Answered step by step

Verified Expert Solution

Question

1 Approved Answer

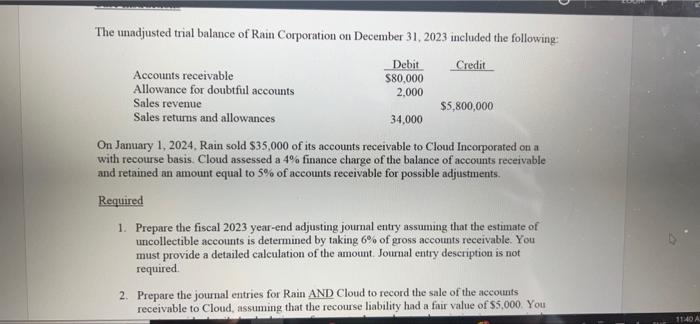

The unadjusted trial balance of Rain Corporation on December 31, 2023 included the following: Debit $80,000 2,000 Accounts receivable Allowance for doubtful accounts Sales revenue

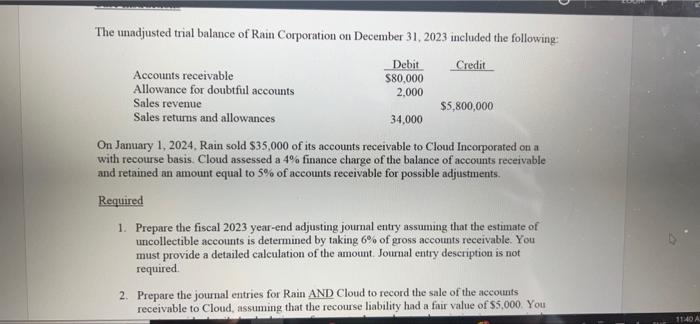

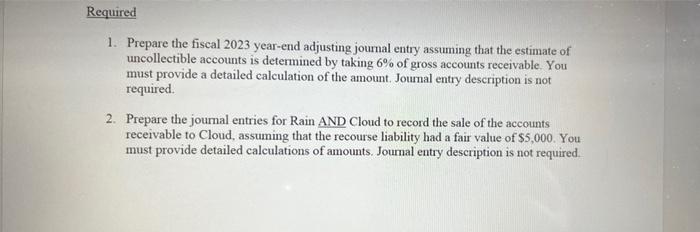

The unadjusted trial balance of Rain Corporation on December 31, 2023 included the following: Debit $80,000 2,000 Accounts receivable Allowance for doubtful accounts Sales revenue Sales returns and allowances 34,000 Credit $5,800,000 On January 1, 2024, Rain sold $35,000 of its accounts receivable to Cloud Incorporated on a with recourse basis. Cloud assessed a 4% finance charge of the balance of accounts receivable and retained an amount equal to 5% of accounts receivable for possible adjustments. Required 1. Prepare the fiscal 2023 year-end adjusting journal entry assuming that the estimate of uncollectible accounts is determined by taking 6% of gross accounts receivable. You must provide a detailed calculation of the amount. Journal entry description is not required. 2. Prepare the journal entries for Rain AND Cloud to record the sale of the accounts receivable to Cloud, assuming that the recourse liability had a fair value of $5,000. You 11:40 A

# I need the journal and every thing please solve all section correctly and completly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started