Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The UK announces the end of austerity. Consensus forecasts suggest that trend real GDP growth is 1.50%. < 3a) What would be the implied

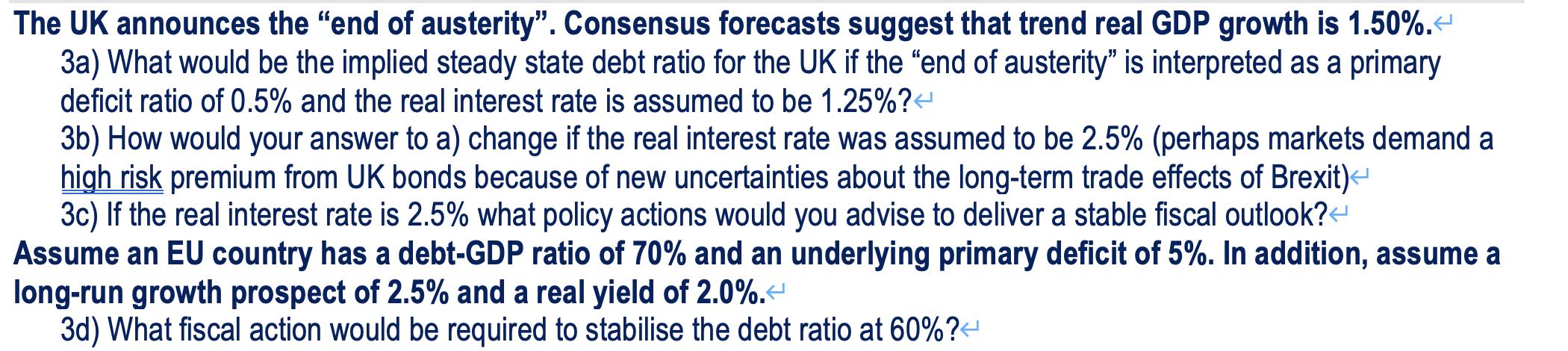

The UK announces the "end of austerity". Consensus forecasts suggest that trend real GDP growth is 1.50%. < 3a) What would be the implied steady state debt ratio for the UK if the "end of austerity" is interpreted as a primary deficit ratio of 0.5% and the real interest rate is assumed to be 1.25%? < 3b) How would your answer to a) change if the real interest rate was assumed to be 2.5% (perhaps markets demand a high risk premium from UK bonds because of new uncertainties about the long-term trade effects of Brexit) < 3c) If the real interest rate is 2.5% what policy actions would you advise to deliver a stable fiscal outlook? < Assume an EU country has a debt-GDP ratio of 70% and an underlying primary deficit of 5%. In addition, assume a long-run growth prospect of 2.5% and a real yield of 2.0%. < 3d) What fiscal action would be required to stabilise the debt ratio at 60%?

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

3a The implied steady state debt ratio for the UK if the end of austerity is interpret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started