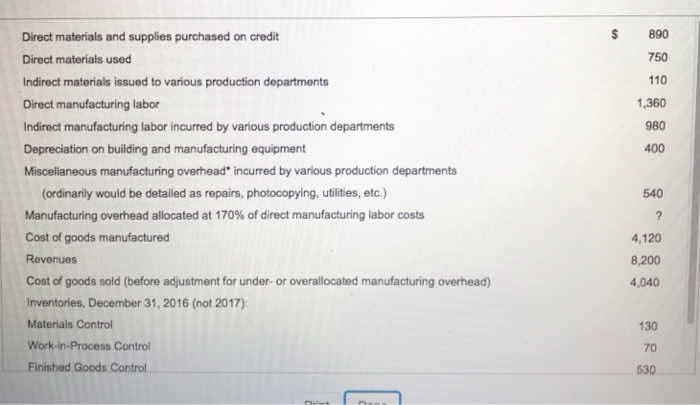

The University of Portland Press is wholly owned by the university, It performs the bulk of its work for other university departments, which pay as though the press were an outside business enterprise. The press also publishes and maintains a stock of books for general sale. The press uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs). The following data (in thousands) pertain to 2017: Click the icon to view the data.) Read the requirements. Requirement 2. Prepare journal entries to summarize the 2017 transactions. As your final entry, dispose of the year-end under- or overallocated manufacturing overhead as a write-off to Cost of Goods Sold. Number your entries. Explanations for each entry may be omitted (Record debits first then credits. Exclude explanations from any journal entries.) Direct materials and supplies purchased on credit, $890 Choose from any list or enter any number in the input fields and then continue to the next question. The University of Portland Press is wholly owned by the university, It performs the bulk of its work for other university departments, which pay as though the press were an outside business enterprise. The press also publishes and maintains a stock of books for general sale. The press uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs). The following data (in thousands) pertain to 2017: Click the icon to view the data.) Read the requirements. Requirement 2. Prepare journal entries to summarize the 2017 transactions. As your final entry, dispose of the year-end under- or overallocated manufacturing overhead as a write-off to Cost of Goods Sold. Number your entries. Explanations for each entry may be omitted (Record debits first then credits. Exclude explanations from any journal entries.) Direct materials and supplies purchased on credit, $890 Choose from any list or enter any number in the input fields and then continue to the next