Answered step by step

Verified Expert Solution

Question

1 Approved Answer

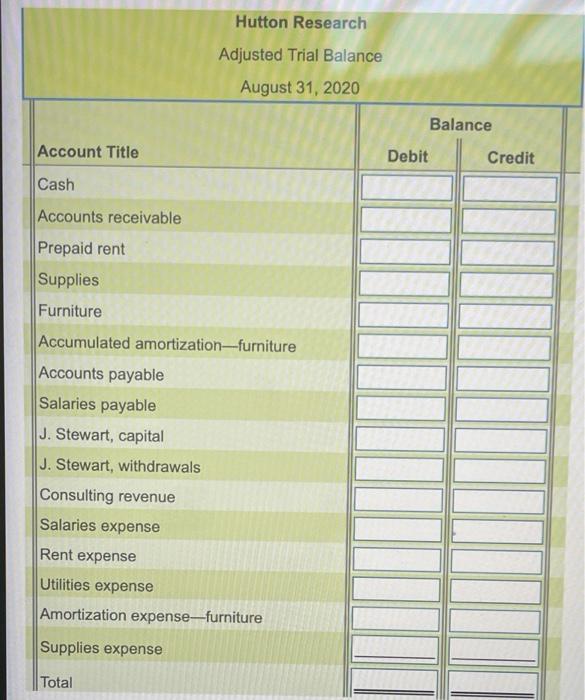

The unadjusted trial balance of Hutton Research at August 31, 2020, and the related month-end adjustment data appear below (Click the icon to view the

The unadjusted trial balance of Hutton Research at August 31, 2020, and the related month-end adjustment data appear below

(Click the icon to view the unadjusted trial balance.)

1 (Click the icon to view the month-end adjustment data.)

Required

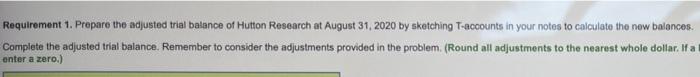

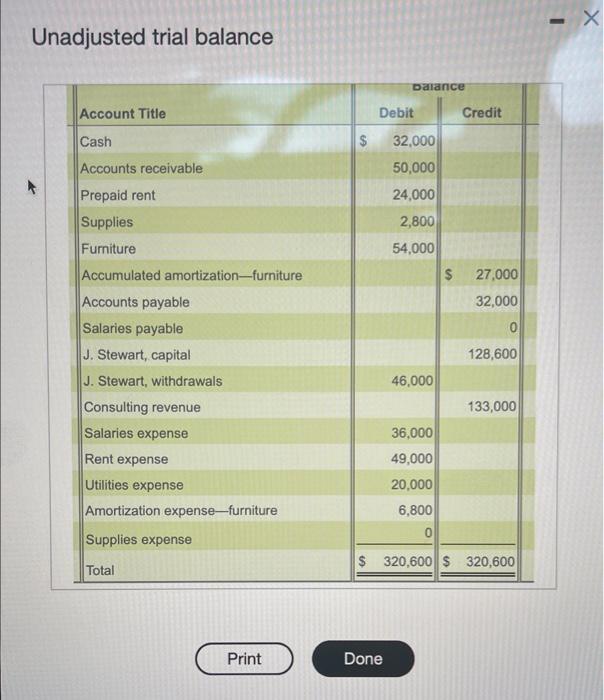

1 Prepare the adjusted trial balance of Hutton Research at August 31, 2020 by sketching T-accounts in your notes to calculate the new balances.

2. Prepare the income statement and the statement of owner's equity for the year ended August 31, 2020, and the balance sheet at August 31, 2020. Write a short description of how the three financial statements are linked

Requirement 1. Prepare the adjusted trial balance of Hutton Research at August 31, 2020 by sketching T-accounts in your notes to calculate the new balances.

Complete the adjusted trial balance. Remember to consider the adjustments provided in the problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started