Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The trial balance of Kenedy and William, trading as partners and sharing profits in the ratio 2:3 as at 31 December 2016 is as

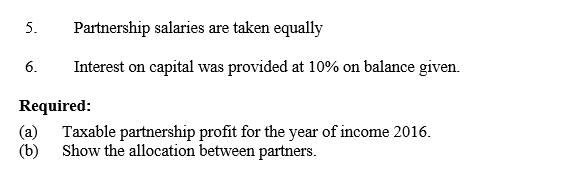

The trial balance of Kenedy and William, trading as partners and sharing profits in the ratio 2:3 as at 31 December 2016 is as follows: Capital: Kenedy William Factory building Furniture at cost Factory equipment at cost Director's car at cost Provision for depreciation Depreciation expense Debtors and prepayments Stocks as at 31st December 2016 Creditors and accruals Balance at bank Gross profit on trading Rent and rates Office salaries Partners salaries Advertising costs Transport costs Deposit on new equipment Short term investment Sh. 5,000,000 750,000 2,000,000 1,000,000 115,000 1,050,000 1,042,000 720,000 300,000 826,000 600,000 210,000 236,000 100,000 600,000 14.549,000 Sh. 3,600,000 5,221,000 710,000 853,000 4,165,000 14.549.000 The following additional information is provided: 1. 2. 3. 4. Rent and rates are for fifteen months to 31 March 2017. The partners had contracted to purchase new equipment for the factory at a cost of Sh.500,000. A debt of Sh.100,000 was paid during December 2016 and the remainder was paid during January 2017 when it was expected. The factory building has been revalued from Sh.4,000,000 The partnership started operating on 1st January 2016 5. Partnership salaries are taken equally 6. Interest on capital was provided at 10% on balance given. Required: (a) Taxable partnership profit for the year of income 2016. (b) Show the allocation between partners.

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started