Answered step by step

Verified Expert Solution

Question

1 Approved Answer

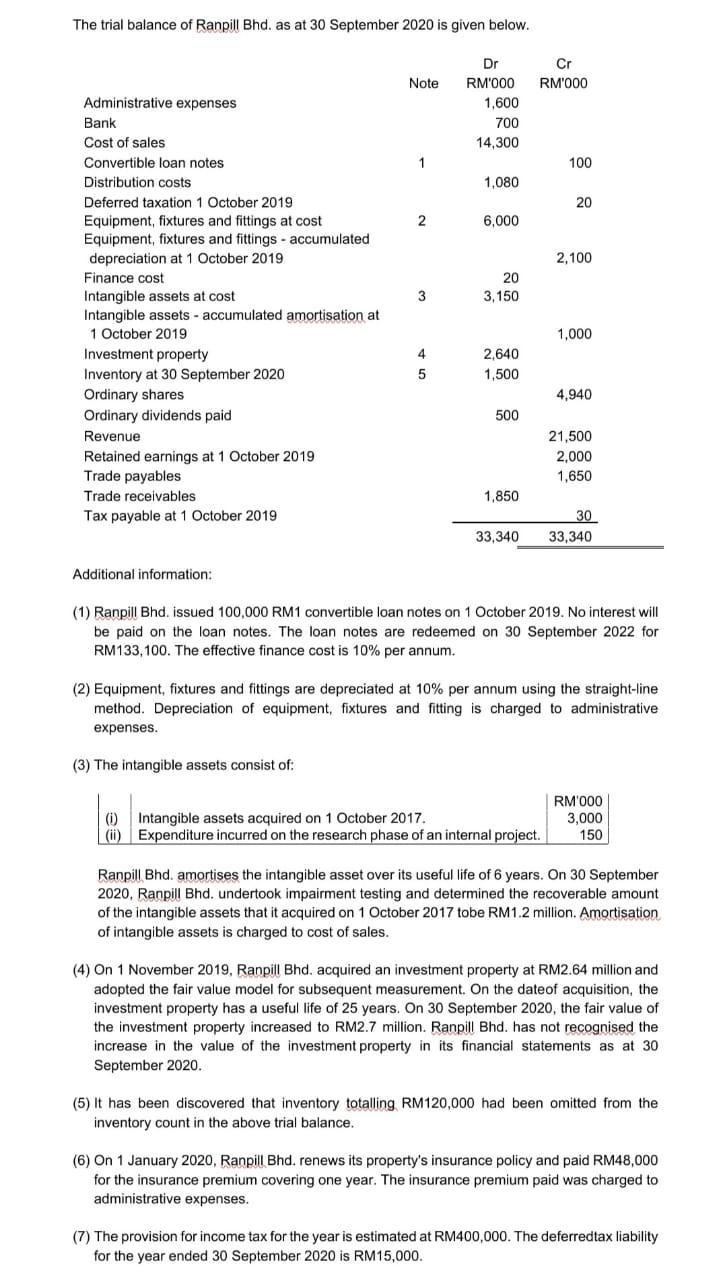

The trial balance of Ranpill Bhd. as at 30 September 2020 is given below. Dr Cr Note RM'000 RM'000 Administrative expenses 1,600 Bank 700

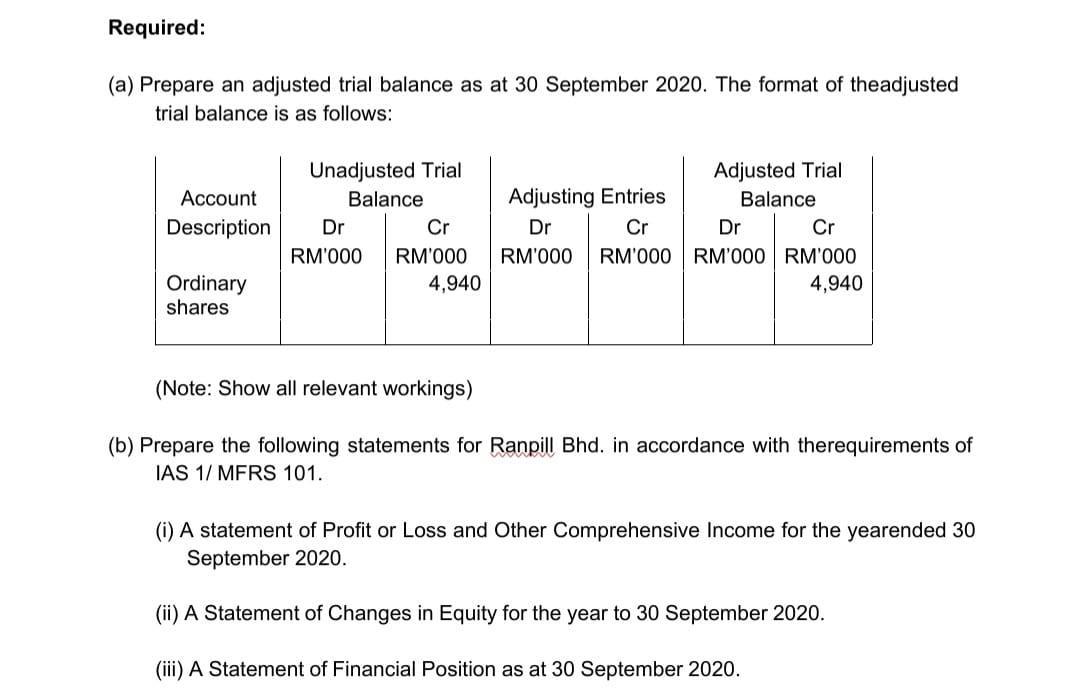

The trial balance of Ranpill Bhd. as at 30 September 2020 is given below. Dr Cr Note RM'000 RM'000 Administrative expenses 1,600 Bank 700 Cost of sales 14,300 Convertible loan notes 1 100 Distribution costs 1,080 Deferred taxation 1 October 2019 20 Equipment, fixtures and fittings at cost Equipment, fixtures and fittings - accumulated depreciation at 1 October 2019 Finance cost 6,000 2,100 20 Intangible assets at cost Intangible assets - accumulated amortisation at 1 October 2019 Investment property Inventory at 30 September 2020 Ordinary shares 3 3,150 1,000 4. 2,640 5 1,500 4,940 Ordinary dividends paid 500 Revenue 21,500 Retained earnings at 1 October 2019 Trade payables 2,000 1,650 Trade receivables 1,850 Tax payable at 1 October 2019 30 33,340 33,340 Additional information: (1) Ranpill Bhd, issued 100,000 RM1 convertible loan notes on 1 October 2019. No interest will be paid on the loan notes. The loan notes are redeemed on 30 September 2022 for RM133,100. The effective finance cost is 10% per annum. (2) Equipment, fixtures and fittings are depreciated at 10% per annum using the straight-line method. Depreciation of equipment, fixtures and fitting is charged to administrative expenses. (3) The intangible assets consist of: RM'000 (i) Intangible assets acquired on 1 October 2017. | (ii) | Expenditure incurred on the research phase of an internal project. 3,000 150 e of 6 years. 30 September Ranpill Bhd. amortises 2020, Ranpill Bhd. undertook impairment testing and determined the recoverable amount of the intangible assets that it acquired on 1 October 2017 tobe RM1.2 million. Amortisation intangible asset over its useful of intangible assets is charged to cost of sales. (4) On 1 November 2019, Ranpill Bhd. acquired an investment property at RM2.64 million and adopted the fair value model for subsequent measurement. On the dateof acquisition, the investment property has a useful life of 25 years. On 30 September 2020, the fair value of the investment property increased to RM2.7 million. Ranpill Bhd. has not recognised the increase in the value of the investment property in its financial statements as at 30 September 2020. (5) It has been discovered that inventory totalling RM120,000 had been omitted from the inventory count in the above trial balance. (6) On 1 January 2020, Ranpill Bhd. renews its property's insurance policy and paid RM48,000 for the insurance premium covering one year. The insurance premium paid was charged to administrative expenses. (7) The provision for income tax for the year is estimated at RM400,000. The deferredtax liability for the year ended 30 September 2020 is RM15,000. Required: (a) Prepare an adjusted trial balance as at 30 September 2020. The format of theadjusted trial balance is as follows: Unadjusted Trial Adjusted Trial Account Balance Adjusting Entries Balance Description Dr Cr Dr Cr Dr Cr RM'000 RM'000 RM'000 RM'000 RM'000 RM'000 Ordinary shares 4,940 4,940 (Note: Show all relevant workings) (b) Prepare the following statements for Ranpill Bhd. in accordance with therequirements of IAS 1/ MFRS 101. (i) A statement of Profit or Loss and Other Comprehensive Income for the yearended 30 September 2020. (ii) A Statement of Changes in Equity for the year to 30 September 2020. (iii) A Statement of Financial Position as at 30 September 2020.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Ranpil Bhd September 30 2020 Unadjusted Trail Balance Adjustments Adjusted Trail Balance Accounts De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started