Answered step by step

Verified Expert Solution

Question

1 Approved Answer

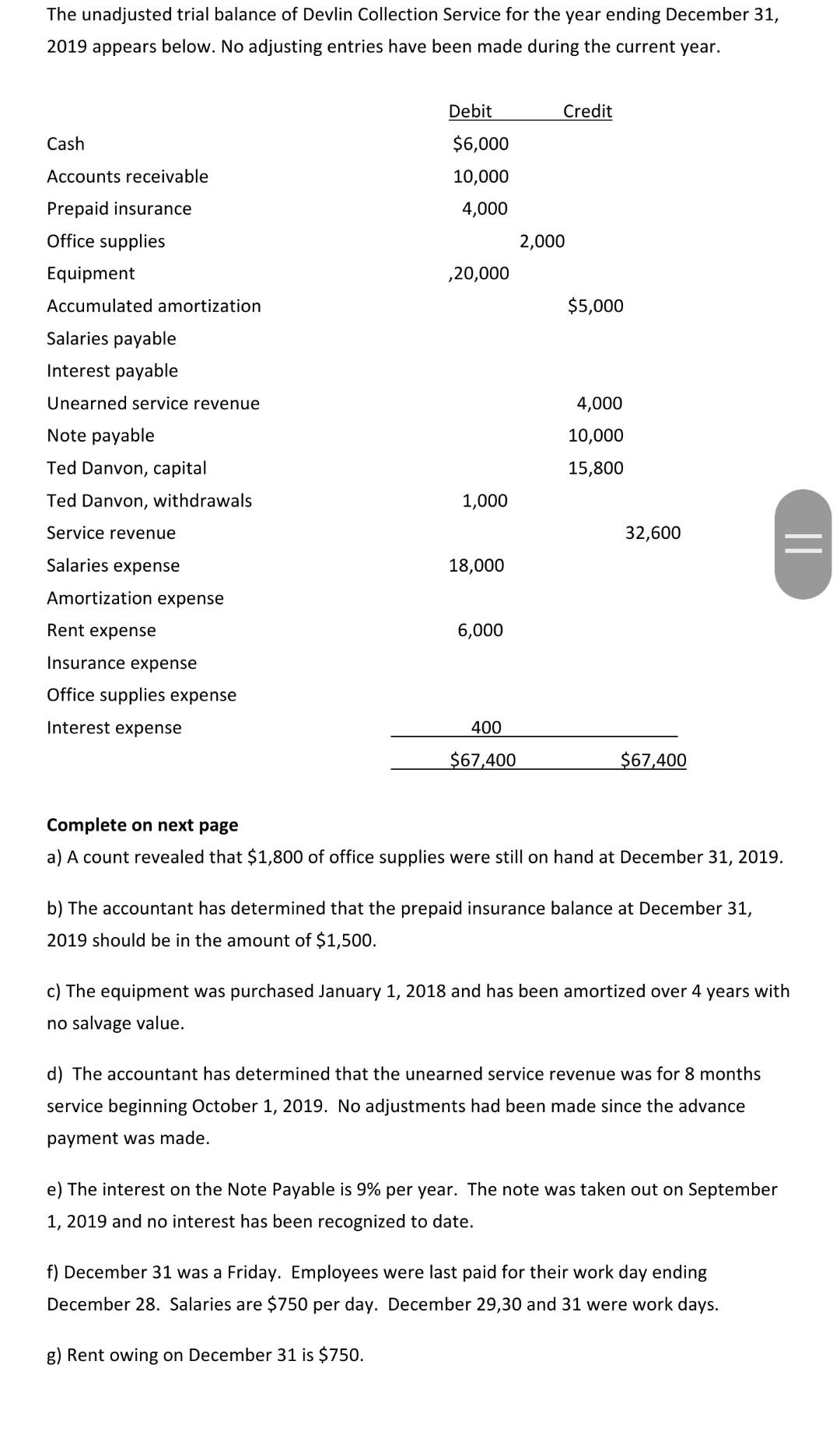

The unadjusted trial balance of Devlin Collection Service for the year ending December 31, 2019 appears below. No adjusting entries have been made during the

The unadjusted trial balance of Devlin Collection Service for the year ending December 31, 2019 appears below. No adjusting entries have been made during the current year. Debit Credit Cash $6,000 Accounts receivable 10,000 4,000 2,000 ,20,000 Prepaid insurance Office supplies Equipment Accumulated amortization Salaries payable Interest payable $5,000 Unearned service revenue 4,000 10,000 Note payable Ted Danvon, capital Ted Danvon, withdrawals 15,800 1,000 Service revenue 32,600 II Salaries expense 18,000 Amortization expense Rent expense 6,000 Insurance expense Office supplies expense Interest expense 400 $67,400 $67,400 Complete on next page a) A count revealed that $1,800 of office supplies were still on hand at December 31, 2019. b) The accountant has determined that the prepaid insurance balance at December 31, 2019 should be in the amount of $1,500. c) The equipment was purchased January 1, 2018 and has been amortized over 4 years with no salvage value. d) The accountant has determined that the unearned service revenue was for 8 months service beginning October 1, 2019. No adjustments had been made since the advance payment was made. e) The interest on the Note Payable is 9% per year. The note was taken out on September 1, 2019 and no interest has been recognized to date. f) December 31 was a Friday. Employees were last paid for their work day ending December 28. Salaries are $750 per day. December 29,30 and 31 were work days. g) Rent owing on December 31 is $750. The unadjusted trial balance of Devlin Collection Service for the year ending December 31, 2019 appears below. No adjusting entries have been made during the current year. Debit Credit Cash $6,000 Accounts receivable 10,000 4,000 2,000 ,20,000 Prepaid insurance Office supplies Equipment Accumulated amortization Salaries payable Interest payable $5,000 Unearned service revenue 4,000 10,000 Note payable Ted Danvon, capital Ted Danvon, withdrawals 15,800 1,000 Service revenue 32,600 II Salaries expense 18,000 Amortization expense Rent expense 6,000 Insurance expense Office supplies expense Interest expense 400 $67,400 $67,400 Complete on next page a) A count revealed that $1,800 of office supplies were still on hand at December 31, 2019. b) The accountant has determined that the prepaid insurance balance at December 31, 2019 should be in the amount of $1,500. c) The equipment was purchased January 1, 2018 and has been amortized over 4 years with no salvage value. d) The accountant has determined that the unearned service revenue was for 8 months service beginning October 1, 2019. No adjustments had been made since the advance payment was made. e) The interest on the Note Payable is 9% per year. The note was taken out on September 1, 2019 and no interest has been recognized to date. f) December 31 was a Friday. Employees were last paid for their work day ending December 28. Salaries are $750 per day. December 29,30 and 31 were work days. g) Rent owing on December 31 is $750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started