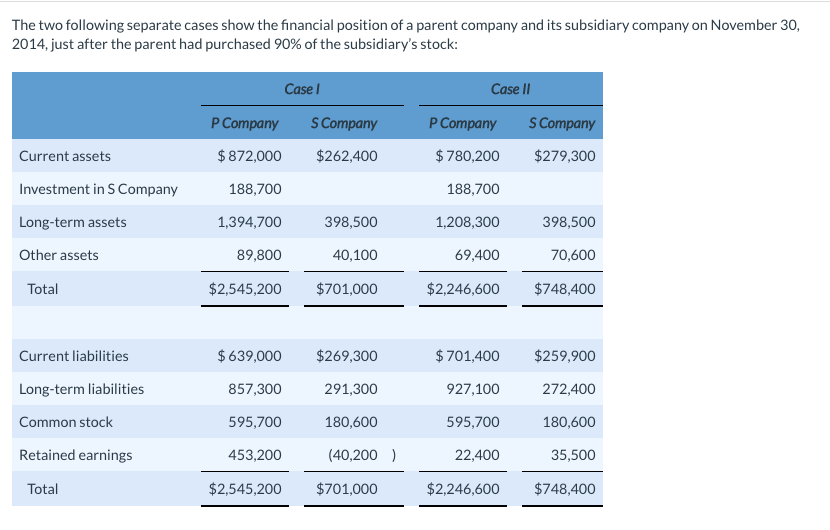

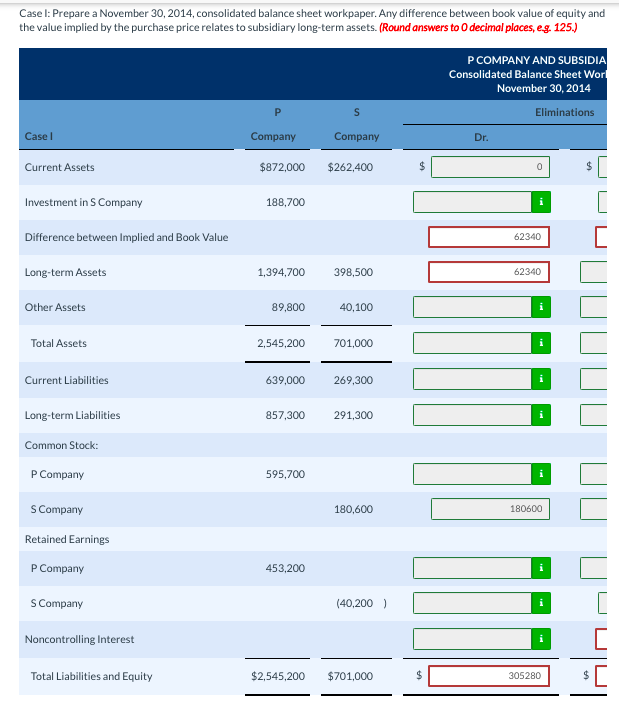

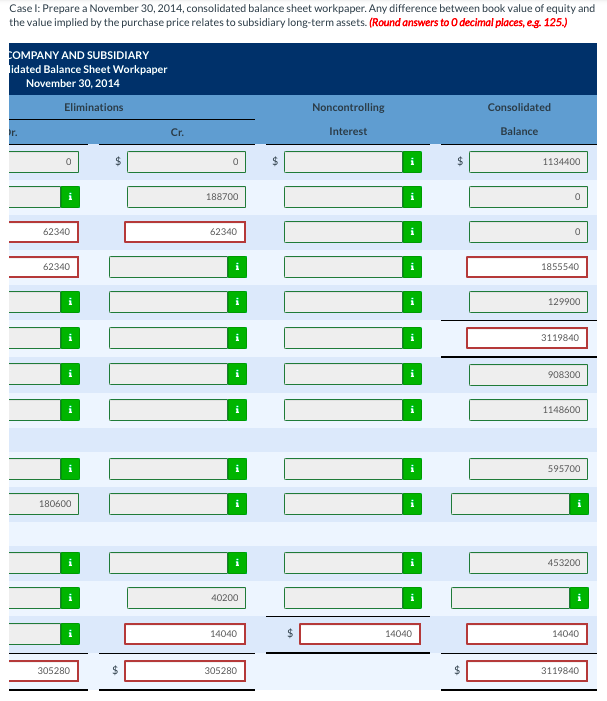

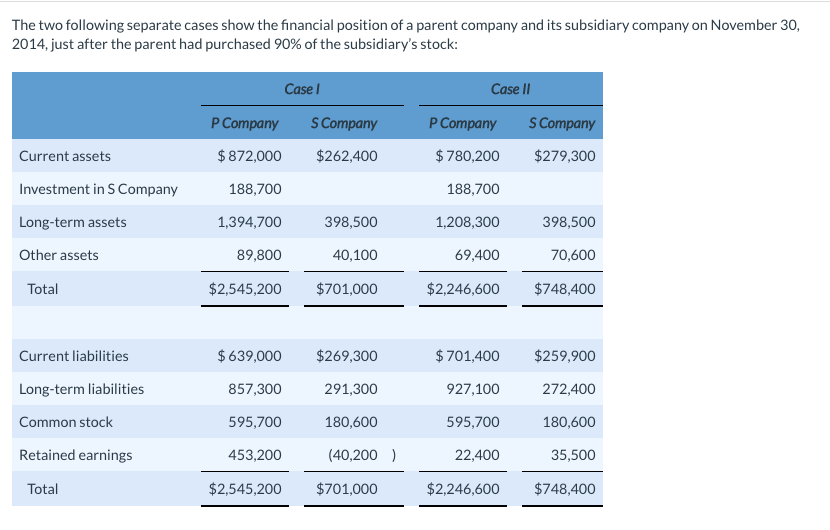

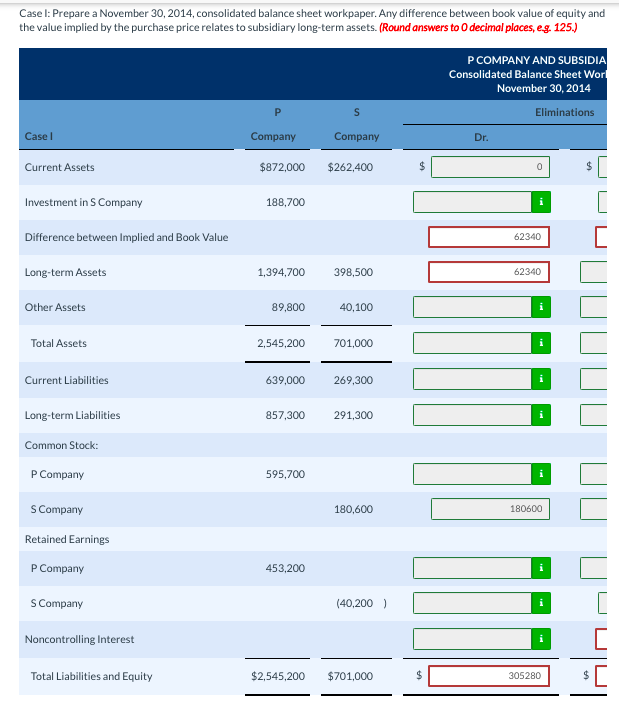

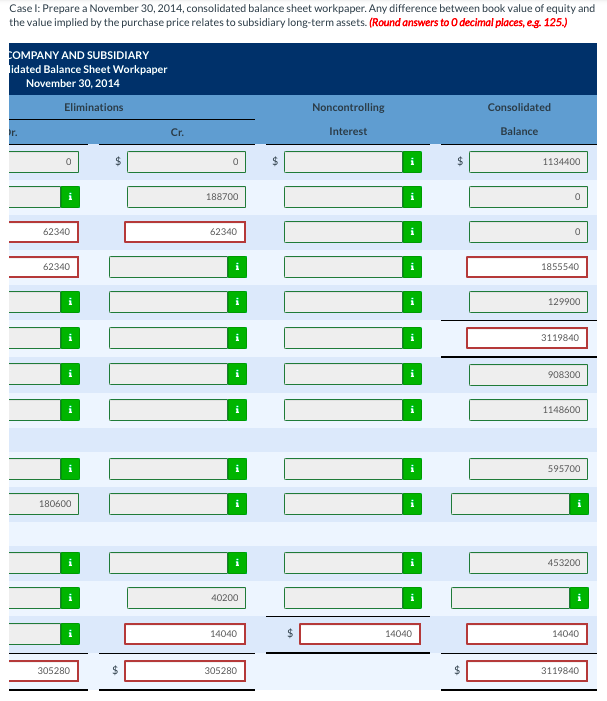

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiary's stock: Case ! Case II P Company S Company P Company S Company Current assets $ 872,000 $262,400 $ 780,200 $279,300 Investment in Company 188,700 188,700 Long-term assets 1,394,700 398,500 1,208,300 398,500 Other assets 89,800 40,100 69,400 70,600 Total $2,545,200 $701,000 $2,246,600 $748,400 Current liabilities $639,000 $269,300 $701,400 $259,900 Long-term liabilities 857,300 291,300 927,100 272,400 Common stock 595,700 180,600 595,700 180,600 Retained earnings 453,200 (40,200) 22,400 35,500 Total $2,545,200 $701,000 $2,246,600 $748,400 Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, eg. 125.) P COMPANY AND SUBSIDIA Consolidated Balance Sheet Wort November 30, 2014 S Eliminations Casel Company Company Dr. Current Assets $872,000 $262,400 $ 0 $ [ [ Investment in Company 188,700 Difference between Implied and Book Value 62340 Long-term Assets 1,394,700 398,500 62340 Other Assets 89,800 40,100 Total Assets 2,545,200 701,000 Current Liabilities 639,000 269,300 Long-term Liabilities 857,300 291,300 Common Stock: P Company 595,700 S Company 180,600 180600 Retained Earnings P Company 453,200 S Company (40,200) [ Noncontrolling Interest Total Liabilities and Equity $2,545,200 $701,000 $ 305280 [ Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. (Round answers to decimal places, eg. 125.) COMPANY AND SUBSIDIARY lidated Balance Sheet Workpaper November 30, 2014 Eliminations Noncontrolling Consolidated Ir. Cr. Interest Balance 0 $ 0 $ 1134400 188700 0 62340 62340 62340 1855540 129900 3119840 908300 1148600 595700 180600 453200 40200 14040 $ 14040 14040 305280 305280 3119840