Answered step by step

Verified Expert Solution

Question

1 Approved Answer

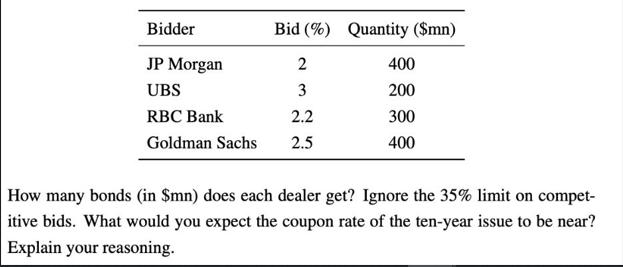

The US Treasury has decided to issue $1bn worth in ten-year debt. There are cur- rently 4 primary dealers that will help in distributing

The US Treasury has decided to issue $1bn worth in ten-year debt. There are cur- rently 4 primary dealers that will help in distributing the issue via competitive bids. There are a total of $100mn in non-competitive bids. The table below lists each dealer's bid: Bid (%) Quantity ($mn) 2 3 2.2 Goldman Sachs 2.5 Bidder JP Morgan UBS RBC Bank 400 200 300 400 How many bonds (in $mn) does each dealer get? Ignore the 35% limit on compet- itive bids. What would you expect the coupon rate of the ten-year issue to be near? Explain your reasoning.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine how many bonds in million each dealer will get we first need to calculate the total qua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started