Answered step by step

Verified Expert Solution

Question

1 Approved Answer

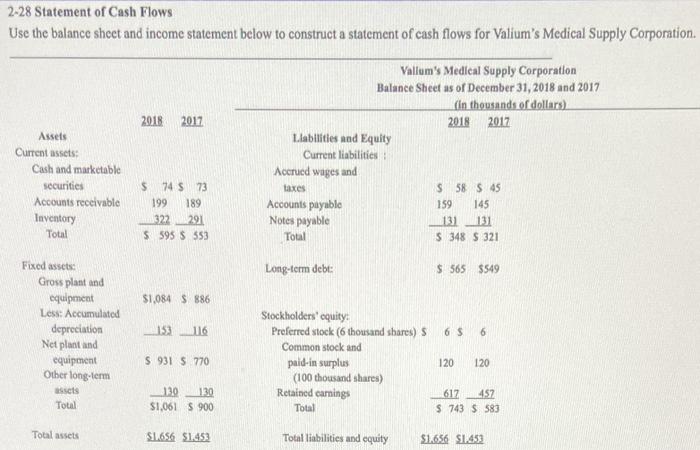

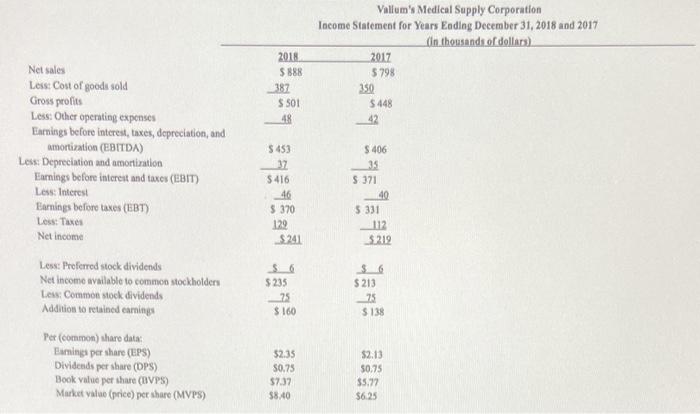

the two pictures are one problem 2-28 Statement of Cash Flows Use the balance sheet and income statement below to construct a statement of cash

the two pictures are one problem

2-28 Statement of Cash Flows Use the balance sheet and income statement below to construct a statement of cash flows for Valium's Medical Supply Corporation. 2018 2017 Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Vallum's Medical Supply Corporation Balance Sheet as of December 31, 2018 and 2017 (in thousands of dollars) 2018 2017 Llabilities and Equity Current liabilities: Accrued wages and taxes S 58 S 45 Accounts payable 159 145 Notes payable 131 131 Total $ 348 S 321 $ 74 S 73 199 189 322 291 5 595 $ 553 Long-term debt: $ 565 $549 $1,084 S 886 Fixed assets Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term 153116 6 $ 6 S 931 S 770 Stockholders' equity: Preferred stock (6 thousand shares) S Common stock and paid-in surplus (100 thousand shares) Retained carnings Total 120 120 Total 130 130 $1.061 S 900 612 452 $ 743 $ 583 Total assets S1656 $1.453 Total liabilities and equity $1.656 $1.453 2018 SBR 387 S 501 48 Vallum's Medical Supply Corporation Income Statement for Years Ending December 31, 2018 and 2017 (In thousands of dollars) 2017 5798 350 $ 448 42 Net sales Lost Cost of goods sold Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Depreciation and amortization Ermings before interest and taxos (EBIT) Les Interest Earnings before taxes (EBT) Less Taxes Net Income S 406 $ 453 32 5 416 46 $ 370 129 $241 S 371 40 5331 $219 $ 235 25 $ 160 $6 $ 213 75 $ 138 Les Preferred stock dividends Net Income wailable to common stockholders Les Common stock dividends Addition to retained earnings Pet (common) share data Earnings per share (EPS) Dividends per share (DPS) Book value per share (IVPS) Market value (price) per share (MVPS) 52.35 50.75 57.37 58.40 $2.13 50.75 $5.77 $6.25 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started