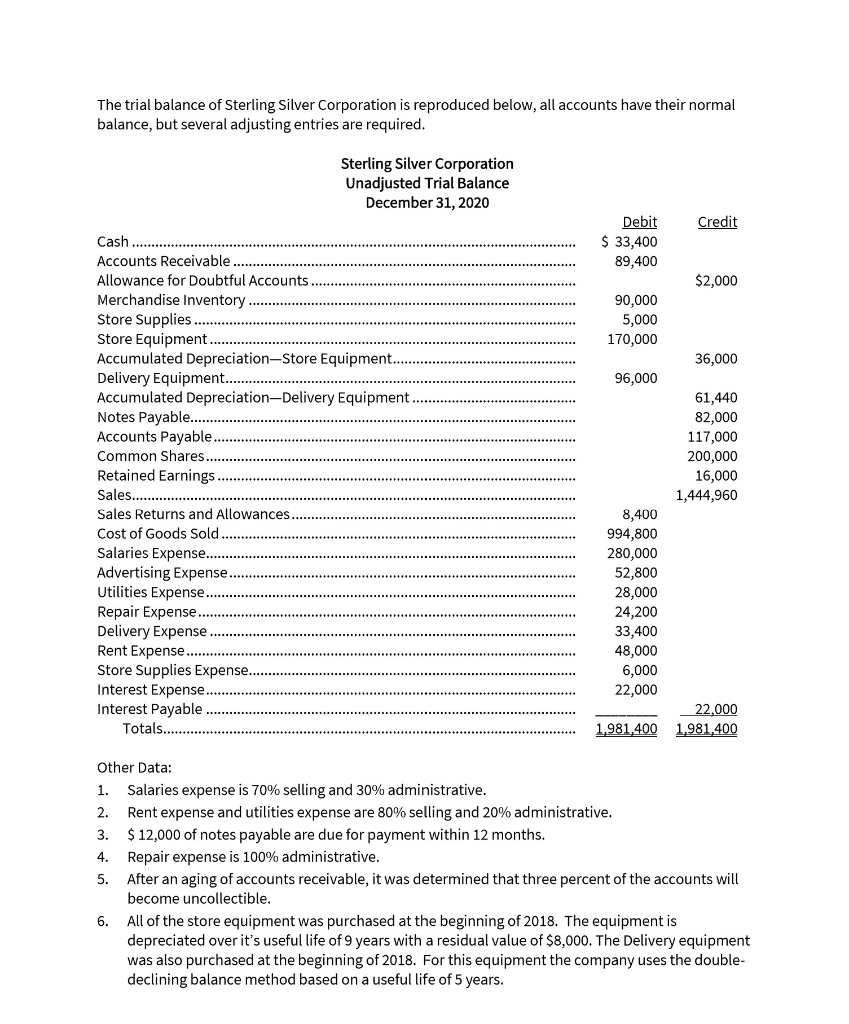

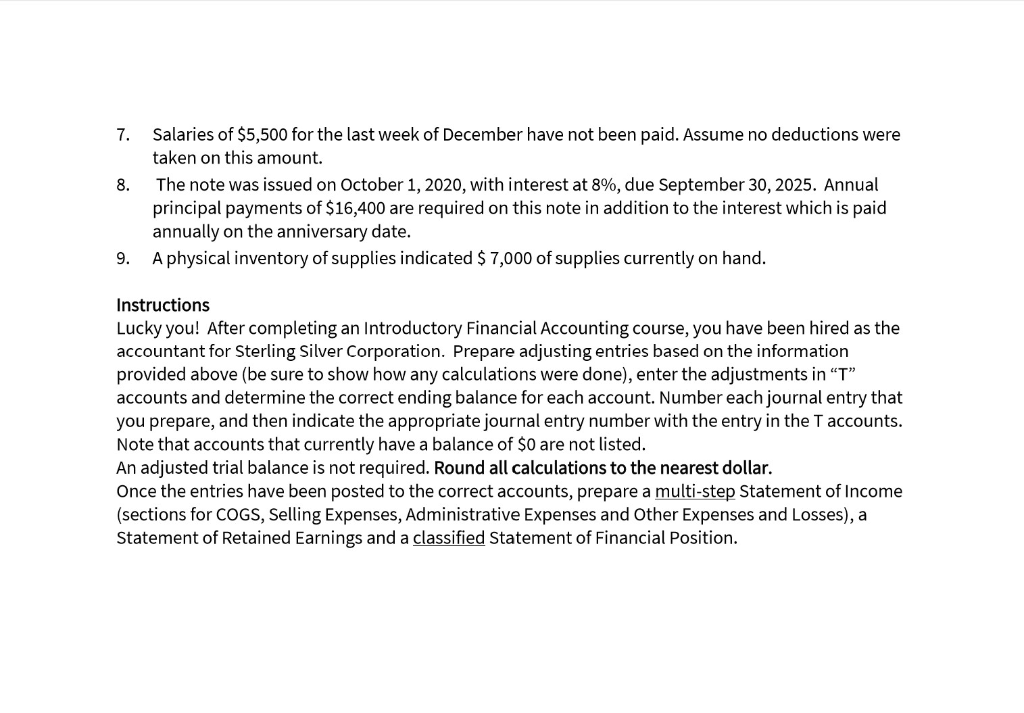

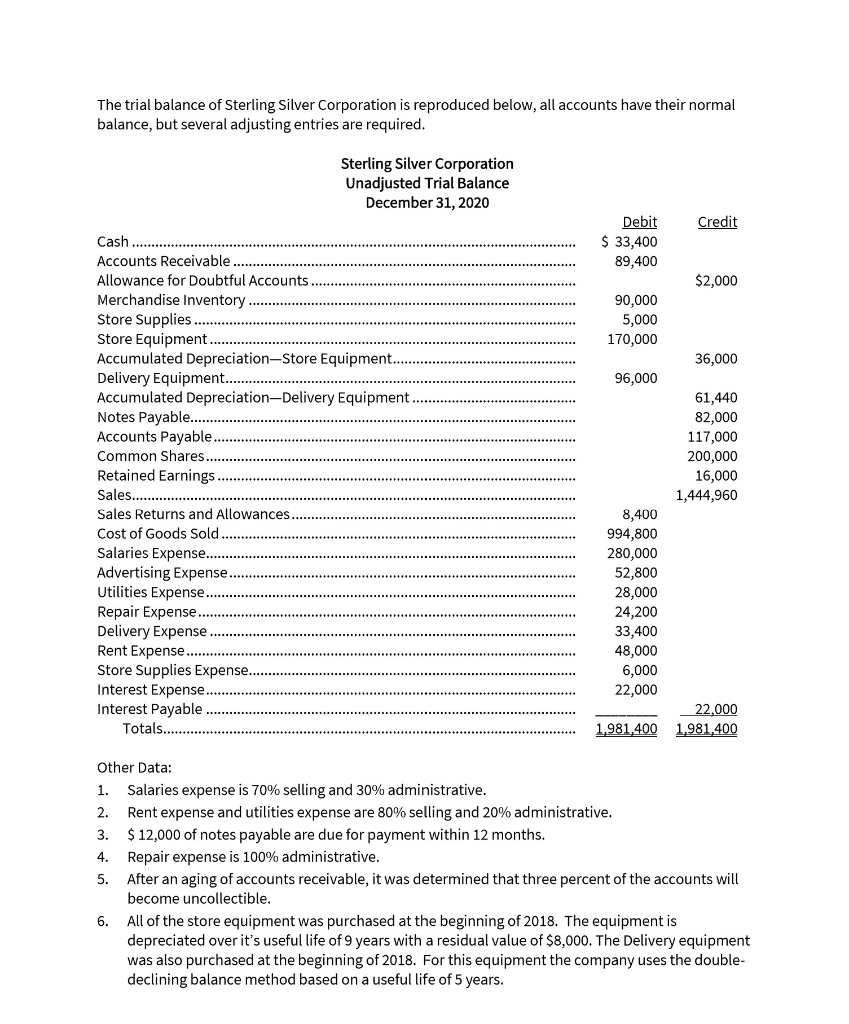

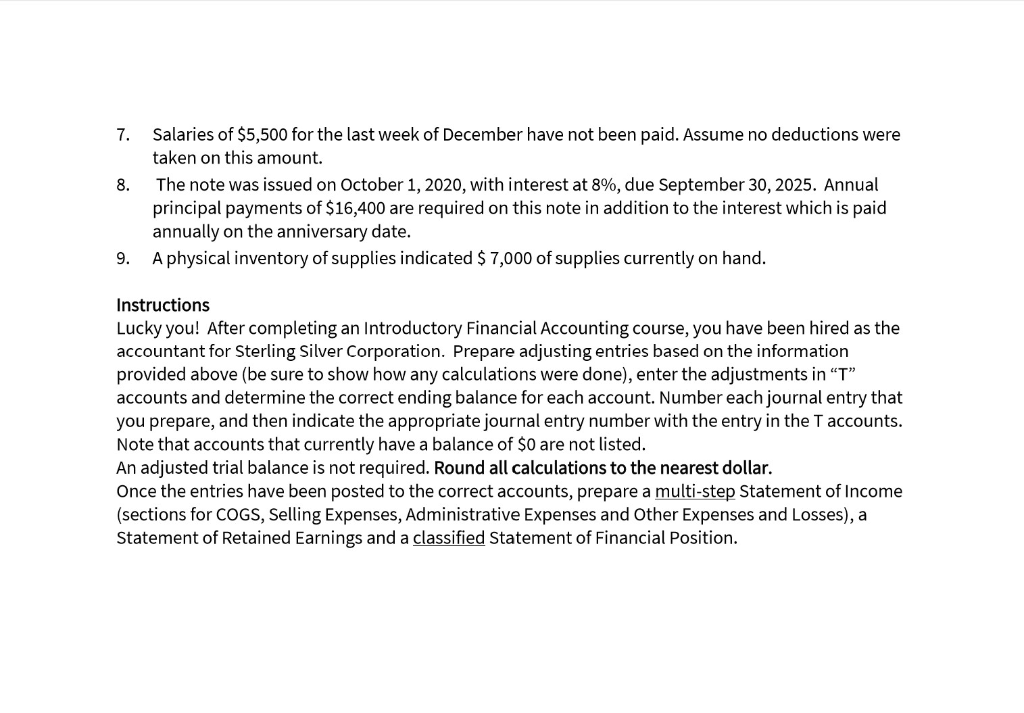

The trial balance of Sterling Silver Corporation is reproduced below, all accounts have their normal balance, but several adjusting entries are required. Sterling Silver Corporation Unadjusted Trial Balance December 31, 2020 Credit Debit $ 33,400 89,400 $2,000 ..... 90,000 5,000 170,000 36,000 96,000 Cash .... Accounts Receivable Allowance for Doubtful Accounts ...... Merchandise Inventory Store Supplies ................... Store Equipment ................ Accumulated Depreciation-Store Equipment... Delivery Equipment....... Accumulated Depreciation-Delivery Equipment ..... Notes Payable... Accounts Payable Common Shares........ Retained Earnings ....... Sales.............. Sales Returns and Allowances... Cost of Goods Sold. Salaries Expense...... Advertising Expense.. Utilities Expense...... Repair Expense... Delivery Expense............. Rent Expense.... Store Supplies Expense...... Interest Expense.... Interest Payable .............. Totals... 61,440 82,000 117,000 200,000 16,000 1,444,960 ......................... 8,400 994,800 280,000 52,800 28,000 24,200 33,400 48,000 6,000 22,000 ............... ........................... 22,000 1,981,400 1,981,400 Other Data: 1. Salaries expense is 70% selling and 30% administrative. 2. Rent expense and utilities expense are 80% selling and 20% administrative. 3. $ 12,000 of notes payable are due for payment within 12 months. 4. Repair expense is 100% administrative. 5. After an aging of accounts receivable, it was determined that three percent of the accounts will become uncollectible. 6. All of the store equipment was purchased at the beginning of 2018. The equipment is depreciated over it's useful life of 9 years with a residual value of $8,000. The Delivery equipment was also purchased at the beginning of 2018. For this equipment the company uses the double- declining balance method based on a useful life of 5 years. 7. Salaries of $5,500 for the last week of December have not been paid. Assume no deductions were taken on this amount. The note was issued on October 1, 2020, with interest at 8%, due September 30, 2025. Annual principal payments of $16,400 are required on this note in addition to the interest which is paid annually on the anniversary date. 9. A physical inventory of supplies indicated $ 7,000 of supplies currently on hand. Instructions Lucky you! After completing an Introductory Financial Accounting course, you have been hired as the accountant for Sterling Silver Corporation. Prepare adjusting entries based on the information provided above (be sure to show how any calculations were done), enter the adjustments in T accounts and determine the correct ending balance for each account. Number each journal entry that you prepare, and then indicate the appropriate journal entry number with the entry in the T accounts. Note that accounts that currently have a balance of $0 are not listed. An adjusted trial balance is not required. Round all calculations to the nearest dollar. Once the entries have been posted to the correct accounts, prepare a multi-step Statement of Income (sections for COGS, Selling Expenses, Administrative Expenses and Other Expenses and Losses), a Statement of Retained Earnings and a classified Statement of Financial Position