank Trade receivables Trade payables Revenue Distribution expenses Cost of Sales 23,035 9,485 56,800 46,800 722,800 30,870 395,700 50,830 35,000 3,800 45,000 69,000 Administration expenses Advertising Auditors Fees Salaries and general expenses Directors fees Rent Inventory at 31/12/2017 Share Capital, E ordinary shares 8% Debentures Retained earnings at O1/01/2017 Dividend paid 5,000 25,500 125,000 45,000 54,350 21,000 1,039,985 1,039,985 Additional information: 1. Bad debts of 5,000 have been identified and should be written off. A provision for bad debts of 3% of the trade receivables is to be created. 2. Draper Limited values inventory at cost. The company has 250 units of product Z on hand, which are now considered to be obsolete. They cost 2.90 per unit to make originally and are valued at this amount in the accounts. A customer has offered to buy them for 1.80 each but the company would have to pay total delivery costs of 150. Alternatively, the products could be reworked for a cost of 0.92 each. The products could then be sold for 4.10 each, if the company spent a total of 185 on selling and distribution costs 3. Draper Limited had no inventory of Product Y on hand at the start of the year The company made the following purchases and sales during the year: Purchases Sales 20 25 January February September 20 March 21 May The closing inventory of Product Y has been erroneously valued at 1,000. This value needs to be amended to the correct FIFO value of the inventory 4. A dividend of 5 cent per share should be accrued. The tax charge for the year is estimated at 6,500 5. The figure for administration expenses includes 1,000 paid to the company's internet service provider during the year, covering the period from 1t July 2017 to 30 June 2018 6. I is the company's policy not to depreciate premises as the estimated useful life exceeds 50 years. The company has adopted a policy of revaluing premises. The Directors received a valuation of 115,000 on the premises as at 31 December 2017 7. Equipment is depreciated at 12.5% on cost. Motor vehicles are depreciated at 10% on a reducing balance basis. Depreciation must be included within distribution costs in the Statement of Profit and Loss. Required a) Prepare the Statement of Profit and Loss and Other Comprehensive Income, a Statement of Changes in Equity for the year ended 31 December 2017 and a Statement of Financial Position at that date for Draper Ltd in a form suitable for publication. Notes to the financial statements are not required. (50 marks) The trial balance of Draper Limited at 31 December 2017 is as follows Dr 140,000 72,000 Premises, at cost Equipment, at cost Accumulated depreciation on equipment at 01/01/2017 Motor Vehicles at cost 18,000 85,000 Accumulated depreciation on motor vehicles at 01/01/2017 Cash at bank Trade receivables Trade payables Revenue Distribution expenses Cost of Sales 23,035 9,485 56,800 46,800 722,800 30,870 395,700 50,830 35,000 3,800 45,000 69,000 Administration expenses Advertising Auditors Fees Salaries and general expenses Directors fees Rent Inventory at 31/12/2017 Share Capital, E ordinary shares 8% Debentures Retained earnings at O1/01/2017 Dividend paid 5,000 25,500 125,000 45,000 54,350 21,000 1,039,985 1,039,985 Additional information: 1. Bad debts of 5,000 have been identified and should be written off. A provision for bad debts of 3% of the trade receivables is to be created. 2. Draper Limited values inventory at cost. The company has 250 units of product Z on hand, which are now considered to be obsolete. They cost 2.90 per unit to make originally and are valued at this amount in the accounts. A customer has offered to buy them for 1.80 each but the company would have to pay total delivery costs of 150. Alternatively, the products could be reworked for a cost of 0.92 each. The products could then be sold for 4.10 each, if the company spent a total of 185 on selling and distribution costs 3. Draper Limited had no inventory of Product Y on hand at the start of the year The company made the following purchases and sales during the year: Purchases Sales 20 25 January February September 20 March 21 May The closing inventory of Product Y has been erroneously valued at 1,000. This value needs to be amended to the correct FIFO value of the inventory 4. A dividend of 5 cent per share should be accrued. The tax charge for the year is estimated at 6,500 5. The figure for administration expenses includes 1,000 paid to the company's internet service provider during the year, covering the period from 1t July 2017 to 30 June 2018 6. I is the company's policy not to depreciate premises as the estimated useful life exceeds 50 years. The company has adopted a policy of revaluing premises. The Directors received a valuation of 115,000 on the premises as at 31 December 2017 7. Equipment is depreciated at 12.5% on cost. Motor vehicles are depreciated at 10% on a reducing balance basis. Depreciation must be included within distribution costs in the Statement of Profit and Loss. Required a) Prepare the Statement of Profit and Loss and Other Comprehensive Income, a Statement of Changes in Equity for the year ended 31 December 2017 and a Statement of Financial Position at that date for Draper Ltd in a form suitable for publication. Notes to the financial statements are not required. (50 marks)